Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

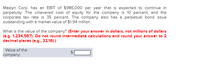

Transcribed Image Text:Maslyn Corp. has an EBIT of $985,000 per year that is expected to continue in

perpetuity. The unlevered cost of equity for the company is 10 percent, and the

corporate tax rate is 35 percent. The company also has a perpetual bond issue

outstanding with a market value of $1.94 million.

What is the value of the company? (Enter your answer in dollars, not millions of dollars

(e.g. 1,234,567). Do not round intermediate calculations and round your answer to 2

decimal places (e.g., 32.16).)

Value of the

company

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Stevenson's Bakery is an all-equity company that has projected perpetual earnings before interest and taxes of $43,700 a year. The cost of equity is 15.2 percent, and the tax rate is 22 percent. The company can borrow money at 7.15 percent. If the company borrows $50,000, what will be its levered value? Multiple Choice O O O O $229,507 $187,613 $203,682 $189,919 $235,250arrow_forwardYoarrow_forwardRefi Corporation is planning to repurchase part of its common stock by issuing corporate debt. As a result, the firm’s debt-equity ratio is expected to rise from 35 percent to 50 percent. The firm currently has $3.1 million worth of debt outstanding. The cost of this debt is 8 percent per year. The firm expects to have an EBIT of $1.3 million per year in perpetuity and pays no taxes. a. What is the market value of the firm before and after the repurchase announcement? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. What is the expected return on the firm’s equity before the announcement of the stock repurchase plan? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the expected return on the equity of an otherwise identical all-equity firm? (Do not round intermediate calculations and…arrow_forward

- CS Cycles is currently financed with 50 percent debt and 50 percent equity. The firm pays $150 each year to its debt investors (at a 12 percent cost of debt), and the debt has no maturity date. What will be the value of the equity if the firm repurchases all of its debt and raises the funds to do this by issuing equity?arrow_forwardProkter and Gramble (PG) currently has $25 billion outstanding debt. PG has a cost of equity capital of 7 percent and a cost of debt capital of 4%. PG's tax rate is 30 percent. PG is expected to have EBIT of $9 billion at the end of this year. If PG's cash flows to equity holders grow at 3% in perpetuity, what is the market value for PG's equity? O $105 billion O $140 billion $165 billion O $100 billionarrow_forwardPMF, Inc., can deduct interest expenses next year up to 30% of EBIT. This limit is equally likely to be $20 million, $28 million, or $36 million. Its corporate tax rate is 38%, and investors pay a 30% tax rate on income from equity and a 35% tax rate on interest income. a. What is the effective tax advantage of debt if PMF has interest expenses of $16 million this coming year? b. What is the effective tax advantage of debt for interest expenses in excess of $36 million? (Ignore carryforwards). c. What is the expected effective tax advantage of debt for interest expenses between $20 million and $28 million? (Ignore carryforwards). d. What level of interest expense provides PMF with the greatest tax benefit? a. What is the effective tax advantage of debt if PMF has interest expenses of $16 million this coming year? %. (Round to one If PMF has interest expenses of $16 million this coming year, the effective tax advantage is decimal place.)arrow_forward

- Mitsui Ltd has 1 million issued shares and expects unlevered after-tax cash flows of $300,000 every year, forever. The company is all-equity financed, and its cost of capital is 12% p.a. The company's tax rate is 30%. The company has just announced its intention to borrow an additional $1,400,000 of perpetual debt (at a 7% p.a. interest rate) and use the proceeds to repurchase shares? a) Calculate the price per share of Mitsui Ltd immediately before the repurchase announcement. b) Calculate the price of a share in Mitsui Ltd immediately after the repurchase announcement but before the new borrowings occur (assuming that the market expects repurchase to occur with certainty and that there are no other information effects). c) Calculate the cost of equity capital for Mitsui Ltd after the share repurchase (ignoring other information effects).arrow_forwardYou are given the following table showing the end of year net debt for a target firm. The cost of net debt is 8.2 percent, and the corporate tax rate is 21 percent. Calculate the present value of the tax shield generated in the four- year period. Year End of Year Net Debt O $81,347 O $26,898 O $21,624 O $102,970 0 $192,500 1 2 7 3 4 $207,000 $390,000 $455,000 $510,000arrow_forwardKyra Ltd. is finance solely with equity. The company considers to obtain a loan of €1,000,000 from a local bank against an interest rate of 8%.This loan will be repaid in 2 years with equal amounts per year.The current corporate tax rate is 35%.Calculate based on the Modigliani & Miller’s proposition 1 with taxes what the added value of the company will be after the announcement of the acceptance of the loan.arrow_forward

- PI Equity (PIE) invested in a biotech company (BIO) with $5 million of EBITDA. PIE paid $35 million with 30% financed at a rate of 6% over three years. Assume BIO's EBITDA grows by 10% each year and they exit after three years at a multiple of 12 times EBITDA. What is the return on invested assets, without regard to any tax benefits attributable to interest or amortization? O 2.8x. O 3.5x. 3.7x. O 4.0x.arrow_forwardThe Nelson Company has $1,137,500 in current assets and $455,000 in current liabilities. Its initial inventory level is $310,000, and it will raise funds as additional notes payable and use them to increase inventory. How much can Nelson's short-term debt (notes payable) increase without pushing its current ratio below 1.8? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What will be the firm's quick ratio after Nelson has raised the maximum amount of short-term funds? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardA company just issued $453000 of perpetual 5% debt and used the proceeds to repurchase stock. The company expects to generate 107000 of EBIT in perpetuity. The company distributes all its earnings as dividends at the end of each year. The firm's unlevered cost of capital is 14% and the tax rate is 25%. Use APV method to calculate the value of the company with leverage. Your Answer: Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education