Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attempt in Progress

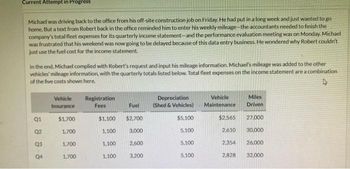

Michael was driving back to the office from his off-site construction job on Friday. He had put in a long week and just wanted to go

home. But a text from Robert back in the office reminded him to enter his weekly mileage-the accountants needed to finish the

company's total fleet expenses for its quarterly income statement-and the performance evaluation meeting was on Monday. Michael

was frustrated that his weekend was now going to be delayed because of this data entry business. He wondered why Robert couldn't

just use the fuel cost for the income statement.

In the end, Michael complied with Robert's request and input his mileage information. Michael's mileage was added to the other

vehicles' mileage information, with the quarterly totals listed below. Total fleet expenses on the income statement are a combination

of the five costs shown here.

Q1

Q2

Q3

Q4

Vehicle

Insurance

$1,700

1,700

1,700

1,700

Registration

Fees

Fuel

$1,100 $2,700

1,100

1,100

1,100

3,000

2,600

3,200

Depreciation

(Shed & Vehicles)

$5,100

5,100

5,100

5,100

Vehicle

Maintenance

$2.565

2,610

Miles

Driven

27,000

30,000

2,354

2,828 32,000

26,000

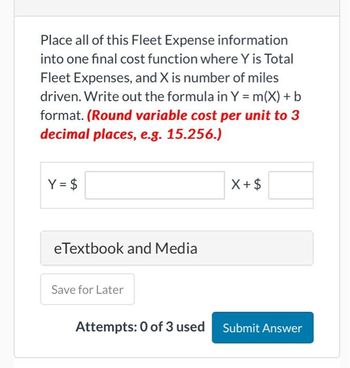

Transcribed Image Text:Place all of this Fleet Expense information

into one final cost function where Y is Total

Fleet Expenses, and X is number of miles

driven. Write out the formula in Y = m(X) + b

format. (Round variable cost per unit to 3

decimal places, e.g. 15.256.)

Y = $

eTextbook and Media

Save for Later

X+ $

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The manager of the Danvers-Hilton Resort Hotel stated that the mean guest bill for a weekend is 600 or less. A member of the hotels accounting staff noticed that the total charges for guest bills have been increasing in recent months. The accountant will use a sample of future weekend guest bills to test the managers claim. a. Which form of the hypotheses should be used to test the managers claim? Explain. H0:600H0:600H0:=600Ha:600Ha:600Ha:600 b. What conclusion is appropriate when H0 cannot be rejected? c. What conclusion is appropriate when H0 can be rejected?arrow_forwardPalmer finally decided to pick up the phone and request an urgent meeting withSands to resolve the problem. He got up enough nerve and put in the call only tobe told that Sands wouldn’t be back in the office until next week. As he put the receiver down, he thought maybe things would get better.TWO WEEKS LATERSands showed up unexpectedly at Palmer’s office and said they needed to talkabout Olds. Palmer was delighted, thinking that now he could tell her what hadbeen going on. But before he had a chance to speak, Sands told him that Olds hadcome to see her yesterday. She told him that Olds confessed that he was having ahard time working on both Crosby’s and Palmer’s projects. He was having difficulty concentrating on the auditing work in the afternoon because he was thinking about some of the consulting issues that had emerged during the morning. Hewas putting in extra hours to try to meet both of the projects’ deadlines, and thiswas creating problems at home. The bottom line was that he…arrow_forwardIt is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer. Normally invoices are sent to customers when products have been shipped or the service has been finished. You manager tells you that we will be shipping equipment and performing the setup services for this customer next month (as early as next week). You know that by preparing the closing entries tomorrow, the revenue will be included in this year’s fiscal year and then the revenue account will be set to zero for the beginning of the year. What is your manager trying to accomplish by asking you to do this?arrow_forward

- t is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer. Normally invoices are sent to customers when products have been shipped or the service has been finished. You manager tells you that we will be shipping equipment and performing the setup services for this customer next month (as early as next week). You know that by preparing the closing entries tomorrow, the revenue will be included in this year’s fiscal year and then the revenue account will be set to zero for the beginning of the year. How would you respond to your manager? Do you have any suggestions or alternative ways you would recommend to your manager on how to record this?arrow_forwardYou are the manager of accounting for a company that sells computer software packages. You have just received word from the comptroller that there has been a change in the expense allowances for employees using their own cars on business. Previously one rate was applied to all employees, but now there will be different allowance rates for regular and nonregular drivers Effective immediately, regular drivers will receive $1.00 per mile for the first 650 miles driven per month, and 25¢ for each additional mile; nonregular drivers will receive 80¢ per mile for the first 150 miles per month, and 25¢ for each additional mile Regular drivers are those who use their own cars frequently on the job to drive to their sales territories. Nonregular drivers are those employees-such as home-office personnel-who only occasionally use their cars on business. To ensure that these categories are used properly, you have requested that the manager of each department notify Accounts Payable, in writing,…arrow_forwardJason Kemp was torn between conflicting emotions. On the one hand, things were going so well. He had just completed 6 months as the assistant financial manager in the Electronics Division of Med-Products Inc. The pay was good, he enjoyed his coworkers, and he felt that he was part of a team that was making a difference in American health care. On the other hand, his latest assignment was causing some sleepless nights. Mel Cravens, his boss, had asked him to “refine” the figures on the division’s latest project—a portable imaging device code—named ZM. The original estimates called for investment of $15.6 million and projected annual income of $1.87 million. Med-Products required an ROI of at least 15% for new project approval. So far, ZM’s rate of return was nowhere near that hurdle rate. Mel encouraged him to show increased sales and decreased expenses in order to get the projected income above $2.34 million. Jason asked for a meeting with Mel to voice his concerns. Jason: Mel, I’ve…arrow_forward

- Jason Kemp was torn between conflicting emotions. On the one hand, things were going so well. He had just completed 6 months as the assistant financial manager in the Electronics Division of Med-Products Inc. The pay was good, he enjoyed his coworkers, and he felt that he was part of a team that was making a difference in American health care. On the other hand, his latest assignment was causing some sleepless nights. Mel Cravens, his boss, had asked him to “refine” the figures on the division’s latest project—a portable imaging device code—named ZM. The original estimates called for investment of $15.6 million and projected annual income of $1.87 million. Med-Products required an ROI of at least 15% for new project approval. So far, ZM’s rate of return was nowhere near that hurdle rate. Mel encouraged him to show increased sales and decreased expenses in order to get the projected income above $2.34 million. Jason asked for a meeting with Mel to voice his concerns. Jason: Mel, I’ve…arrow_forwardData Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 15% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 Rashid’s hard drive crashes and he sends it to DRS. June 12 After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $2,200. June 13 Rashid informs DRS that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 15% educational discount and reducing the cost by $330 ( = $2,200 × 15%). June 16 DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today’s date, offering a 4% discount for payment within 10 days. June 19 When Rashid receives the hard drive, he notices that DRS did not successfully recover all data.…arrow_forwardData Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 20% discount to students and faculty at educational institutions. Consider the following transactions during the month of June. June 10 Rashid’s hard drive crashes and he sends it to DRS. June 12 After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $2,900. June 13 Rashid informs DRS that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 20% educational discount and reducing the cost by $580 ( = $2,900 × 20%). June 16 DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today’s date, offering a 3% discount for payment within 10 days. June 19 When Rashid receives the hard drive, he notices that DRS did not successfully…arrow_forward

- You are working for a large firm that has asked you to attend a career fair at a university that is 185 miles from your office. You need to be there at 9:00 a.m. on a Monday morning. You can drive your personal car and be reimbursed $0.55 per mile, but you would need to leave home at 5:30 a.m. to get to the event and set up on time. Company policy allows you to spend the night if you must leave town before 6:00 a.m. The hotel across the street from campus charges $85 per night. Instead of driving, you could catch a 7:00 a.m. flight with a round-trip fare of $260. Flying would require you to rent a car for $29 per day, and you would have an airport parking fee of $20 for the day. The company pays a per diem of $40 for incidentals if you spend at least 6 hours out of town. (The per diem would be for one 24-hour period for either flying or driving.) As a manager, you are responsible for recruiting within a budget and want to determine which is more economical. Use the information provided to answer these questions. A. What is the total amount of expenses you would include on your expense report if you drive? B. What is the total amount of expenses you would include on your expense report if you fly? C. What is the relevant cost of driving? D. What is the relevant cost of flying? E. What is the differential cost of flying over driving? F. What other factors should you consider in your decision between driving and flying?arrow_forwardDerek Dingler conducts corporate training seminars on managerial accounting techniques all around the country. An upcoming training seminar is to be held in Philadelphia. Just prior to that engagement, Derek will be in New York City. He plans to stay in Philadelphia the night of the seminar, as the next morning he plans to meet with clients about future training seminar possibilities. One travel option is to fly from New York to Philadelphia on the first flight on Friday morning, which will get him to Philadelphia two hours before the start of his seminar. The cost of that flight is $287. Uber fees for his time in Philadelphia will cost $68. His meal per diem is $40 for each full day and $25 for each half day. The hotel cost is $225 per night. His second option is to rent a car and drive the two hours to Philadelphia from New York City the afternoon before the seminar. The cost of the rental car including gas is $57 per day and the car will be needed for two full days. At the end of…arrow_forwardDerek Dingler conducts corporate training seminars on managerial accounting techniques all around the country. An upcoming training seminar is to be held in Philadelphia. Just prior to that engagement, Derek will be in New York City. He plans to stay in Philadelphia the night of the seminar, as the next morning he plans to meet with clients about future training seminar possibilities. One travel option is to fly from New York to Philadelphia on the first flight on Friday morning, which will get him to Philadelphia two hours before the start of his seminar. The cost of that flight is $287. Uber fees for his time in Philadelphia will cost $68. His meal per diem is $40 for each full day and $25 for each half day. The hotel cost is $225 per night. His second option is to rent a car and drive the two hours to Philadelphia from New York City the afternoon before the seminar. The cost of the rental car including gas is $57 per day and the car will be needed for two full days. At the end of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:CengagePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:CengagePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning