FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

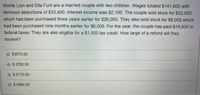

Transcribed Image Text:Monte Lion and Ella Funt are a married couple with two children. Wages totaled $141,600 with

itemized deductions of $33,400. Interest income was $2,100. The couple sold stock for $32,000

which had been purchased three years earlier for $26,000. They also sold stock for $8,000 which

had been purchased nine months earlier for $6,000. For the year, the couple has paid $19,500 in

federal taxes. They are also eligible for a $1,000 tax credit. How large of a refund will they

receive?

$3015.00

$ 3762.50

$ 5172.00

$ 5684.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- George and Peggy Fulwider bought a house from Sally Sinclair for $225,500. In lieu of a 10% down payment, Ms. Sinclair accepted 5% down at the time of the sale and a promissory note from the Fulwiders for the remaining 5%, due in four years. The Fulwiders also agreed to make monthly interest payments to Ms. Sinclair at 10% interest until the note expires. The Fulwiders obtained a loan from their bank for the remaining 90% of the purchase price. The bank in turn paid the sellers the remaining 90% of the purchase price, less a sales commission of 6% of the purchase price, paid to the sellers' and the buyers' real estate agents. (d) Find the Fulwiders' monthly interest-only payment to Ms. Sinclair. (Round your answer to the nearest cent.)$ (e) Find Ms. Sinclair's total income from all aspects of the down payment (including the down payment, the amount borrowed under the promissory note, and the monthly payments required by the promissory note).$ (f) Find Ms. Sinclair's net income from the…arrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forwardJanice earns $85,000 working as an administrative assistant in a public company based in New York. The company provides a matching contribution in the 401(k) plan of 50% up to a maximum contribution of 4% of compensation. Her 401(k) plan account had $20,000 in it at the beginning of the year. She contributed $5,000 to the plan this year and the employer made the matching contribution before year end. The ending balance of the account is $30,000. What is her return on her investments this year for the 401(k) account? A. 8.8%. B. 9.9%. C. 12.5%. D. 25%.arrow_forward

- Jeremy (unmarried) earned $100,300 in salary and $6,300 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $23,300 in itemized dedications, including $2,000 of charitable contributions to his church. -Determine Jeremy’s tax refund or taxes due. -Assume that in addition to the original facts, Jeremy had a long term capital gain of $5,050. What is Jeremy’s tax refund or tax due including the tax on the capital gain? -Assume the original facts except that Jeremy has only $7,000 in itemized deductions. Assume the charitable contribution deduction for non-itemized applies to 2022. What is Jeremy’s tax refund or tax due?arrow_forwardCheck my work. Bill and Mary filed a joint Federal income tax return this year. Mary owns a 30% interest in MAJIC Partnership, a women’s dress boutique. Mary’s share of the partnership’s net income is $280,000. Her shares of the partnership’s W–2 wages and unadjusted basis of depreciable property are $100,000 and $300,000, respectively. Mary’s share of the partnership income is $280,000 * 20% = $56,000 50% of W-2 wages is $100,000*.5= $50,000 25% of W-2 wages plus 2.5% of adjusted basis of depr prop = $100,000 * 25% +$300,000 * 2.5% =$32,500 The QBI deduction is $50,000 per the limitation phase What is the maximum QBI deduction if MAJIC’s income was from qualified services and Bill and Mary’s total taxable income was $450,000? The QBI deduction can be used for qualified service businesses only if the taxable income before the QBI deduction does not exceed the threshold. Since MAJIC’s…arrow_forwardYolanda is a cash basis taxpayer with the following tranasctions during the year: Cash received from sales of products $70,000 Cash paid for expenses (except rent and interest) $40,000 Rent prepaid on a leased building for 18 monts beginning December 1 $48,600 Prepaid interest on a bank loan, paid on December 31 for the next 3 months 5,000 Calculate Yolanda's income from her business for this calendar year.arrow_forward

- Erika has a mining operation. In 2021, she earned 175 coins with a fair market value (FMV) of $250 per coin at the time she received them. She received 11.25 coins at the same time for transaction verifications. She had no other income from the mining. She sold 120 of the coins for $265 per coin a month later. Her deductible expenses for the mining operation were $12,000. Finally, she earned ten coins for interest with an FMV of $2,300 total. How much net income does Erika show on her Schedule C?arrow_forwardJeremy (unmarried) earned $100,000 in salary and $6,000 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremey qualifies to file as head of household and has $23,000 in itemized deductions, including $2,000 of charitable contributions to his church. Determine the amount Jeremy’s taxes due.arrow_forwardAt the end of the first pay period of the year, Sofia earned $4,000 of salary. Withholdings from Sofia's salary include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $500 of federal income taxes, $160 of medical insurance deductions, and $10 of life insurance deductions. Compute Sofia's net pay for this first pay period. Gross pay FICA Social Security FICA Medicare Federal income taxes Medical insurance deduction Life insurance deduction Total deductions Net payarrow_forward

- Jeremy (unmarried) earned $100,700 in salary and $6,700 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,700 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules.) Required: Determine Jeremy's tax refund or taxes due. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $7,050. What is Jeremy's tax refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Assume the original facts except that Jeremy has only $5,000 in itemized deductions. Assume the charitable contribution deduction for non-itemizers applies to 2022. What is Jeremy's tax refund or tax due?arrow_forwardCharles and Martha (both age 30), cach saved $15,000 (pre tax) at the end of every year over their working lives. Both worked till age 65 years. Charles saved his money in a qualified pension plan while Martha saved in her personal account after paying taxes. Martha turned over her portfolio every year and the combination of ordinary income on dividends and interest and capital gains on sale of stock came to a 20% tax rate on investment retums. If both generated a pretax retum of 6% per year and were in 25% marginal tax bracket throughout their lives, compute the difference in their net accumulated savings at retirement $167,137 O $278,654 $222,849 O $696.535arrow_forwardRebecca entered into a written contract to sell certain real estate to Mary, a minor, for $80,000, payable $4,000 on the execution of the contract and $800 on the first day of each month thereafter until paid. Mary paid the $4,000 down payment and eight monthly installments before attaining her majority. Thereafter, Mary made two additional monthly payments and caused the contract to be recorded in the county where the real estate was located. Mary was then advised by her attorney that the contract was voidable. After being so advised, Mary immediately tendered the contract to Rebecca, together with a deed reconveying all of Mary’s interest in the property to Rebecca. Also, Mary demanded that Rebecca return the money she had paid under the contract. Rebecca refused the tender and declined to repay any portion of the money paid to her by Mary. Can Mary cancel the contract and recover the amount paid to Rebecca? Explain.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education