FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

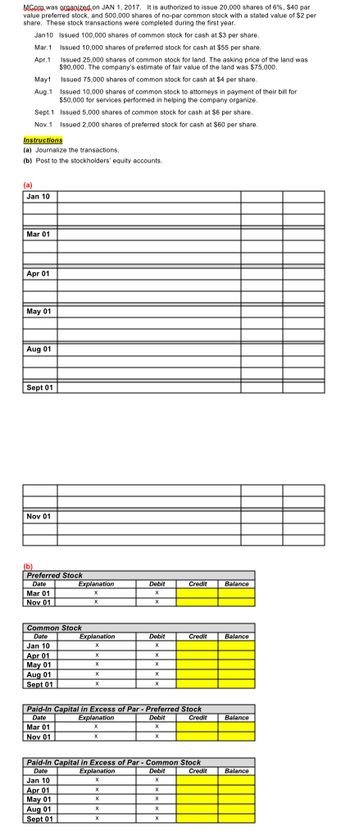

Transcribed Image Text:MCore was organized on JAN 1, 2017. It is authorized to issue 20,000 shares of 6%, $40 par

value preferred stock, and 500,000 shares of no-par common stock with a stated value of $2 per

share. These stock transactions were completed during the first year.

Jan10 Issued 100,000 shares of common stock for cash at $3 per share.

Mar.1

Issued 10,000 shares of preferred stock for cash at $55 per share.

Apr.1

Issued 25,000 shares of common stock for land. The asking price of the land was

$90,000. The company's estimate of fair value of the land was $75,000.

Issued 75,000 shares of common stock for cash at $4 per share.

Issued 10,000 shares of common stock to attorneys in payment of their bill for

$50,000 for services performed in helping the company organize.

Issued 5,000 shares of common stock for cash at $6 per share.

May 1

Aug.1

(a)

Sept. 1

Nov.1 Issued 2,000 shares of preferred stock for cash at $60 per share.

Instructions

(a) Journalize the transactions.

(b) Post to the stockholders' equity accounts.

Jan 10

Mar 01

Apr 01

May 01

Aug 01

Sept 01

Nov 01

(b)

Preferred Stock

Date

Mar 01

Nov 01

Common Stock

Date

Jan 10

Apr 01

May 01

Aug 01

Sept 01

Explanation

X

X

Mar 01

Nov 01

Explanation

X

Jan 10

Apr 01

May 01

Aug 01

Sept 01

X

X

X

X

Explanation

X

X

Debit

X

X

Explanation

X

X

X

Debit

X

Paid-In Capital in Excess of Par - Preferred Stock

Date

Debit

Credit

X

X

X

X

X

X

X

X

Paid-In Capital in Excess of Par - Common Stock

Date

Debit

Credit

X

Credit

X

X

Credit

X

X

Balance

Balance

Balance

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Wildhorse Corporation was organized on January 1, 2025. It is authorized to issue 9,200 shares of 8%, $100 par value preferred stock, and 538,600 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Apr. May Aug. 1 1 1 Sept. 1 Nov. 1 Issued 80,120 shares of common stock for cash at $6 per share. Issued 5,470 shares of preferred stock for cash at $112 per share. Issued 24,910 shares of common stock for land. The asking price of the land was $90,180; the fair value of the land was $80,120. Issued 80,120 shares of common stock for cash at $9 per share. Issued 9,200 shares of common stock to attorneys in payment of their bill of $51,900 for services rendered in helping the company organize. Issued 9,200 shares of common stock for cash at $11 per share. Issued 1,090 shares of preferred stock for cash at $113 per share. Prepare the journal entries to cord the above transactions. (List all…arrow_forwardOn January 1, 2018, Tonge Industries had outstanding 800,000 common shares ($1 par) that originally sold for $20 per share, and 3,000 shares of 10% cumulative preferred stock ($100 par), convertible into 30,000 common shares. On October 1, 2018, Tonge sold and issued an additional 20,000 shares of common stock at $36. At December 31, 2018, there were 28,000 incentive stock options outstanding, issued in 2017, and exercisable after one year for 28,000 shares of common stock at an exercise price of $30. The market price of the common stock at year-end was $48. During the year, the price of the common shares had averaged $40. Net income was $940,000. The tax rate for the year was 40%. Required: Compute basic and diluted EPS for the year ended December 31, 2018. (Enter your answers in thousands.) Basic Diluted Numerator 1 1 1 Denominator = Earnings per share =arrow_forwardOn January 1, 2018, Tonge Industries had outstanding 700,000 common shares ($1 par) that originally sold for $25 per share, and 5,000 shares of 10% cumulative preferred stock ($100 par), convertible into 50,000 common shares. On October 1, 2018, Tonge sold and issued an additional 12,000 shares of common stock at $37. At December 31, 2018, there were 22,000 incentive stock options outstanding, issued in 2017, and exercisable after one year for 22,000 shares of common stock at an exercise price of $34. The market price of the common stock at year-end was $52. During the year, the price of the common shares had averaged $44. Net income was $840,000. The tax rate for the year was 40%. Required: Compute basic and diluted EPS for the year ended December 31, 2018. (Enter your answers in thousands.) Basic Diluted $ $ Numerator Answer is complete but not entirely correct. 790,000/ 840,000 X Denominator 703,000 754,784 - S $ Earnings per share 1.12 1.11arrow_forward

- Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Issued 85,000 shares of common stock for cash at $4 per share. Issued 5,150 shares of preferred stock for cash at $110 per share. Apr. 1 Issued 22.000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land was $84,000. May 1 Issued 78,000 shares of common stock for cash at $5.25 per share. Aug. 1 Sept. 1 Nov. 1 Issued 11.000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 per share. Issued 1,000 shares of preferred stock for cash at $113 per share.arrow_forwardSolvearrow_forwardJoy Company was authorized to issue common stock of 100,000 shares with P50 par value on January 1, 2014. Eighty thousand shares were sold during the first year at P50 per share and 4,000 shares were alter reacquired as treasury at P65 per share. A stock split of 5-for-1 was approved on December 31, 2014. On January 31, 2015, a 10% stock dividend was paid and on March 1, 2015, the treasury stock was reissued at P68 per share. How many shares were outstanding on March 1, 2015?arrow_forward

- Hideo Co. was organized on January 1, 2021, with 300,000 shares of common stock with a $6 par value authorized. During 2021, Hideo had the following stock transactions: January 4 Issued 60,000 shares at $10 per share. March 8 Issued 20,000 shares at $11 per share. May 17 Purchased 7,500 shares at $12 per share. July 6 Issued 15,000 shares at $13 per share. August 27 Sold 5,000 treasury shares at $14 per share. If Hideo uses the cost method to record treasury stock transactions, the total amount of additional paid-in capital at December 31, 2021 is:arrow_forwardOn April 1, 2019, Kelly Corporation began operations and authorized 100,000 shares of $5 par value common stock. The company engaged in the following transactions:April 1 Issued 20,000 shares of common stock for $200,000.April 15 Issued 10,000 shares of common stock for $125,000.May 12 Purchased 2,500 shares of common stock for $75,000.June 30 The board of directors declared a $0.20 per share cash dividend to be paid on July 15 to shareholders of record on July 51. Prepare journal entries for the above transactions.2. Prepared the stockholders’ equity section of Kelly Corporation’s balance sheet as of June 30, 2019. Net income for the period April 1 through June 30 was $150,000.3. What effect, if any, will the cash dividend declaration on June 30 have on Kelly Corporation’s net income, retained earnings, and cash flows?arrow_forwardBlue Cab Company had 50,000 shares of common stock outstanding on January 1, 2018. On April 1, 2018, the company issued 20,000 shares of common stock. The company had outstanding fully vested incentive stock options for 5,000 shares exercisable at $10 that had not been exercised by its executives. The end-of-year market price of common stock was $13 while the average price for the year was $12. The company reported net income in the amount of $269,915 for 2018. What is the diluted earnings per share (rounded)?arrow_forward

- Knapp Industries began business on January 1, 2018 by issuing all of its 1,000,000 authorized shares of its $1 par value common stock for $40 per share. On June 30, Knapp declared a cash dividend of $2 per share to stockholders of record on July 31. Knapp paid the cash dividend on August 30. On November 1, Knapp reacquired 200,000 of its own shares of stock for $50 per share. On December 22, Knapp resold 100,000 of these shares for $60 per share. Required: Prepare all of the necessary journal entries to record the events described above. Prepare the stockholders' equity section of the balance sheet as of December 31, 2018 assuming that the net income for the year was $6,000,000.arrow_forwardAccounting Wildhorse Co. was organized on January 1, 2022. It is authorized to issue 14,500 shares of 8%, $100 par value preferred stock, and 533,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 78,000 shares of common stock for cash at $6 per share. Mar. 1 Issued 4,750 shares of preferred stock for cash at $105 per share. Issued 24,000 shares of common stock for land. The asking price of the land was $87,000. The fair value of the land was $87,000. Apr. 1 May 1 Issued 76,500 shares of common stock for cash at $4.25 per share. Issued 11,000 shares of common stock to attorneys in payment of their bill of $42,000 for services performed in helping the company organize. Aug. 1 Sept. 1 Issued 11,500 shares of common stock for cash at $5 per share. Nov. 1 Issued 1,500 shares of preferred stock for cash at $108 per share. (a) Your answer is partially correct. Post to the stockholders'…arrow_forwardEarly 2014, H industries was forms with authorization to issue 250,000 share of $10 par value common stock and 30,000 shares of $100 par value cumulative preferred stock. During 2014, all preferred stock was issued at par, and 120,000 shares of common stock were sold for $16 per share. The preferred stock is entitled to a dividends equal to 10 percent of its par value before any dividends are paid on the common stock. During the first five years of business (2014 through 2018), the company earned income totaling$3,700,00 and paid dividends of 50 cents per share each year on the common stock outstanding. On January 2,2016, the company purchased 20,000 shares of its own common stock in the open market for $400,00. On January 2, 2018, it reissued 10,000 shares of this thesauri stock for $250,000. The remaining 10,000 were still held in treasury at December 31,2018. Prepare the stockholders’ equity section of the balance sheet H industries at December 31, 2018. Include supporting…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education