FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

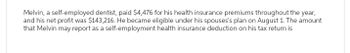

Transcribed Image Text:Melvin, a self-employed dentist, paid $4,476 for his health insurance premiums throughout the year,

and his net profit was $143,216. He became eligible under his spouses's plan on August 1. The amount

that Melvin may report as a self-employment health insurance deduction on his tax return is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Paul is self-employed as a dentist. He practices under the name "Paul J. Vance, DDS." Paul's gross receipts during the year were $111,000. He uses the cash method of accounting. His business expenses are $68,890. Assume the QBI amount is net of the self-employment tax deduction. What is he qualified business income deduction for 2020?arrow_forwardDuring the current tax year, Doug incurs the following deductible expenses: State Income Tax $2,300 Local Property Tax $3,000 Medical Expenses $ 800 Charitable Contributions $2,000 Doug is 33, single with no dependents. His has $35,000 AGI for the year. What is the amount of Doug's taxable income.arrow_forwardMelvin, a self-employed dentist paid $4,476 for his health insurance premiums throughout the year and is net profit was 143,216. he became eligible under his spouse's plan on August 1st. the amount of Melvin may report a self-employment health insurance deduction on his tax return is whatarrow_forward

- Jeremy (unmarried) earned $101,000 in salary and $6,050 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $24,060 in itemized deductions. (Use the tax rate schedules, Tax rates for Net Capital Gains and Qualified Dividends.) Required: a. Determine Jeremy's tax refund or taxes due. b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,020. What is Jeremy's tax refund or tax due including the tax on the capital gain? c. Assume the original facts except that Jeremy has only $7,100 in itemized deductions. What is Jeremy's tax refund or tax due?arrow_forwardTucker (age 52) and Elizabeth (age 48) are a married couple. Tucker is covered under a qualified retirement plan at his job and earned $90,000 in 20x 4. Elizabeth is employed as a lab technician and earned $30,000 but is not covered under a qualified retirement plan. They file a joint return; have interest and dividend income of $25,000. What is the maximum amount of tax deductible contributions that may be made to a traditional IRA? $12,000 $13,000 50 $6,000arrow_forwardTerry and Jennifer, both in their 30s, file a joint income tax return for 2020. Terry’s wages are $26,000 and Jennifer’s wages are $34,000 for the year. Their total adjusted gross income is $60,000, and Joan is covered by a qualified pension plan at work but Terry is not. a. What is the maximum amount that Terry and Jennifer may each deduct for contributions to their traditional individual retirement accounts in 2020? b. If Jennifer's wages are $85,000 for 2020, instead of $34,000, and their adjusted gross income is $111,000, what is the maximum amount that Terry and Jennifer may each deduct for contributions to their traditional individual retirement accounts?arrow_forward

- For each taxpayer, compute the maximum contribution to the retirement plan. a. Lewis, a self-employed individual, has net earned income of $50,000 in 2019. If Lewis has no employees, calculate the maximum contribution to a SEP plan that he may deduct from his adjusted gross income. b. During 2019, Linda, age 32, has a salary of $40,000. She participates in a Section 401(k) plan and chooses to defer 25 percent of her compensation. What is the maximum amount Linda can contribute to the Section 401(k) plan on a tax-deferred basis? If Linda's salary was $125,000, instead of $40,000, what is the maximum amount that she could contribute to the Section 401(k) plan on a tax-deferred basis?arrow_forwardJohn Leslie lives with his wife and 21 year old blind son, Keith, who qualifies for the disability tax credit. Keith has no income of his own. During 2020, John paid medical expenses of $16,240 for Keith. None of these expenses involve attendant care. John’s Taxable Income for 2020 was $100,000. Determine the total amount of tax credits related to Keith that will be available to John.arrow_forwardSusan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2019, Susan’s income is $41,214 and Stan’s is $12,000 and both are self-employed. They also have $500 in interest income from tax-exempt bonds. The Collins enrolled in health insurance for all of 2019 through their state exchange but did not elect to have the credit paid in advance. The 2019 Form 1095-A that the Collins received from the exchange lists the following information:Annual premiums $9,800Annual premium for the designated silver plan in the state $10,800 Compute the Collins’ premium tax credit for 2019.arrow_forward

- Joyce is a single, cash-method taxpayer. On April 11, 2021, Joyce paid $120 in state income taxes with her 2020 state income tax return. During 2021, Joyce had $1,600 in state income taxes withheld. On April 13, 2022, Joyce paid $200 with her 2021 state tax return. During 2022, she had $2,100 in state income taxes with-held from her paycheck. Upon filing her 2022 tax return on April 15, 2023, she received a refund of $450 for excess state income taxes withheld. Joyce had total AGI in 2022 and 2023 of $51,000 and $53,500, respectively. In 2022, Joyce also paid $13,500 in qualified residence interest. a. What is the amount of state income taxes Joyce may include as an itemized deduction for 2021? b. What is Joyce’s allowed itemized deduction for state income taxes for 2022? c. What is Joyce’s taxable income for 2022?arrow_forwardAlice is single and self-employed in 2022. Her net business profit on her Schedule C for the year is $166,000. What are her self-employment tax liability and additional Medicare tax liability for 2022?arrow_forwardMalcolm Moore, single, had medical expenses of $5,000 last year and was able to deduct $3,000 of them. He was reimbursed $4,500 of these expenses this year by his insurance company. His total itemized deductions last year were $19,000. What amount must he include in this year's tax return as gross income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education