FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

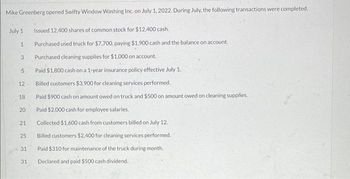

Transcribed Image Text:Mike Greenberg opened Swifty Window Washing Inc. on July 1, 2022. During July, the following transactions were completed.

Issued 12,400 shares of common stock for $12,400 cash.

Purchased used truck for $7,700, paying $1,900 cash and the balance on account.

Purchased cleaning supplies for $1,000 on account.

Paid $1,800 cash on a 1-year insurance policy effective July 1.

Billed customers $3,900 for cleaning services performed.

Paid $900 cash on amount owed on truck and $500 on amount owed on cleaning supplies.

July 1

1

3

5

12

18

20

21

25

31

31

Paid $2,000 cash for employee salaries.

Collected $1,600 cash from customers billed on July 12.

Billed customers $2,400 for cleaning services performed.

Paid $310 for maintenance of the truck during month.

Declared and paid $500 cash dividend.

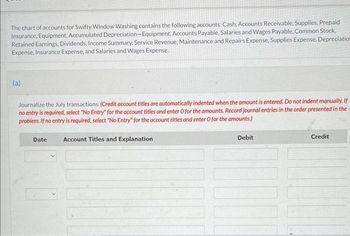

Transcribed Image Text:The chart of accounts for Swifty Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid

Insurance, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable, Common Stock,

Retained Earnings, Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation

Expense, Insurance Expense, and Salaries and Wages Expense.

(a)

Journalize the July transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the

problem. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Date

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Halogen Laminated Products Company began business on January 1, 2021. During January, the following transactions occurred: Jan. 1 Issued common stock in exchange for $101,000 cash. 2 Purchased inventory on account for $36,000 (the perpetual inventory system is used). 4 Paid an insurance company $2,520 for a one-year insurance policy. Prepaid insurance was debited for the entire amount. 10 Sold merchandise on account for $12,100. The cost of the merchandise was $7,100. 15 Borrowed $31,000 from a local bank and signed a note. Principal and interest at 10% is to be repaid in six months. 20 Paid employees $6,100 salaries for the first half of the month. 22 Sold merchandise for $10,100 cash. The cost of the merchandise was $6,100. 24 Paid $15,100 to suppliers for the merchandise purchased on January 2. 26 Collected $6,050 on account from customers. 28 Paid $1,100 to the local utility company for January gas and…arrow_forwardQuestion (I got $44,000... correct?): Riley Company began operations on August 1, 2026 and entered into the following transactions during 2026: 1. On August 1, Riley Company sold common stock to owners in the amount of $60,000 and borrowed $48,000 from a local bank on a 10-month, 10% note payable. 2. On August 14, Riley Company purchased inventory for $42,000 cash. 3. On September 1, Riley Company purchased a 3-year insurance policy for $27,000 cash. 4. On September 19, Riley Company purchased land for $30,000 cash. 5. On October 28, Riley Company sold two-thirds of the inventory that was purchased on August 14 to a customer for $62,000 cash. 6. On December 3, Riley Company sold the land that was purchased on September 19 for $19,000 cash. 7. On December 31, Riley recorded all necessary adjusting entries. Calculate the amount of total expenses reported in Riley Company's 2026 income statement after all of the above transactions have been recorded and posted.arrow_forwardwith this entries July 1 Began business by making a deposit in a company bank account of $40,000, in exchange for 4,000 shares of $10 par value common stock. July 1 Paid the premium on a 1-year insurance policy, $4,800. July 1 Paid the current month's store rent expense, $3,600. July 6 Purchased repair equipment from Paul's Pool Equipment Company, $7,800. Paid $600 down and the balance was placed on account. July 8 Purchased repair supplies from Mary's Repair Company on credit, $450. July 10 Paid telephone bill, $300. July 11 Cash pool service revenue for the first third of July, $2,650. July 18 Made payment to Mary's Repair Company, $300. July 20 Cash pool service revenue for the second third of July, $4,000. July 31 Cash pool service revenue for the last third of July, $2,250. July 31 Paid the current month's electric bill, $500. July 31 Declared and paid cash dividend of $1,100. i have to Prepare adjusting entries using the following information in…arrow_forward

- Mike Greenberg opened Cheyenne Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $9,800 cash in the company. 1 Purchased used truck for $6,560, paying $1,640 cash and the balance on account. 3 Purchased cleaning supplies for $740 on account. 5 Paid $1,440 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,030 for cleaning services performed. 18 Paid $820 cash on amount owed on truck and $410 on amount owed on cleaning supplies. 20 Paid $1,640 cash for employee salaries. 21 Collected $1,310 cash from customers billed on July 12. 25 Billed customers $2,050 for cleaning services performed. 31 Paid $240 for maintenance of the truck during month. 31 Owner withdrew $490 cash from the company. Date Account Titles and Explanation Debit Credit July 1July…arrow_forwardOn June 1, the company paid 2 years of insurance premiums worth $2,000.00 to Farmers' Insurance Co. The entry will include: a. Debit to Cash for $2,000.00 b. Credit to Cash for $2,000.00 c. Debit to Insurance Expense for $2,000.00 d. Credit to Prepaid Insurance for $2,000.00 e. Debit to Prepaid Insurance for $1,000.00arrow_forwardChapati Company started business on January 1, 2020. Some of the events that occurred in its first year of operations follow: Transactions 1. An insurance policy was purchased on February 28 for $2,340. The insurance policy was for one year of coverage that began on March 1, 2020. 2. During the year, inventory costing $139,000 was purchased, all on account. 3. Sales to customers totalled $201,000. Of these, $41,000 were cash sales. 4. Payments to suppliers for inventory that had been purchased earlier totalled $112,000. 5. Collections from customers on account during the year totalled $139,000. 6. Customers paid $27,000 in advance payments for goods that will be delivered later. 7. Equipment that cost $180,000 was purchased on October 1 for $40,000 cash plus a two-year, 10% note with a principal amount of $140,000. (Use Notes Payable) 8. Wages totalling $49,000 were paid to employees during the year. 9. The board of directors declared dividends of $12,000 in…arrow_forward

- Mike Greenberg opened Cheyenne Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $9,800 cash in the company. 1 Purchased used truck for $6,560, paying $1,640 cash and the balance on account. 3 Purchased cleaning supplies for $740 on account. 5 Paid $1,440 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,030 for cleaning services performed. 18 Paid $820 cash on amount owed on truck and $410 on amount owed on cleaning supplies. 20 Paid $1,640 cash for employee salaries. 21 Collected $1,310 cash from customers billed on July 12. 25 Billed customers $2,050 for cleaning services performed. 31 Paid $240 for maintenance of the truck during month. 31 Owner withdrew $490 cash from the company. List of accounts: Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated…arrow_forward*Just need help with number 8 and 9 Mike Greenberg opened Kleene Window Washing Inc. on July 1, 2019. During July, the following transactions were completed. July: 1 Issued 12,000 shares of common stock for $12,000 cash. 1 Purchased used truck for $8,000, paying $2,000 cash and the balance on account. 3 Purchased cleaning supplies for $900 on account. 5 Paid $1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $3,700 for cleaning services performed. 18 Paid $1,000 cash on amount owed on truck and $500 on amount owed on cleaning supplies. 20 Paid $2,000 cash for employee salaries. 21 Collected $1,600 cash for employee salaries. 25 Billed customers $2,500 for cleaning services performed. 31 Paid $290 for maintenance of the truck during month. 31 Declared and paid $600 cash dividend. The chart of accounts for Kleene Window Washing contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Equipment, Accumulated…arrow_forwardCan you please help me finish this? The filled in answers I have correct.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education