Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Kindly help me with accounting questions

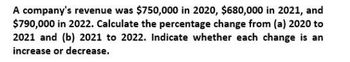

Transcribed Image Text:A company's revenue was $750,000 in 2020, $680,000 in 2021, and

$790,000 in 2022. Calculate the percentage change from (a) 2020 to

2021 and (b) 2021 to 2022. Indicate whether each change is an

increase or decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- After analyzing the transactions, prepare a vertical analysis schedule for the company for 2021 and 2020 using service revenue as the base amount. Round percentages to two decimal places. Here is the operating data for Yalis Cleaning, Inc.: 2021 2020Service revenue $523,000 $476,000Operating expenses 385,500 319,800Income tax expense 34,375 39,050Net income $103,125 $117,150arrow_forwardIf Sandhill Co. had net income of $423,800 in 2020 and it experienced a 30% increase in net income over 2019, what was its 2019 net income?arrow_forwardprepare a horizontal analysis of revenues and grossin dollar amounts and in 2019 and 2018. (Enter amounts in millions as provided to you in the problem statement. Round the percentages to one decimal place, X.X%. Use a minus sign or parentheses to indicate a decrease.) (In millions) 2019 2018 2017 Revenue $9,575 $9,300 $8,975 cost of goods sold $6,250 $6,000 $5,890 Increase (decrease) 2019 2018 Amount Percentage Amount Percentage Revenue Gross Profitarrow_forward

- Coho Company had net income of $744,800 in 2020 and it experienced a 33% increase in net income over 2019. /hat was its 2019 net income?arrow_forwardPlease describe what is meant by “Times Interest Earned.” How is it calculated? Suppose you calculated this ratio for a company for two consecutive years and the results were the following: year 2018 – 24.0 year 2017 – 28.0 Please interpret the results. What conclusions can you draw?arrow_forwardPlease help mearrow_forward

- Please give correct Answersarrow_forwardThe income statements for Federer Sports Apparel for 2022 and 2021 are presented below. Required: Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your percentage answers to 1 decimal place.) FEDERER SPORTS APPAREL Income Statement For the Years Ended December 31 Year Increase (Decrease) 2022 2021 Amount Net sales 19,100,000 S 15,800,000 Cost of goods sold 13,064,400 7,189,000 Gross profit 6,035,600 8,611,000 1,680,800 1,264,000 Operating expenses Depreciation expense 1,069,600 1,069,600 Inventory write-down 267,400 Loss (litigation) 1,585,300 347,600 Income before tax 1,432,500 5,929,800 Income tax expense 515,700 2,085,600 Net income $4 916,800 S 3,844,200arrow_forwardHere is the operating data for Yalis Cleaning, Inc.: After analyzing the transactions, prepare a vertical analysis schedule for the company for 2021 and 2020 using service revenue as the base amount. Round percentages to two decimal places.arrow_forward

- Operating data for Joshua Corporation are presented below. 2020 2019 Sales revenue $ 755,000 $ 604,000 Cost of goods sold 464,325 386,560 Selling expenses 118,535 75,500 Administrative expenses 58,135 54,360 Income tax expense 37,750 24,764 Net income 76,255 62,816 Prepare a schedule showing a vertical analysis for 2020 and 2019. (Round answers to 1 decimal place, e.g. 48.5%.)arrow_forwardPlease helparrow_forwardOperating data for Riverbed Corp are presented below. 2022 2021 Sales revenue $850,500 $643,000 Cost of goods sold 529,000 409,600 Selling expenses 121,800 75,900 Administrative expenses 73,300 50,700 Income tax expense 33,000 23,500 Net income 93,400 83,300 Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round percentages to 1 decimal place, e.g. 12.1%.) RIVERBED CORPCondensed Income Statementchoose the accouning period For the Years Ended December 31December 31For the Month Ended December 31 2022 2021 Amount Percent Amount Percent Sales $850,500 enter percentages % $643,000 enter percentages % Cost of goods sold 529,000 enter percentages % 409,600 enter percentages % Gross profit 321,500 enter percentages % 233,400 enter percentages % Selling…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning