FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Data Recovery Services (DRS) specializes in data recovery from crashed hard drives. The price charged varies based on the extent of damage and the amount of data being recovered. DRS offers a 15% discount to students and faculty at educational institutions. Consider the following transactions during the month of June.

| June 10 | Rashid’s hard drive crashes and he sends it to DRS. |

|---|---|

| June 12 | After initial evaluation, DRS e-mails Rashid to let him know that full data recovery will cost $2,200. |

| June 13 | Rashid informs DRS that he would like them to recover the data and that he is a student at UCLA, qualifying him for a 15% educational discount and reducing the cost by $330 ( = $2,200 × 15%). |

| June 16 | DRS performs the work and claims to be successful in recovering all data. DRS asks Rashid to pay within 30 days of today’s date, offering a 4% discount for payment within 10 days. |

| June 19 | When Rashid receives the hard drive, he notices that DRS did not successfully recover all data. Approximately 20% of the data has not been recovered and he informs DRS. |

| June 20 | DRS reduces the amount Rashid owes by 20%. |

| June 30 | Rashid pays the amount owed. |

Required:

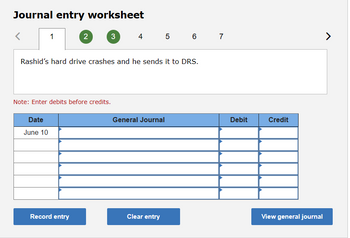

1. Record the necessary transaction(s) for Data Recovery Services on each date.

2. Show how net revenues would be presented in the income statement.

3. Calculate net revenues if Rashid had paid his bill on June 25.

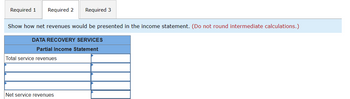

Transcribed Image Text:Required 1 Required 2 Required 3

Show how net revenues would be presented in the income statement. (Do not round intermediate calculations.)

DATA RECOVERY SERVICES

Partial Income Statement

Total service revenues

Net service revenues

Transcribed Image Text:Journal entry worksheet

<

1

Date

June 10

2

3

Rashid's hard drive crashes and he sends it to DRS.

Note: Enter debits before credits.

Record entry

4 5 6 7

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On April 13th 2022: K.C. is sued for cheating its customers by adding ice to cold beverages, thereby reducing the amount of precious liquid contained in the cups. By the time lawsuit occurs, the lawsuit loss is not probable and can not be estimated. On May 18th 2022: K.C. is sued for a week-long insomnia its customer sustained after the customer consumed K.C. signature expresso – The Death Wish. By the time K.C. is served, the lawsuit loss is probable and can be reasonable estimated between $ 90,000 to $ 100,000. On January 28th 2023 (before 2022 financial report is issued): new evidence related to ICE CUBE lawsuit surfaced. K.C.’s ice cube is on average 50% larger than industry standard! Thus, K.C. determines the lawsuit is probable and can be reasonable estimated at $ 15,500. With respect to each of the above events, Should K.C. recognize any gain/loss in its 2022 financial report? If so, what is the correct journal entry (entries) Whether and how should K.C. disclose the…arrow_forwardEthics Case Electronics, Inc. is a high-volume, wholesale merchandising company. Most of its inventory turns over four or five times a year. The company has had 50 units of a particular brand of computers on hand for over a year. These computers have not sold and probably will not sell unless they are discounted 60 to 70%. The accountant is carrying them on the books at cost and intends to recognize the loss when they are sold. This way, she can avoid a significant write-down in inventory on the current year’s financial statements. 1. Is the accountant correct in her treatment of the inventory? Why or why not? 2. If the computers cost $1,000 each and their market value is 40% of their cost, journalize the entry necessary for the write-down. 3. In groups of three or four, make a list of reasons why inventories of electronic equipment might have to be written down.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Your client, Piano Keys Inc., owns and operates a piano repair shop in Albany, New York. Piano Keys specializes in the repair and restoration of pianos. In November of last year, the roof over two-thirds of the Piano Keys building collapsed due to the weight of the snow on the roof. Since then, the portion of building damaged by the roof collapse has been demolished, an addition was built onto the undamaged portion (one-third) of the building, and Piano Keys reopened for business on September 1st of this year. The following data includes financial information regarding the matter provided by the client. The fair market value of the building (immediately before the roof collapse): $1,800,000 Piano Keys adjusted basis in the building: $300,000 Fair market value of the building immediately after the roof collapse was $600,000. Insurance proceeds due to the destruction of his building: $1,200,000 Demolition and construction costs: $1,500,000. ($1,200,000 of the insurance proceeds…arrow_forwardA large company has hired your friend. She tells you that her boss has asked customers to sign sales agreements just before year end indicating a sale has been made.The boss told customers that he will give them 30 days (well into the next year) to change their minds. If they do not change their minds they will quickly receive the merchandise. If they do change their minds he promised to cancel their orders, take merchandise back, and cancel the invoices.Your friend has been told by her boss to recognize the sales agreements as revenue this year. Your friend has concerns about recognizing revenue before the merchandise is shipped. She likes the company and wants to keep her job.What do you advise her to do?arrow_forwardDaniel Hudson, the general counsel of eHarbour, has received a letter from a dissatisfied eHarbour user. The user downloaded the eHarbour app to his phone and used the navigation software to compete in a local regatta. The user claims that the app stopped working during the regatta when he was leading the race and that he ended up placing fourth rather than winning the regatta. An internal investigation shows that the software indeed had a temporary service outage on the day of the race for approximately 10 minutes for selected users. The customer is demanding $100,000, including the $5,000 prize awarded to the first-place winner, and emotional damages in the amount of $95,000 for not winning the race. The company is worried about the bad publicity with a lawsuit but does not want to pay such a large settlement. Discuss the different types of alternative dispute resolution that could be used to avoid litigation. In your role as a paralegal or legal assistant at eHarbour, give a…arrow_forward

- The University of Cincinnati Center for Business Analytics is an outreach center that collaborates with industry partners on applied research and continuing education in business analytics. One of the programs offered by the center is a quarterly Business Intelligence Symposium. Each symposium features three speakers on the real-world use of analytics. Each corporate member of the center (there are currently 10) receives five free seats to each symposium. Nonmembers wishing to attend must pay $75 per person. Each attendee receives breakfast, lunch, and free parking. The following are the costs incurred for putting on this event: Rental cost for the auditorium: Registration Processing: Speaker Costs: Continental Breakfast: Lunch: Parking: (a) The Center for Business Analytics is considering a refund policy for no-shows. No refund would be given for members who do not attend, but nonmembers who do not attend will be refunded 50% of the price. Build a spreadsheet model that calculates a…arrow_forwardIn early July, Toni purchased a $60 ticket to what was expected to be the concert of the year. Parking for the game was expected to cost approximately $20, and Toni would likey spend another $20 for food at the concert. It is now November, at the weather is expected to be heavy rains the night of the concert. Toni is thinking about skipping the show and watching a movie at home with friends instead. The cost of take-out food for the friend get together is $40. The amount of sunk cost that should influence Toni's decision to spend the night indoors with friends is: $40,$100,$80 or $0?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education