FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

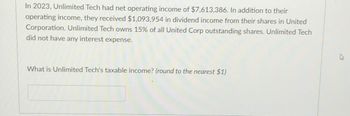

Transcribed Image Text:In 2023, Unlimited Tech had net operating income of $7,613,386. In addition to their

operating income, they received $1,093,954 in dividend income from their shares in United

Corporation. Unlimited Tech owns 15% of all United Corp outstanding shares. Unlimited Tech

did not have any interest expense.

What is Unlimited Tech's taxable income? (round to the nearest $1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Presented below are two independent situations: (a) (b) Sheridan Inc. acquired 10% of the 417,000 shares of common stock of Schuberger Corporation at a total cost of $15 per share on June 17, 2022. On September 3, Schuberger declared and paid a $117,000 dividend. On December 31, Schuberger reported net income of $517,000 for the year. (a) Pina Corporation obtained significant influence over Hunsaker Company by buying 30% of Hunsaker's 117,000 outstanding shares of common stock at a cost of $16 per share on January 1, 2022. On May 15, Hunsaker declared and paid a cash dividend of $117,000. On December 31, Hunsaker reported net income of $217,000 for the year. Prepare all necessary journal entries for 2022 for (a) Sheridan and (b) Pina. (List all debit entries before credit entries. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries…arrow_forward7) DeHaan Company owns 40,000 shares of the common stock of Curtis Company. DeHaan decided to divest itself of this investment by distributing the Curtis shares in the form of a property dividend. The dividend ratio is one share of Curtis for every four shares of DeHaan common shares held by shareholders. DeHaan has 160,000 common shares outstanding. On April 15, 2024, the date of declaration, Curtis stock had a par of $5 per share, a book value of $12 per share, and a fair value of $17 per share. Required:Prepare any necessary journal entries. The shares were distributed on May 15, 2024, to stockholders of record on May 1, 2024.arrow_forwardOpus Limited is a CCPC. In 2023, the company received the following dividends: Dividends on Portfolio Investments Dividends from Magnum Inc. [(100%) ($55,000)] Dividends from Masterpiece Ltd. [(40%) ( $100,000)] $ 35,000 55,000 40,000 Opus owns 100% of the shares of Magnum Inc. and 40% of the shares of Masterpiece Ltd. Masterpiece received a dividend refund of $10,000 on its dividend payment, while Magnum received a dividend refund of $15,000. Required: Determine the amount of Part IV Tax payable by Opus Limited for the current year. Part iv tax rate: 38¹3%arrow_forward

- On January 1, 2023, Cullumber Corp. had cash and common shares of $80,000. At that date, the company had no other asset, liability, or shareholders' equity balances. On January 2, 2023, Cullumber paid $60,000 cash for equity securities that it designated as FV-OCI investments. During the year, Cullumber received non-taxable cash dividends of $27,000 and had an unrealized holding gain of $25,000 (net of tax) on these securities. Determine the following amounts for 2023: (a) (b) (c) Net Income /(Loss) Other Comprehensive Income Comprehensive Income (d) Accumulated Other Comprehensive Income (as at the end of 2023) $ $ tA LAarrow_forwardPackard Inc. is a public company. On January 1, 2020 Packard Inc. purchased 10,000 common shares (15%) of Saturn Inc. for $115,000 in cash. Saturn had common shares of $225,000 and retained earnings of $475,000 on this date. Packard considered Saturn a FVTPL investment; as it did not give Packard significant influence. On December 31, 2020 the Saturn shares were trading at $13.00 per share. On January 1, 2021, Packard purchased an additional 25% of Saturn's shares for $217,000 in cash. This second purchase allowed Packard to exert significant influence over Saturn. The following information was available on the date of acquisition: Carrying Value Fair Value Assets not subject to depreciation $205,000 Assets subject to depreciation (10 year useful life) 750,000 Patent (7 year useful life) 35,000 Liabilities 115,000 115,000 Saturn depreciates assets using the straight-line method and has a 35% tax rate. During the two years, Saturn reported the following: Dividends Declared $275,000…arrow_forwardYou are given financial statements and a Dupont analysis for Tesco and Ahold. What do you conclude about the two companies’ performances based on these numbers?arrow_forward

- Sapphire Jewellery Pty Ltd (SJ) is a resident private company. During the 2023 income year, SJ recorded an accounting profit of $80,000 In addition to the transactions recorded in the financial statements, SJ noted the following: SJ sold shares held as an investment for $45,000. The shares were purchased in 2017 for $ 25,000 Calculate the taxable income of SJ for the 2023 income year. Question 2Select one: $100,000 $ 90,000 $60,000 $70,000arrow_forwardIn 2021, ACME Corporation (a C corporation) had operating income of $250,000. ACME sold investments that resulted in a $120,000 short-term capital gain and a $200,000 long-term capital loss. ACME received a dividend of $100,000 from Andiron, Inc. ACME owns 5% of Andiron stock. In 2020, ACME had taxable income of $100,000 (which included $20,000 of LTCG). In 2017, 2018, and 2019, ACME did not have any capital transactions. Determine ACME's taxable income for 2021. Determine Acme's tax liability for 2021. Assume that ACME is a client. Explain what the client can expect in terms of the overall tax liability in 2021.arrow_forwardOn January 3, 2023, Sheppard Corporation purchased 15% of Meredith Corporation's common stock for $62,000. Meredith's net income for the years ended December 31, 2023 and 2024 were $18,000 and $56,000 respectively. Meredith declared no dividends during 2023; however, during 2024, the company declared a $70,000 dividend. On December 31, 2023, the fair value of Meredith's stock that Sheppard Corporation owned had increased to $73,000; in 2024, it increased again to $79,000. What will be the carrying value of the investment at the end of December 31, 2024? Group of answer choices $79,000 $135,000 $73,000 $62,000arrow_forward

- . Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1, 2013, at which time Sergio's stockholders' equity consisted of $15,000 of Common Stock and $6,000 of Retained Earnings. The fair values of Sergio Corporation's assets and liabilities were identical to recorded book values when Paulee acquired its 80% interest. Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2013. Paulee Corporation sold inventory items to Sergio during 2013 and 2014 as follows: 2013 2014 Paulee's sales to Sergio $5,000 $6,000 Paulee's cost of sales to Sergio 3,000 3,500 Unrealized profit at year-end 1,000 1,500 At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory…arrow_forwardTurner Company owns 10% of the outstanding shares of ICA Company. Turner has a choice to measure this investment (a) at fair value through profit or loss, (b) at fair value through other comprehensive income, or (c) using the equity method. During the current year, ICA paid a $5 million cash dividend on its shares. What effect did this dividend have on Turner's 2022 financial statements under each of the above bases of measurement? Explain the reasoning for this effect.arrow_forwardBuyCo, Incorporated, holds 21 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $11,100 per year. For 2023, Marqueen reported earnings of $111,000 and declares cash dividends of $29,000. During that year, Marqueen acquired inventory for $43,000, which it then sold to BuyCo for $86,000. At the end of 2023, BuyCo continued to hold merchandise with a transfer price of $29,000. What Equity in Investee Income should BuyCo report for 2023? How will the intra-entity transfer affect BuyCo’s reporting in 2024? If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education