FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

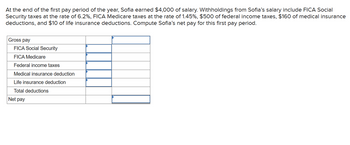

Transcribed Image Text:At the end of the first pay period of the year, Sofia earned $4,000 of salary. Withholdings from Sofia's salary include FICA Social

Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $500 of federal income taxes, $160 of medical insurance

deductions, and $10 of life insurance deductions. Compute Sofia's net pay for this first pay period.

Gross pay

FICA Social Security

FICA Medicare

Federal income taxes

Medical insurance deduction

Life insurance deduction

Total deductions

Net pay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maxwell Friedman's weekly gross earnings for the week ending March 9 were $860, and her federal income tax withholding was $154.80. Assuming the social security tax rate is 6% and Medicare tax is 1.5% of all earnings, what is Friedman's net pay? If required, round your answer to two decimal places.arrow_forwardAt the end of the first pay period of the year, Dan earned $6,600 of salary. Withholdings from Dan's salary include Federal Insurance Contributions Act (FICA) Social Security taxes at the rate of 6.2%, Federal Insurance Contributions Act (FICA) Medicare taxes at the rate of 1.45%, $792 of federal income taxes, $255 of medical insurance deductions, and $19 of life insurance deductions. Compute Dan's net pay for this first pay period. Multiple Choice O $6,600.00 O $5,808.00 O $5,303.10 Earrow_forwardMorgan is an employee of Redwind Company. He earned $12,350 for the current month. Prior to the current payroll period, his year-to-date wages amounted to $131,200. Assume that the following tax rates are currently in effect. 7 FICA Tax OASDI Medicare Federal Income Tax Withholding Net pay (take-home pay): Rate X 6.2% 1.45% 25% Required: Compute Morgan's take-home pay (net pay) for the month. Note: Round your answer to the nearest cent. Ceiling $0 $128,400 No ceiling BEE Karrow_forward

- Mai earns a gross weekly income of $464.00. How much Social Security tax should be withheld the first week of the year? How much Medicare tax should be withheld? Assume a 4.2% FICA rate and a 1.45% Medicare rate. Round to the nearest cent.arrow_forwardAna Marie has a received a total of 318,877.72 annual salary. She pays her mandatory contributions and receives a monthly rice allowance of 2,000, 13th and 14th month pay, a travel allowance of 1,500 monthly and food allowance of 500. Supply the table below: Monthly salary SSS contribution Philhealth Contribution Pag-ibig contribution De minimis benefits 13th month pay and other benefits Total Mandatory Contributions Total Exempt benefits Taxable incomearrow_forwardHank earns $21.00 per hour with time-and-a-half for hours in excess of 40 per week. He worked 50 hours at his job during the first week of March, 2024. Hank pays income taxes at 15% and 7.65% for OASDI and Medicare. All of his income is taxable under FICA. Determine Hank's net pay for the week. (Do not round any intermediate calculations, and round your final answer to the nearest cent.) OA. $731.33 OB. $981.75 OC. $893.39 D. $699.82 GIDarrow_forward

- Shirley Riddle earns $2,333 biweekly. She is single and claims no withholding allowances. She saves 2% of her salary for retirement and pays $22.81 in nonexempt insurance premiums each pay period. The Social Security Tax is 6.2% from earnings to be taxed. The Medicare tax is 1.45% from all earnings. What are her net earnings for each pay period?arrow_forwardCarol Blane’s cumulative yearly earnings for the year are $29,000, counting her current payperiod salary amount of $4,500. Assume the FICA tax rate is 6.2 percent for Social Security, witha limit of $106,800, and 1.45 percent for Medicare, applied to all earnings. The FUTA tax is 0.6percent, with a limit of $7,000, and the SUTA tax is 5.4 percent, with a limit of $7,000. Theemployer's payroll tax expense entry will include a credit to: a. FICA Tax Payable for $279.00.b. FICA Tax Payable for $344.25.c. Federal Unemployment Tax Payable for $27.00.d. State Unemployment Tax Payable for $243.00.e. Federal Unemployment Tax Payable for $270.00.arrow_forwardJohn Doe is married and claims 3 withholding allowances. He collects overtime pay when he works over 40 hours a week. If his gross pay is $1,306.88, determine his weekly net earnings. Use the following deductions: FWT (Percentage Method), FICA 6.2%, Medicare 1.45%, SDI 1%, Health Insurance ($80/week), Union Dues ($4.50/week), and Trust Fund ($95/week). $891.28 $819.32 O $768.31 $786.67arrow_forward

- Calculate Social Security taxes, Medicare taxes, and FIT for Jordon Barrett. He earns a monthly salary of $11,500. He is single and claims 1 deduction. Before this payroll, Barrett’s cumulative earnings were $128,080. (Social Security maximum is 6.2% on $128,400 and Medicare is 1.45%.) Calculate FIT by the percentage method, as well as the social security taxes and medicare taxes.arrow_forwardAmy's gross pay for the week is $850. Her deduction for federal income tax is based on a rate of 25%. She has voluntary deductions of $255. Her year−to−date pay is under the limit for OASDI. What is her net pay? (Assume a FICA—OASDI Tax of 6.2% and FICA—Medicare Tax of 1.45%. Round all calculations to the nearest cent.)arrow_forwardJulie Whiteweiler made $930 this week. Only social security (fully taxable) and federal income taxes attach to her pay. Whiteweiler contributes $100 each week to her company's 401(k) plan and has $30 put into her health savings account (nonqualified) each week. Her employer matches this $30 each week. Determine Whiteweiler's take-home pay if she is head of household. Enter deductions beginning with a minus sign (-). Round your calculations and final answers to the nearest cent. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. Click here to access the Wage-Bracket Method Tables. Gross pay $930 HSA contributions -30 401(k) deductions -100 OASDI tax -57.66 HI tax -13.49 FIT Net pay $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education