ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5. Interest, inflation, and purchasing power

Suppose Diamond is a sports fan and buys only football tickets. Diamond deposits $2,000 into a savings account that pays an annual nominal interest

rate of 20%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a football ticket

has a price of $20.00.

Initially, Diamond's $2,000 deposit has a purchasing power of

100 football tickets.

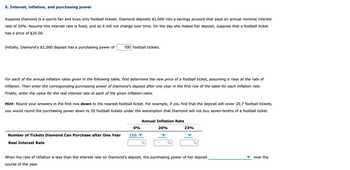

For each of the annual inflation rates given in the following table, first determine the new price of a football ticket, assuming it rises at the rate of

inflation. Then enter the corresponding purchasing power of Diamond's deposit after one year in the first row of the table for each inflation rate.

Finally, enter the value for the real interest rate at each of the given inflation rates.

Hint: Round your answers in the first row down to the nearest football ticket. For example, if you find that the deposit will cover 20.7 football tickets,

you would round the purchasing power down to 20 football tickets under the assumption that Diamond will not buy seven-tenths of a football ticket.

Number of Tickets Diamond Can Purchase after One Year

Real Interest Rate

0%

100

Annual Inflation Rate

20%

%

%

23%

%

When the rate of inflation is less than the interest rate on Diamond's deposit, the purchasing power of her deposit

course of the year.

over the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai to answer I will report your answer Solve it Asap with explanation and calculationarrow_forward5. Interest, inflation, and purchasing power Suppose Diamond is a fan of young-adult fiction and buys only young-adult books. Diamond deposits $2,000 into a savings account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a young-adult book has a price of $20.00. Initially, Diamond's $2,000 deposit has a purchasing power of young-adult books. For each of the annual inflation rates given in the following table, first determine the new price of a young-adult book, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Diamond's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest young-adult book. For example, if you find that the deposit will cover 20.7…arrow_forward5. Interest, inflation, and purchasing power Suppose Amy is a cinephile and buys only movie tickets. Amy deposits $2,000 in a bank account that pays an annual nominal interest rate of 5%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a movie ticket is priced at $20.00. Initially, the purchasing power of Amy's $2,000 deposit is movie tickets. For each of the annual inflation rates given in the following table, first determine the new price of a movie ticket, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Amy's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest movie ticket. For example, if you find that the deposit will cover 20.7 movie tickets, you would round the purchasing power down to 20 movie tickets under…arrow_forward

- 5. Interest, inflation, and purchasing power Suppose Dalton is an avid reader and buys only reusable tote bagses. Dalton deposits $4,000 into a savings account that pays an annual nominal interest rate of 5%. Assume this interest rate is fixed, and so it will not change over time. On the day she makes her deposit, suppose that a reusable tote bags has a price of $10.00. Initially, Dalton's $4,000 deposit has a purchasing power of reusable tote bagses. For each of the annual inflation rates given in the following table, first determine the new price of a reusable tote bags, assuming rises at the rate of inflation. Then enter the corresponding purchasing power of Dalton's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest reusable tote bags. For example, if you find that the deposit will cover 20.7 reusable tote…arrow_forward5 On March 7, 2018, you could read in The New York Times that the Governor of West Virginia offered the state's teachers "a 1 percent a year raise for the next five years." The article noted that "if inflation averages 2 percent a year for that period, this translates into an effective 5 percent pay cut." [R170] Is the “5 percent pay cut” claim correctarrow_forwardSuppose that you are considering whether to enroll in a summer computer-training program that costs $3,600. If you take the program, you will have to give up $1,800 of earnings from your summer job. You figure that the program will increase your earnings by $600 per year for each of the next 10 years. Beyond that, it is not expected to affect your earnings. Suppose the interest rate is 10% Use the preceding information to calculate the present value of the wage increase resulting from the training program. Then decide whether the investment is worthwhile, given the present value of the cost of the training program. At this interest rate, the present value of the increase in wages is about the training. Thus, from a strictly monetary viewpoint, you than the present value of the total cost of , which is participate in the training program.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education