Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

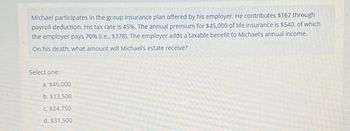

Transcribed Image Text:Michael participates in the group insurance plan offered by his employer. He contributes $162 through

payroll deduction. His tax rate is 45%. The annual premium for $45,000 of life insurance is $540, of which

the employer pays 70% (.e.. $378). The employer adds a taxable benefit to Michael's annual income.

On his death, what amount will Michael's estate receive?

Select one:

a. $45.000

b. $13.500

C. $24,750

d. $31.500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mark and carried married and they will file a joint breturn the both work full-time and their total income in 2020 is 89000 all from wages.they have one dependent child aubrey [5] during the year the spent 7000 for aubreys child care . Neith mark now carried recieve any dependent care benefit from employer what amouy may the use to calculate the child care creditarrow_forwardArnie is single and receives Social Security benefits. His AGI is $27,000 (includes half of the social security) and his Social Security benefits are $7,200 per year. $ 2800 of his Social Security benefits are taxable. Dlonk 1arrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2022). In 2022, her net Schedule C income was $304,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part b (Algo) b. She sets up an individual 401(k).arrow_forward

- Greg died on July 1, 2021, and left Lea, his wife, a $45,000 life insurance policy which she elects to receive at $9,000 per year plus interest for 5 years. In the current year, Lea receives $9,500. How much should Lea include in her gross income?arrow_forwardD’von works for a company that matches his 401(k) retirement contributions at a rate of “$0.50 per $1” of his contributions, up to 6% of his salary. D’von earns $60,000/year. Using Uncle Al’s advice, what is the minimum amount of salary that D’von should contribute to his 401(k) plan each year? A. $3,600 B. $7,200 C. $9,600 D. $18,000arrow_forward39. Annie is covered by a $200,000 group-term life insurance policy of which her daughter is the sole beneficiary. Annie's employer pays the entire premium for the policy, for which the uniform premium table factor is $0.75 per $1,000 per month of coverage. How much, if any, of the cost of the group-term life insurance is included in Annie's gross income on an annual basis? a. $0. b. $450. c. $1,350. d. $1,800.arrow_forward

- Kevin is a 48-year-old nurse who earns an annual salary of $95,000. His employer provides group-term life insurance coverage equal to twice the annual salary for all employees. The annual amount of income for each $1,000 of taxable insurance coverage for an individual 48 years old is $1.80. How much gross income must Kevin report for this benefit? (Round answer to O decimal places, e.g. 125.) Income $arrow_forwardFor each taxpayer, compute the maximum contribution to the retirement plan. a. Lewis, a self-employed individual, has net earned income of $50,000 in 2019. If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross income. b. During 2019, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax-deferred basis?arrow_forwardFor each situation listed indicate the amount to be included in income for current year. The federal interest rate of 5.5% is in effect. Linda collected $42,000 on a life insurance policy from her husband, Leon's death. The insurance policy was provided by Leon's employer, and the premiums were excluded from Leon's gross income as group term life insurance. The policy face value was $40,000.arrow_forward

- [The following information applies to the questions displayed below.] In 2023, LeSean (age 59 and single) has earned income of $4,800. He also has $31,700 of unearned (capital gain) income. c. If he does not participate in an employer-sponsored plan, what is the maximum deductible IRA contribution LeSean can make in 2023 if he has earned income of $15,300? Maximum deductible IRA contributionarrow_forwardFrank, who is single, received $6,000 of social security benefits. His AGI before the social security benefits was $14,000. He also had $100 of tax-exempt interest. What is the amount of taxable social security benefits? Multiple Choice • $0. ● $6,000. $3,000. $17,100.arrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education