SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

I need correct answer of this general accounting question

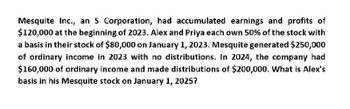

Transcribed Image Text:Mesquite Inc., an S Corporation, had accumulated earnings and profits of

$120,000 at the beginning of 2023. Alex and Priya each own 50% of the stock with

a basis in their stock of $80,000 on January 1, 2023. Mesquite generated $250,000

of ordinary income in 2023 with no distributions. In 2024, the company had

$160,000 of ordinary income and made distributions of $200,000. What is Alex's

basis in his Mesquite stock on January 1, 2025?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Oriole Company owns 3100 of the 10000 outstanding shares of Skysong Corporation common stock. During 2021, Skysong earns $360000 and pays cash dividends of $141000.Oriole should report investment revenue for 2021 of $111600. $141000. $67890. $43710.arrow_forwardIn 2023, Unlimited Tech had net operating income of $7,613,386. In addition to their operating income, they received $1,093,954 in dividend income from their shares in United Corporation. Unlimited Tech owns 15% of all United Corp outstanding shares. Unlimited Tech did not have any interest expense. What is Unlimited Tech's taxable income? (round to the nearest $1)arrow_forwardDuring 2023, Elisabeth Ltd. purchased 8,000 shares of Lilly of the Valley Corp. for $34 per share ($272,000 total). Elisabeth held these shares until September 2025, when it sold them for $42 per share. During these three years, Lilly of the Valley paid dividends of $2 per share on July 31. On Elisabeth's fiscal year-end (December 31), shares of Lilly of the Valley closed at $39, $30, and $46 in 2023, 2024, and 2025, respectively. Required Assume that the company designated half of the Lilly of the Valley shares as FVPL and the other half irrevocably elected to record fair value changes through OCI. Determine the amounts to be reported on Elisabeth's balance sheet and statement of comprehensive income with respect to the company's investment in Lilly of the Valley Corp. What do you observe about the total amount of retained earnings for the three years combined? Complete the analysis for 2024. Balance sheet Financial asset Equity: AOCI on Lilly of the Valley shares* Retained earnings…arrow_forward

- On January 1, 2023, Kinney, Inc., an S corporation, reports $33,600 of accumulated E & P and a balance of $84,000 in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year is $42,000. Kinney distributes $50,400 to each shareholder on July 1, and it distributes another $25,200 to each shareholder on December 21. How are the shareholders taxed on the distributions? Ignore the 20% QBI deduction. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Erin and Frank each report $ dividend income for the July 1 distribution and $ distribution. Assuming that the shareholders have sufficient basis in their stock, Erin and Frank each receive a tax-free distribution from AAA. $ each for the December 21arrow_forwardIn 2020, Merced, Inc. (a C-corporation) had net operating income of $20,000. During 2021, Merced also had long-term capital gains of $50,000 and long-term capital losses of $65,000. In addition, Merced, Inc. received a $70,000 dividend from Dolphin, Inc. in 2020. Merced owns 25% of the shares of Dolphin. Note: the operating income only includes revenue and expenses directly related to operations (it does not include any capital transactions or dividends). Determine Merced’s tax liability of 2020.arrow_forwardIn 2020, Merced, Inc. (a C-corporation) had net operating income of $20,000. During 2021, Merced also had long-term capital gains of $50,000 and long-term capital losses of $65,000. In addition, Merced, Inc. received a $70,000 dividend from Dolphin, Inc. in 2020. Merced owns 25% of the shares of Dolphin. Note: the operating income only includes revenue and expenses directly related to operations (it does not include any capital transactions or dividends). What is Merced’s taxable income for 2020?arrow_forward

- Sunland Company owns 29000 of the 50000 outstanding shares of Taylor, Inc. common stock. During 2021, Taylor earns $1320000 and pays cash dividends of $1050000.Sunland should report investment revenue for 2021 of $765600. $609000. $0. $156600.arrow_forward15.On January 2, 2020, Howdy Doody bought 15% of Ranger's common stock for $ 54,000. Ranger's net income as of December 31, 2020 was $ 80,000. During 2020, Ranger declared and paid dividends of $ 64,000. As of December 31, 2018, the market value of Howdy Doody-owned Ranger shares had risen to $ 69,000. How much is Howdy's total effect on net income caused by investing in Ranger for 2020? Select one: a. $ 15,000. b. $ 21,000. c. $ 24,600. d. $ 9,600.arrow_forwardOn January 1, 2024, Nana Company paid $100,000 for 6,300 shares of Papa Company common stock. The ownership in Papa Company is 10%. Nana Company does not have significant influence over Papa Company. Papa reported net Income of $51,000 for the year ended December 31, 2024. The fair value of the Papa stock on that date was $50 per share. What amount will be reported in the balance sheet of Nana Company for the Investment in Papa at December 31, 2024? Multiple Choice O O $270,000 $315,000 $255,000 $240,000arrow_forward

- On January 1, 2024, Nana Company paid $100,000 for 8, 100 shares of Papa Company common stock. The ownership in Papa Company is 10%. Nana Company does not have significant influence over Papa Company. Papa reported net income of $55,000 for the year ended December 31, 2024. The fair value of the Papa stock on that date was $55 per share. What amount will be reported in the balance sheet of Nana Company for the investment in Papa at December 31, 2024? A: $400, 500B: $445, 500C: $385,500D: $ 370, 500arrow_forwardRizzo Co. has Net Income of $279,000 for 2024. Over the past two years, the company had outstanding 125,000 shares of common stock. During the year, the company paid dividends on preferred stock in the amount of $45,000. The company has outstanding all year 20,000 shares of cumulative preferred stock. Each share of preferred stock is convertible into 4 shares of common stock. The company's tax rate is 20 percent. What is the company's basic earnings per share?arrow_forwardPharoah Company owns 3200 of the 10000 outstanding shares of Sheridan Corporation common stock. During 2021, Sheridan earns $370000 and pays cash dividends of $142000.If the beginning balance in the investment account was $820000, the balance at December 31, 2021 should bearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you