FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

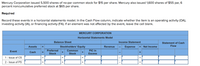

Transcribed Image Text:Mercury Corporation issued 5,500 shares of no-par common stock for $15 per share. Mercury also issued 1,600 shares of $55 par, 6

percent noncumulative preferred stock at $65 per share.

Required

Record these events in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA),

investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank.

MERCURY CORPORATION

Horizontal Statements Model

Balance Sheet

Income Statement

Statement of Cash

Flow

Assets

Stockholders' Equity

Revenue

Expense

Net Income

Event

Preferred

Common

PIC in

Cash

Stock

Stock

Excess

1 - Issue of CS

2 - Issue of PSs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardS1. Accountarrow_forwardNutrition Inc. reissued treasury stock. How would this be shown on a statement of cash flows? decrease in cash from an investing activity increase in cash from a financing activity decrease in cash from an operating activity decrease in cash from a financing activity increase in cash from an investing activity increase in cash from an operating activity Nutrition Inc. made a payment on a past due account payable. How would this be shown on a statement of cash flows? increase in cash from a financing activity decrease in cash from an operating activity increase in cash from an operating activity decrease in cash from a financing activity increase in cash from an investing activity decrease in cash from an investing activityarrow_forward

- Renaldo Cross Company paid $2,000 interest on short-term notes payable, $10,000 principal of long-term bonds, and $6,000 in dividends on its common stock. Renaldo Cross Company would report cash outflows from activities, as follows: Multiple Choice Operating, $0; investing, $10,000; financing, $8,000. Operating, $0; investing, $0; financing, $18,000. Operating, $2,000; investing, $10,000; financing, $6,000. Operating, $2,000; investing, $0; financing, $16,000. 身arrow_forwardThe Stancil Corporation provided the following current information: Proceeds from long-term borrowing $ 13,800 Proceeds from the sale of common stock 5,000 Purchases of fixed assets 27,500 Purchases of inventories 2,600 Payment of dividends 13,800 Determine the total cash flows spent on fixed assets and NWC, and determine the cash flows to investors of the firm. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.)arrow_forward8arrow_forward

- On May 1, Year 3, Love Corporation declared a $68,700 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in the following horizontal statements model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA).arrow_forwardNo explanation of answers requiredarrow_forwardJanzen Company recorded employee salaries earned but not yet paid. Which of the following represents the effect of this transaction on the horizontal financial statements model? A. B. C. D. Assets + Balance Sheet Liabilities + + + Multiple Choice Option B Option A Option C Option D + Stockholders' Equity Income Statement Revenue + - Expense = + + + Net income + Statement of Cash Flows -Operating Activity -Investing Activityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education