FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

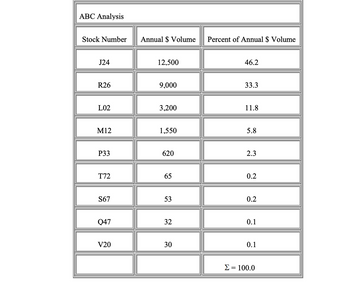

Transcribed Image Text:Class C items usually represent only a small amount of the annual dollar volume spent on inventory, only about

5%, but are the majority of items, about 55% of all the items stocked. These are only guideline and the exact

amounts will change for different situations, but we are looking for the trivial many items, meaning the large

number of items that cost only a small amount of the total annual cost of all inventory.

Managing inventory is expensive and so we look for items where we spend less on managing these items in

inventory (forecasting, inventory controls, cycle counting, etc). For instance, a small amount of additional safety

stock may be less costly than the close managing of the item through supplier management, inventory controls,

and cycle counting.

With the small amount of items that we have in problems like this we don't always see the exact guidelines given

above. From the information we have what are the least costly items, usually there will be quite a few? From the

options below, select ALL of the inventory stock numbers (items) that would be classified as C items

during an ABC analysis (see problem from download in previous step):

Note: points off for incorrect answers

☐

U

☐

T72

R26

M12

Q47

V20

Transcribed Image Text:ABC Analysis

Stock Number

Annual $ Volume Percent of Annual $ Volume

J24

12,500

46.2

R26

9,000

33.3

L02

3,200

11.8

M12

1,550

5.8

P33

620

2.3

T72

65

0.2

S67

53

0.2

Q47

32

0.1

V20

30

0.1

Σ = 100.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- 10-6 Given the following share price history, calculate the standard deviation of the returns on this stock. Year Share price 1 $20 2 $22 3 $24 4 $26 5 $28 Select one: a. 0.01% b. 0.99% c. 1.81% d. 8.78% e. 9.95%arrow_forwardF1arrow_forwardName Symbol Close Net Chg Volume 52 Wk High 52 wk low Div Yield P/E YTD %Chg Gen Dyn GD 142.97 -0.47 1,375,410 153.76 121.61 3.04 2.13 15.39 11. W4.08 1. How many shares could you buy for $5,000? 2. What must be Gen Dyn's earnings per share? 3. What was the firms' closing price on the day before the listing?arrow_forward

- D0 = $2, g = 5%, P0 = $30, find the stock return 10% 11% 12% 13%arrow_forwardTABLE 5.3 Risk and return of investments in major asset classes, 1927-2018 Average Risk premium Standard deviation max min T-bills 3.38 na 3.12 14.71 -0.02 T-bonds 5.83 2.45 11.59 41.68 -25.96 Stocks 11.72 8.34 20.05 57.35 -44.04arrow_forwardQUESTION 5.1 Use the attached information and answer this qiestion: Use the Gordon growth model to estimate the cost of the ordinary shares of AMN Limited from the attached information.arrow_forward

- STOCK HI LO % PE 100s CLOSE CHG (DIV) 62.50 38.00 RJW 1.60 3.2 17 10 ?? -49 a. What was the closing price for this stock that appeared in yesterday's paper? * b. If the company currently has 22 million shares of stock outstanding, what was net income for the most recent four quarters?arrow_forwardStock i’s standard deviation35.00%Market’s standard deviation32.00%Correlation between Stock i and the market0.65Beta coefficient of Stock i:arrow_forwardProblem 9-21 Risk, Return, and Their Relationship (LG9-3, LG9-4)Consider the following annual returns of Estee Lauder and Lowes Companies: Estee LauderLowes CompaniesYear 123.9%6.0%Year 224.016.6Year 318.14.7Year 450.444.0Year 517.314.0Compute each stocks average return, standard deviation, and coefficient of variation.Note: Round your answers to 2 decimal places.arrow_forward

- Marty McFly’s portfolio: Stock Number of Shares Price per Share A 110 $22 B 660 $16 C 360 $44 D 180 $33 The weight of stock C in Marty McFly’s portfolio is: a. 55.57 b. 38.61 c. 34.30 d. 50.57 e. 45.57arrow_forwardEsc Chapter 12 Practice Problems 1. Suppose a stock had an initial price of $77 per share, paid a dividend of $1.35 per share during the year, and had an ending share price of $83. Compute the percentage total return. Q Search 1 Q A N @ 2 W S F2 X # 3 E F3 D $ 4 R F DII % 5 F5 T G * F6 A 6 Y B * H & 7 PrtScn U N * 8 Home 1 M 9 Page K End о F10 ) 0 PgUp F11 Parrow_forwardB20 x✓ fx A B 5 Earnings 6 4 Shares Outstanding Dividends, Per Share (Just Paid) 7 Return on Equity 8 Beta 9 10 Market Data 11 Market Return 12 Risk-Free Rate 13 25,000,000 $50,000,000 $1.25 0.15 1.35 Expected Return 0.12 0.03 14 Required: 15 16 Using the information in the tables above, complete the necessary steps to calculate the P/E ratio and the PEG ratio. 17 (Use cells A4 to B12 from the given information to complete this question.) 18 19 The M. Smith and Family Corporation 20 Capitalization Rate 21 Earnings Per Share 22 Plowback Rate 23 Sustainable Growth Rate 24 Price 25 P/E Ratio 26 Sustainable Growth Rate (as Percentage, use for PEG Calculation) 27 PEG Ratio 28 29 Calculations $2.00 0.375 0.056 5.625arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education