Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Sales returns account at the end of 2013 ?

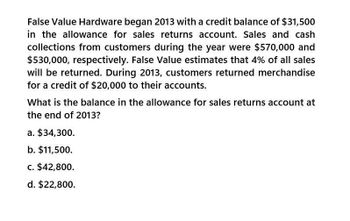

Transcribed Image Text:False Value Hardware began 2013 with a credit balance of $31,500

in the allowance for sales returns account. Sales and cash

collections from customers during the year were $570,000 and

$530,000, respectively. False Value estimates that 4% of all sales

will be returned. During 2013, customers returned merchandise

for a credit of $20,000 to their accounts.

What is the balance in the allowance for sales returns account at

the end of 2013?

a. $34,300.

b. $11,500.

c. $42,800.

d. $22,800.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Tonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit sales will be uncollectible. Allowance for Doubtful Accounts has a credit balance of 275. Prepare the adjusting entry at year-end for the estimated bad debt expense. (a) Based on an aging of its accounts receivable, Kyles Cyclery estimates that 3,200 of its year-end accounts receivable will be uncollectible. Allowance for Doubtful Accounts has a debit balance of 280 at year-end. Prepare the adjusting entry at year-end for the estimated uncollectible accounts.arrow_forwardLast year, Tobys Hats had net sales of 45,000,000 and cost of goods sold of 29,000,000. Tobys had the following balances: Refer to the information for Tobys on the previous page. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardBerry Farms has an accounts receivable balance at the end of 2018 of $425,650. The net credit sales for the year are $924,123. The balance at the end of 2017 was $378,550. What is the number of days sales in receivables ratio for 2018 (round all answers to two decimal places)?arrow_forward

- Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardWhat percentage of sales is expected to be returned on these general accounting question?arrow_forwardNeed helparrow_forward

- At the beginning of 2009, Pental Company had the following balances: A/R = $122,000 Allowance for Uncollectible Accounts = $7,900 During 2009, their credit sales were $1,173,000 and collections on A/R were $1,150,000. The following additional transactions occurred during the year: Feb 17, wrote off XXX Account, $3.600 May 28, wrote off YYY Account, $2,400 Dec 15, wrote off ZZZ Account, $900 Dec 31, recorded bad debts expense assuming that Penman's policy is to record bad debts expense at 0.8% of credit sales (Hint: The allowance account is increased by 0.8% of credit sales regardless of write-offs.) Compute the ending balance in A/R and the allowance for uncollectible accounts. Show how Pental's Dec 31, 2009 balance sheet reports the two accounts.arrow_forwardNeed help with this accounting problem with correct calculationarrow_forwardPlease give me answer general accountingarrow_forward

- Flimflam Corp had sales to customers of $475,000 during 2015. The company has consistently experienced a 35% gross profit percentage and estimates that 5% of all sales will be returned. During 2015, customers returned merchandise for credit of $18,000 to their accounts. The balance in the allowance for sales returns account at the beginning of 2015 was $24,000. What is the balance in the allowance for sales returns account at the end of 2015?arrow_forwardSanta Maria Widget reviewed the following information from its accounting records for the year ended December 31, 2011, before adjustment:Sales during 2011$800,000Credit Sales are 80% of salesCollections from customers in 2011590,000Accounts Receivable 165,000Allowance for Uncollectible Accounts (before adjustment)2,050 credit Santa Maria Widget uses the percent-of-sales method, at 1.5%, to estimate uncollectible accounts for 2011. The president of the company wants to change to the aged accounts receivable method and estimates $7,500 as the uncollectible amount for 2011. For each method of determining the estimate amount, you are to provide: 1. the adjusting Journal entry. 2. the ending balance in the Allowance account. 3. the net realizable value of accounts receivable. my answer was: 1) Bad Debt Expense $9,600 Allowance for uncollectible accounts $9,600 2) Ending balance in allowance account $11,650 3)Net…arrow_forwardDuring 2014, SABA Company had net sales of $11,400,000. Most of the sales were on credit. At the end of 2014, the balance of Accounts Receivable was $1,400,000 and Allowance for Uncollectible Accounts had a debit balance of $48,000. SABA Company’s management uses two methods of estimating uncollectible accounts expense: the percentage of net sales method and the accounts receivable aging method. The percentage of uncollectible sales is 1.5 percent of net sales, and based on an aging of accounts receivable, the end-of-year uncollectible accounts total $140,000. Show your computations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning