FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

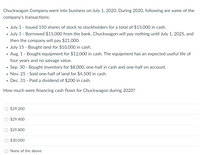

Transcribed Image Text:Chuckwagon Company went into business on July 1, 2020. During 2020, following are some of the

company's transactions:

July 1 - Issued 150 shares of stock to stockholders for a total of $15,000 in cash.

July 1 - Borrowed $15,000 from the bank. Chuckwagon will pay nothing until July 1, 2025, and

then the company will pay $21,000.

July 15 - Bought land for $10,000 in cash.

Aug. 1 - Bought equipment for $12,000 in cash. The equipment has an expected useful life of

four years and no salvage value.

Sep. 30 - Bought inventory for $8,000, one-half in cash and one-half on account.

• Nov. 25 - Sold one-half of land for $4,500 in cash.

Dec. 31 - Paid a dividend of $200 in cash.

How much were financing cash flows for Chuckwagon during 2020?

$29,200

O $29,400

$29,800

O $30,000

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected circumstances relate to pending lawsuits for Erismus, Inc. Erismus’s fiscal year ends onDecember 31. Financial statements are issued in March 2019. Erismus prepares its financial statements accordingto U.S. GAAP.Required:Indicate the amount of asset or liability that Erismus would record, and explain your answer.1. Erismus is defending against a lawsuit. Erismus’s management believes the company has a slightly worse than50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,000,000.2. Erismus is defending against a lawsuit. Erismus’s management believes it is probable that the company willlose in court. If it loses, management believes that damages could fall anywhere in the range of $2,000,000 to$4,000,000, with any damage in that range equally likely.3. Erismus is defending against a lawsuit. Erismus’s management believes it is probable that the company willlose in court. If it loses, management believes that damages will…arrow_forwardUsing the attached financial statement footnote. Explain why the application of time value is appropriate to account for the transaction.arrow_forwardSubject: accountingarrow_forward

- On November 1, 2019, Sherman Company sold $20,000 of merchandise inventory to a customer that originally cost $11,000. Sherman accepted a 90 day note receivable from the customer as payment for the inventory. The customer agreed to a 4% interest rate and will pay both principle and interest on January 31, 2020. Sherman Company closes their accounting records on December 31 and will need to prepare financial statements on that date. Required: Prepare journal entries for Sherman Company for: 1) November 1, 2019 – the date of sale 2) December 31, 2019 – adjustment (to recognize interest revenue) 3) January 31, 2020 – to record customer payment of principle and interestarrow_forwardThe following account balances are for the Agee Company as of January 1, 2020, and December 31, 2020. All amounts are denominated in kroner (Kr). Accounts payable Accounts receivable Accumulated depreciation-buildings Accumulated depreciation-equipment Bonds payable-due 2023 Buildings Cash Common stock Depreciation expense Dividends (10/1/20) Equipment Gain on sale of building. Rent expense Retained earnings Salary expense Sales Utilities expense Relevant exchange rates for 1 Kr were as follows: 2013 2014 January 1, 2020 April 1, 2020 July 1, 2020 October 1, 2020 December 31, 2020 Average for 2020 $ 2.45 2.25 2.55 2.65 2.85 2.95 3.05 2.75 January 1, 2020 (24,000) 45,000 (36,000) 0 Additional Information • Agee issued additional shares of common stock during the year on April 1, 2020. Common stock at January 1, 2020, was sold at the start of operations in 2013. (For all requirements, input all answers as positive.) 8. Remeasurement b. Translation adjustment • Agee purchased buildings in…arrow_forwardIncluded in Bonita Company’s December 31, 2020, trial balance are the following accounts: Accounts Payable $243,100, Pension Liability $378,400, Discount on Bonds Payable $34,200, Unearned Rent Revenue $50,800, Bonds Payable $406,100, Salaries and Wages Payable $28,700, Interest Payable $13,060, and Income Taxes Payable $37,400.Prepare the long-term liabilities section of the balance sheet.arrow_forward

- A corporation has the following account balances on December 31, 2019: Accounts receivable 4,200 Advertising expense 450 Cash $500 Interest expense 400 Wages expense 2,200 Service revenue 4,500 Supplies used 240 Unused supplies 200 Net income for 2019 is:arrow_forwardSweet home Inc., includes the following selected accounts in its general ledger at December 31, screenshot attacahed thanks fas fakopearrow_forwardSplish Corporation borrowed $58,500 on November 1, 2020, by signing a $60,000, 3-month, zero-interest-bearing note. Prepare Splish's November 1, 2020, entry; the December 31, 2020, annual adjusting entry; and the February 1, 2021, entry. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record interest) (To pay note)arrow_forward

- s of Placeless Wireless include the following as of December 31, 2024: ew the accounting records.) es on th Wireles ese lia Data table Accounts Payable Mortgages Payable (long-term) Interest Payable Bonds Payable (long-term) Total Stockholders' Equity $ 76,000 80,000 22,000 61,000 150,000 Print Salaries Payable Bonds Payable (current portion) Premium on Bonds Payable Uneamed Revenue (short-term) Done $ B 7,000 21,000 11,000 2,800 Xarrow_forwardAssume that Lululemon Athletica Inc. reported the following summarized data at December 31, 2020. Accounts appear in no particular order. Revenues: $275, Other Liabilities: $38, Other assets: $101, Cash and other Current assets: 53, Accounts Payable: $5, Expenses: $244, Shareholder's equity: $80. Prepare the Trail Balance of Lululemon at December 31,2020. List the accounts in proper order, as shown on "in class" practice. How much was Lululemon's net income or net loss?arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education