FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Jeremy (unmarried) earned $100,300 in salary and $6,300 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $23,300 in itemized dedications, including $2,000 of charitable contributions to his church.

-Determine Jeremy’s tax refund or taxes due.

-Assume that in addition to the original facts, Jeremy had a long term capital gain of $5,050. What is Jeremy’s tax refund or tax due including the tax on the capital gain ?

-Assume the original facts except that Jeremy has only $7,000 in itemized deductions. Assume the charitable contribution deduction for non-itemized applies to 2022. What is Jeremy’s tax refund or tax due?

Transcribed Image Text:$85,550

$ 178,150

$340,100

$431,900

$ 647,850

$ 178,

$340,100

$431,900

$ 647,850

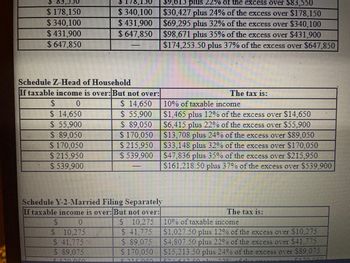

Schedule Z-Head of Household

If taxable income is over: But not over:

$

0

$ 14,650

$ 55,900

$ 89,050

$ 170,050

$ 215,950

$ 539,900

S

0

S 10,275

$ 41,775

$ 89,075

6 170 ASA

$ 14,650

$ 55,900

$ 89,050

170,050

$ 215,950

$ 539,900

Schedule Y-2-Married Filing Separately

If taxable income is over: But not over:

S 10,275

S 41,775

$ 89,075

S 170,050

C 015 05

$9,615 plus 22% of the excess over $83,550

$30,427 plus 24% of the excess over $178,150

$69,295 plus 32% of the excess over $340,100

$98,671 plus 35% of the excess over $431,900

$174,253.50 plus 37% of the excess over $647,850

The tax is:

10% of taxable income

$1,465 plus 12% of the excess over $14,650

$6,415 plus 22% of the excess over $55,900

708 plus 24% of the excess over 9,050

$33,148 plus 32% of the excess over $170,050

$47,836 plus 35% of the excess over $215,950

$161,218.50 plus 37% of the excess over $539,900

The tax is:

10% of taxable income

$1,027.50 plus 12% of the excess over $10,275

$4,807.50 plus 22% of the excess over $41,775

$15,213.50 plus 24% of the excess over $89,075

CO1A17501 200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2023 and 2024), Trevor expects to report salary of $98,000, contribute $8,600 to charity, and pay $3,250 in state income taxes. Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,900 and $23,500, respectively, each year. Assume that Trevor makes the charitable contribution for 2024 in December of 2023. Estimate Trevor's taxable income for 2023 and 2024 using the 2023 amounts for the standard deduction.arrow_forwardHaley, 44, is unmarried, filing head of household with the following income for the year. Wages $32,275 dollars, Bank interest $380, Municipal bond interest $330, Lottery prize $800. Gift from her father's $4000. Haley also contributed $2500 to her traditional IRA, which she will deduct. Halley's adjusted gross income is $30,955. $30,955, $31,285, $34,485, $37,785.arrow_forwardJeremy (unmarried) earned $100, 800 in salary and $6,800 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,800 in itemized deductions, including $ 2,000 of charitable contributions to his church. (Use the tax rate schedules.) Required: Determine Jeremy's tax refund or taxes due. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $7,550. What is Jeremy's tax refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Assume the original facts except that Jeremy has only $4,500 in itemized deductions. Assume the charitable contribution deduction for non- itemizers applies to 2022. What is Jeremy's tax refund or tax due?arrow_forward

- Xialu is a single taxpayer who is under age 65 and in good health. For 2020, she has a salary of $25,000 and itemized deductions of $7,000. Xialu allows her mother to live with her during the winter months (3–4 months per year), but her mother provides all of her own support otherwise. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 a. How much is Xialu's adjusted gross income?$fill in the blank b. In order to minimize taxable income, Xialu will _______ in the amount of $fill in the blank c. What is the amount of Xialu's taxable income?$fill in the blankarrow_forwardFrankie lives in NJ, is divorced with one child, and made $80,000 last year. He qualified for several below the line, itemizable deductions (He paid $5,600 in mortgage interest, $9,500 in property taxes, and he donated $550 worth to charity during the year). Frankie can claim one child tax credit of $2,000. His ex-spouse agreed that he can claim head of household this year. Use the Income Tax Table Reference Sheet to answer the following questions. 1. Should Frankie itemize his taxes or take the standard deduction? * A. Itemize B. Standard Please answer very soon will give rating surelyarrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses. Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm: Utilities: $2,000 Office Rent: $14,000 Self-Employment Tax: $5,000 Salary for her secretary: $20,000 Fines/Penalties: $8,000 Payroll Taxes (Employer Portion): $1,000 Business Meals: $2,000 Bribe to police officer to forgive parking violation $1,500 Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income for the purposes of the QBI deduction. Also, during the year a tornado…arrow_forward

- Grady received $8,760 of Social Security benefits this year. Grady also reported salary and interest income this year. What amount of the benefits must Grady include in his gross income under the following five independent situations? Grady files married separate and reports salary of $23,540 and interest income of $740arrow_forwardJeremy earned $100,000 in salary and $6,000 in interest income during the year. Jeremy’s employer withheld $10,000 of federal income taxes from Jeremy’s paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $23,000 in itemized deductions, including $2,000 of charitable contributions to his church. (Use the tax rate schedules.) b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,000. What is Jeremy’s tax refund or tax due including the tax on the capital gain?arrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forward

- Darrell (46) is unmarried. His mother, Marlene (81), lives in a nursing home. Darrell pays the entire cost of the nursing home and more than 50% of Marlene's total support. Darrell's wages were $77,000; Marlene's income consisted of $1,800 taxable interest and $9,600 social security benefits. What is Darrell's correct and most favorable 2019 filing status?arrow_forwardChester is single and paid the following items / taxes in 2020: • Paid $ 6,100 to his township for real estate taxes on his condo.• Paid $ 4,800 in association fees to the condo association on his condo.• Chester had $ 1,000 withheld from his pay for NJ State Income taxes.• Chester had $ 3,600 withheld from his pay for social security taxes.• Chester was assessed $ 1,400 by the state of New Jersey to settle an audit of his 2018 State Income Tax return. $ 1,075 was for additional 2018 state income tax and $ 325 was for interest and penalties. Chester paid the $ 1,400 in October of 2020.• Chester paid $ 1,650 in NJ Sales taxes. How much taxes may Chester deduct as an itemized deduction for taxes in 2020?arrow_forwardIn 2021, Laureen is currently single. She paid $2,740 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,740 each for a total of $5,480). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $12,440 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend graduate school. Finally, Laureen paid $1,420 for herself to attend seminars at a community college to help her improve her job skills. Laureen's AGI is $45,000 What is the maximum amount of education credits Laureen can claim for these expenditures? (Leave no answer blank. Enter zero if applicable.) Description Credits American opportunity tax credit Lifetime learning creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education