Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

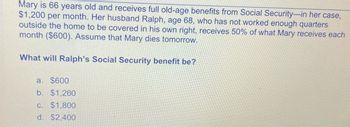

Transcribed Image Text:Mary is 66 years old and receives full old-age benefits from Social Security-in her case,

$1,200 per month. Her husband Ralph, age 68, who has not worked enough quarters

outside the home to be covered in his own right, receives 50% of what Mary receives each

month ($600). Assume that Mary dies tomorrow.

What will Ralph's Social Security benefit be?

a. $600

b. $1,200

c. $1,800

d. $2.400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- n 2021 Betty loaned her son, Juan, $10,000 to help him buy a car. In 2023, before he repaid the $10,000, Betty to Juan that she was "tearing up" the $10,000 note as a graduation present. How should Juan treat the amount forgi O A. taxable income in year of forgiveness B. excludible gift in year of forgiveness OC. taxable income in year of loan O D. excludible gift in year of loanarrow_forward36. One year prior to his death, Bobby lends his son $250,000 at a 10% interest rate per year to purchase land. As part of the promissory note, the promissory note will cancel upon Bobby's death. At the time of death no payments were made and Bobby did not seek payment from his son. Assuming this is John's only asset, what is the value of his gross estate? a. $0 b. $25,000 c. $250,000 d. $275,000arrow_forwarddot image plas.1arrow_forward

- Question 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forwardInterview Notes Herb and Alice are married and file a joint return. Herb is 74 years old and Alice turns 72 in February 2023. Neither are blind. • • . Alice is confused about the Required Minimum Distribution rules, and wants to know when she should take her first distribution from her IRA. Both Herb and Alice are retired. Herb works part time as a greeter. • Herb earned $12,000 in wages and has fully taxable pension income of $4,800. The couple also received Social Security benefits of $46,000. They received no other income in 2023. Herb and Alice's grandson, Stuart, lives with them while he attends the local university. Stuart is 20, a full-time student, and is claimed as a dependent by his parents. . Herb, Alice and Stuart are U.S. citizens, lived in the United States all year, and have valid Social Security numbers. 1. What is Herb and Alice's standard deduction? a. $27,700 Ob. $29,200 c. $29,550 d. $30,700arrow_forwardWang is a 43 - year old computer programmer who earns an annual salary of $80,000. His employer provides group - term life insurance coverage at twice the annual salary for all employees. The annual amount of income for each $1,000 of taxable insurance coverage for an individual 43 years old is $1.20. How much gross income must Wang report for this benefit? Group of answer choices $0 $132 $192 $96arrow_forward

- c. How much will the family receive (to the nearest dollar)? 647.51/1-6 1-(1.005264 .OOS 647.51.146.4 = 94795.46 150000-94795.46-55204.54₁,6 = 33122.72 4. A couple are planning for retirement. They plan to retire at age 70. At that time they wish to be able to withdraw $7500 per month from their retirement account for a period of 25 years, reducing the balance to zero. How much should they start saving now in an account that pays 7.54% compounded monthly to achieve their goal? Assume that they will be able to earn at least 7.54% interest compounded monthly from now until they are age 95. nt How much interest is earned over the 65 year period? A = P(1 + £ ) m² FV= PMT ((1+1)^-1) 7500 (1.076+25-1)arrow_forwardLaura and her husband Kevin have been married for 25 years and are planning to retire this year. Kevin's PIA is $13000. Laura's PIA is $3000. Assuming they are both at full retirement age, what is their maximum joint retirement benefit under Social Security? $16000 O $13000 $19500 O $26000arrow_forwardQuestion 8 of 75. Linda, age 54, takes a $12,500 distribution from her traditional IRA. She uses the distribution to pay qualified education expenses for her husband's grandson, Noah. Noah is attending a state university, and his tuition expenses alone were more than $20,000 in 2022. Neither Linda nor her husband will claim him as a dependent. How much of Linda's distribution is subject to the 10% additional tax on early distributions? $0 $2,500 $10,000 $12,500arrow_forward

- Please answer.upvote confirmarrow_forwardIf the executor needs to pay a debt at the time of a decedent's death, which of the following options will cost the least? Use the decedent's cash Sell something Borrow money Special IRS extension provisions Life insurance If your estate has to pay an estate tax, what is the tax rate? 40% of the unified credit. 40% of the equivalent exemption. The amount of the unified credit in the year of death 40%.arrow_forward40. Jim has earned an average of $3,290 per month over his lifetime. He is planning to retire at 66, the full retirement age for his year of birth. Using the formula of calculating Social Security as 90% of earnings of the first $680 and 32% of earnings over $680. calculate Paul's monthly retirement benefit. A. $1,052.80 B. $2,961.00 C. $1,447.20 D. $3,655.56arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education