Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

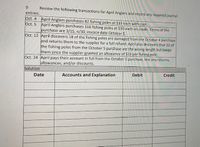

Transcribed Image Text:9.

Review the following transactions for April Anglers and record any required journal

entries.

Oct. 4

April Anglers purchases 82 fishing poles at $33 each with cash.

Oct. 5 April Anglers purchases 116 fishing poles at $30 each on credit. Terms of the

purchase are 3/15, n/30, invoice date October 5.

Oct. 12 April discovers 18 of the fishing poles are damaged from the October 4 purchase

and returns them to the supplier for a full refund. April also discovers that 32 of

the fishing poles from the October 5 purchase are the wrong length but keeps

them since the supplier granted an allowance of $15 per fishing pole.

Oct. 24 April pays their account in full from the October 5 purchase, less any returns,

allowances, and/or discounts.

Solution

Debit

Credit

Date

Accounts and Explanation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need the cost of good sold in this exercise

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

I need the cost of good sold in this exercise

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Barns purchased 888 gallons of paint at $19 per gallon from a supplier on June 3. Terms of the purchase are 2/15, n/45, invoice dated June 3. Blue Barns pays their account in full on June 20. On June 22, Blue Barns discovers 20 gallons are the wrong color and returns the gallons for a full cash refund. Record the journal entries to recognize these transactions for Blue Barns.arrow_forwardOn March 1, Bates Board Shop sells 300 surfboards to a local lifeguard station at a sales price of $400 per board. The cost to Bates is $140 per board. The terms of the sale are 3/15, n/30, with an invoice date of March 1. Create the journal entries for Bates to recognize the following transactions. A. the initial sale B. the subsequent customer payment on March 10arrow_forwardRecord the journal entry for each of the following transactions. Glow Industries purchases 750 strobe lights at $23 per light from a manufacturer on April 20. The terms of purchase are 10/15, n/40, invoice dated April 20. On April 22, Glow discovers 100 of the lights are the wrong model and is granted an allowance of $8 per light for the error. On April 30, Glow pays for the lights, less the allowance.arrow_forward

- PB5. LO 6.3Review the following transactions for April Anglers and record any required journal entries. Oct. 4 April Anglers purchases 82 fishing poles at $33 each with cash. Oct. 5 April Anglers purchases 116 fishing poles at $30 each on credit. Terms of the purchase are 3/15, n/30, invoice date October 5. Oct. 12 April discovers 18 of the fishing poles are damaged from the October 4 purchase and returns them to the supplier for a full refund. April also discovers that 32 of the fishing poles from the October 5 purchase are the wrong length but keeps them since the supplier granted an allowance of $15 per fishing pole. Oct. 24 April pays their account in full from the October 5 purchase, less any returns, allowances, and/or discounts.arrow_forwardOn June 1, Lupita Candy Supplies sells 1,250 candy buckets to a local school at a sales price of $10 per bucket. The cost to Lolita is $2 per bucket. The terms of the sale are 2/10, n/60, with an invoice date of June 1. Create the journal entries for Lupita to recognize the following transactions. A. the initial sale B. the subsequent customer payment on July 12arrow_forwardsarrow_forward

- Ariel Enterprises purchases 32 cellular telephones on credit from a manufacturer on November 3 at a price of $400 per phone. Terms of the purchase are 3/5, n/30 with an invoice date of November 3. Ariel Enterprises pays in full for the phones on November 6. Create the journal entries for Ariel Enterprises for the following transactions. A. the initial purchase B. the subsequent payment on November 6arrow_forwardThe billing cycle for Mr. Lang’s credit card begins on September 8 and ends on October 7. He is carrying a balance of $458 from the previous billing cycle. During the current billing period, the following transactionsoccurred. The annual interest rate is 19% (September has 30 days). Find the average daily balance and the finance charge. Post date Description AmountSept 18 Payment $35.00Sept 26 Purchase $125Oct 3 Purchase $84 Date Rangearrow_forwardAir Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.arrow_forward

- Can you help with these questions?arrow_forwardOn March 19 Gunderson’s Hardware received a $20,800 invoice dated March 15. Cash discount terms were 3/10, n/30. On March 24, Gunderson sent an $8,320 partial payment. What is the outstanding amount due on this invoice? What is the outstanding on this invoice?arrow_forwardSame Day Surgery Center received a 120-day, 7% note for $96,000, dated April 9 from a customer on account. Assume 360 days in a year. a. Determine the due date of the note. b. Determine the maturity value of the note.$ c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Aug. 7arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning