FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

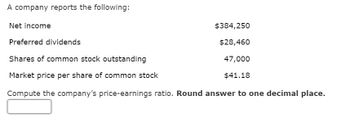

Transcribed Image Text:A company reports the following:

- **Net income:** $384,250

- **Preferred dividends:** $28,460

- **Shares of common stock outstanding:** 47,000

- **Market price per share of common stock:** $41.18

**Task:** Compute the company's price-earnings ratio. Round the answer to one decimal place.

Expert Solution

arrow_forward

Step 1

PE Ratio is the market price per share on the earning per share

Earnings is net income less preferred dividend

Earning per share is earning divided by number of common shares

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardny Annual Cash Dividend per Share Market Valueper Share 1 $ 11.00 $ 169.23 2 8.00 98.77 3 7.30 72.28 4 1.80 118.15 Compute the dividend yield for each of these four separate companies.arrow_forwardA company reports the following: Net income $697,770 Preferred dividends $51,690 Shares of common stock outstanding 48,000 Market price per share of common stock $39.03 Calculate the company's earnings per share on common stock. Round your answer to the nearest cent. $fill in the blank 1arrow_forward

- Name Symbol Close Net Chg Volume 52 Wk High 52 wk low Div Yield P/E YTD %Chg Gen Dyn GD 142.97 -0.47 1,375,410 153.76 121.61 3.04 2.13 15.39 11. W4.08 1. How many shares could you buy for $5,000? 2. What must be Gen Dyn's earnings per share? 3. What was the firms' closing price on the day before the listing?arrow_forwardI want to answer this questionarrow_forwardA company reported the following: Net income $423,790 Preferred dividends $31,390 Shares of common stock outstanding 36,000 Market price per share of common stock $184.43 Calculate the company's price-earnings ratio. Round your answer to two decimal places.fill in the blank 1arrow_forward

- Brock Company's financial information is listed below. Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit. Assets Cash and short-term investments $35,766 Accounts receivable (net) 32,541 Inventory 34,460 Property, plant, and equipment 215,693 Total assets $318,460 Liabilities and Stockholders' Equity Current liabilities $67,513 Long-term liabilities 90,221 Common stock, $10 par 61,070 Retained earnings 96,656 Total liabilities and stockholders' equity $318,460 Income Statement Sales $99,202 Cost of goods sold 44,641 Gross margin $54,561 Operating expenses 28,479 $26,082 Net incomearrow_forwardWhat is Ella Company’s equity ratio? a. 25.78% d. 74.22% b. 100.00% e. 137.78% c. 34.74%arrow_forwardCompany Ticker Price per Share Earnings per Share Book Value per Share Abbott Labs ABT 54.35 3.69 13.79 Bristol-Myers-Squibb BMY 25.45 1.93 7.33 GlaxoSmithKline GSK 41.3 3.15 6.03 Johnson & Johnson JNJ 62.6 4.58 18.27 Merck MRK 36.25 3.81 10.86 Pfizer PFE $18.30 $1.20 8.19 Assuming that Novartis AG (NVS) has an EPS of $3.35, based upon the average P/E ratio for its competitors, Novartis' stock price is closest to:arrow_forward

- What is the total stockholders' equity based on the following account balances? Common Stock $450,000 Paid-in Capital in Excess of Par $90,000 Retained Earnings Treasury Stock a. $740,000 b. $730,000 c. $720,000 d. $640,000 $190,000 $10,000arrow_forwardhello, I need help pleasearrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education