Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

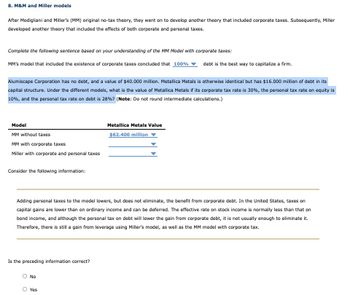

Transcribed Image Text:8. M&M and Miller models

After Modigliani and Miller's (MM) original no-tax theory, they went on to develop another theory that included corporate taxes. Subsequently, Miller

developed another theory that included the effects of both corporate and personal taxes.

Complete the following sentence based on your understanding of the MM Model with corporate taxes:

MM's model that included the existence of corporate taxes concluded that 100%

Alumiscape Corporation has no debt, and a value of $40.000 million. Metallica Metals is otherwise identical but has $16.000 million of debt in its

capital structure. Under the different models, what is the value of Metallica Metals if its corporate tax rate is 30%, the personal tax rate on equity is

10%, and the personal tax rate on debt is 28%? (Note: Do not round intermediate calculations.)

Model

MM without taxes

MM with corporate taxes

Miller with corporate and personal taxes

Consider the following information:

Is the preceding information correct?

Adding personal taxes to the model lowers, but does not eliminate, the benefit from corporate debt. In the United States, taxes on

capital gains are lower than on ordinary income and can be deferred. The effective rate on stock income is normally less than that on

bond income, and although the personal tax on debt will lower the gain from corporate debt, it is not usually enough to eliminate it.

Therefore, there is still a gain from leverage using Miller's model, as well as the MM model with corporate tax.

No

debt is the best way to capitalize a firm.

Metallica Metals Value

$62.400 million

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Jordan, Corp., has debt outstanding with a market value of $3 million. The value of the firm would be $X million if it were entirely financed by equity. The company also has 360,000 shares of stock outstanding that sell at $50 per share. The corporate tax rate is 30 percent. The expected bankruptcy cost is 0.9 million. If there is no other market friction like agency cost/benefit, what is X? $19.2 million O $21 million O $5.7 million O $20.1 millionarrow_forwardA company has an un-leveraged value of 1,000,000 and debt 500,000. If the company is subject to a corporate tax rate of 0.35, and investors in the company are subject to a tax rate of 0.05 on equity income and 0.10 on debt income, what is the company's value?arrow_forwardLEX Corporation has $350 million of debt outstanding at an interest rate of 8 percent. What is the dollar value of the tax shield on that debt, just for this year, if LEX is subject to a 35 percent marginal tax rate? (Enter amount in dollars.) Value of tax shield $enter the dollar value of the tax shieldarrow_forward

- Gunnar Corp uses no debt. The weighted average cost of capital is 9 percent. If the current market value of the equity is $37 million and there are no taxes, what is the cost of equity for this corporation? 1000 O 6% O 8% O 7% ○ 9%arrow_forwardSuppose that MNINK Industries’ capital structure features 63 percent equity, 8 percent preferred stock, and 29 percent debt. Assume the before-tax component costs of equity, preferred stock, and debt are 11.40 percent, 9.30 percent, and 8.00 percent, respectively.What is MNINK’s WACC if the firm faces an average tax rate of 21 percent and can make full use of the interest tax shield? (Round your answer to 2 decimal places.)arrow_forwardKendall Corporation has no debt but can borrow at 6.5 percent. The firm’s WACC is currently 10 percent, and there is no corporate tax. What is the company’s cost of equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g., 32. If the firm converts to 10 percent debt, what will its cost of equity be? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. If the firm converts to 45 percent debt, what will its cost of equity be? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. What is the company’s WACC in parts (b) and (c)? Note: Do not round intermediate calculations and enter your answers as a percent rounded to the nearest whole number, e.g., 32.arrow_forward

- An unlevered firm has a value of $900 million. An otherwise identical but levered firm has $180 million in debt at a 4% interest rate, which is its pre-tax cost of debt. Its unlevered cost of equity is 12%. No growth is expected. Assuming the federal-plus-state corporate tax rate is 25%, use the MM model with corporate taxes to determine the value of the levered firm. Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to the nearest whole number. S millionarrow_forwardDollar General (DG) is choosing between financing itself with only equity or with debt and equity. Regardless of how it finances itself, the EBIT for DG will be $545.63 million. If DG does use debt, the interest expense will be $57.85 million. If DG‘s corporate tax rate is 0.30, how much will DG pay (in millions) in total to ALL investors if it uses both debt and equity? Instruction: Type ONLY your numerical answer in the unit of millionsarrow_forwardByrd Enterprises has no debt. Its current total value is $47.2 million. Assume the company sells $18.5 million in debt. Ignoring taxes, what is the debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Assume the company’s tax rate is 21 percent. What is the debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education