FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

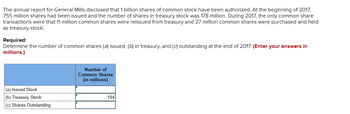

Transcribed Image Text:The annual report for General Mills disclosed that 1 billion shares of common stock have been authorized. At the beginning of 2017,

755 million shares had been issued and the number of shares in treasury stock was 178 million. During 2017, the only common share

transactions were that 11 million common shares were reissued from treasury and 27 million common shares were purchased and held

as treasury stock.

Required:

Determine the number of common shares (a) issued, (b) in treasury, and (c) outstanding at the end of 2017. (Enter your answers in

millions.)

(a) Issued Stock

(b) Treasury Stock

(c) Shares Outstanding

Number of

Common Shares

(in millions)

194

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The stockholders’ equity accounts of Flint Corporation on January 1, 2017, were as follows. Preferred Stock (8%, $100 par noncumulative, 4,950 shares authorized) $297,000 Common Stock ($4 stated value, 321,000 shares authorized) 1,070,000 Paid-in Capital in Excess of Par Value—Preferred Stock 14,850 Paid-in Capital in Excess of Stated Value—Common Stock 513,600 Retained Earnings 686,500 Treasury Stock (4,950 common shares) 39,600 During 2017, the corporation had the following transactions and events pertaining to its stockholders’ equity. Feb. 1 Issued 4,950 shares of common stock for $29,700. Mar. 20 Purchased 1,400 additional shares of common treasury stock at $7 per share. Oct. 1 Declared a 8% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.60 per share cash dividend to common stockholders of record on December 15, payable December 31, 2017. Dec. 31…arrow_forwardIn a recent annual report, Rosh Corporation disclosed that 60,800,000 shares of common stock have been authorized. At the beginning of the fiscal year, a total of 36,436,357 shares had been issued and the number of shares in treasury stock was 7,251,269. During the year, 562,765 additional shares were issued, and the number of treasury shares increased by 3,074,188. Determine the number of shares outstanding at the end of the year. Note: Amounts to be deducted should be indicated by a minus sign. Computation of Shares Outstanding Issued shares Treasury stock Shares outstandingarrow_forward.arrow_forward

- The stockholders’ equity accounts of Flint Corporation on January 1, 2017, were as follows. Preferred Stock (8%, $100 par noncumulative, 4,950 shares authorized) $297,000 Common Stock ($4 stated value, 321,000 shares authorized) 1,070,000 Paid-in Capital in Excess of Par Value—Preferred Stock 14,850 Paid-in Capital in Excess of Stated Value—Common Stock 513,600 Retained Earnings 686,500 Treasury Stock (4,950 common shares) 39,600 During 2017, the corporation had the following transactions and events pertaining to its stockholders’ equity. Feb. 1 Issued 4,950 shares of common stock for $29,700. Mar. 20 Purchased 1,400 additional shares of common treasury stock at $7 per share. Oct. 1 Declared a 8% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.60 per share cash dividend to common stockholders of record on December 15, payable December 31, 2017. Dec. 31…arrow_forwardChauncey Corporation began business on June 30, 2016. At that time, it issued 20,000 shares of $50 par value, six percent, cumulative preferred stock and 90,000 shares of $10 par value common stock. Through the end of 2018, there had been no change in the number of preferred and common shares outstanding. Assume that Chauncey declared dividends of $0 in 2016, $120,000 in 2017, and $186,000 in 2018. Calculate the total dividends and the dividends per share paid to each class of stock in 2016, 2017, and 2018. Round to two decimal places.arrow_forwardGlen Tay Inc. had issued 24,000 shares of its no-par common shares on April 1, 2017 for property with an appraisal value of $320,000. The common shares of the company were being traded at $13.15 each on that day. What is the journal entry required to record the issuance of the shares? Select one: a. DR Common Shares Receivable, $320,000; CR Common Share Capital, $315,600; CR Gain On Issue Of Shares, $4,400. b. DR Common Shares Receivable, $320,000; CR Common Share Capital, $315,600; CR Contributed Surplus - Common Shares, $4,400. c. DR Property, $320,000; CR Common Share Capital, $315,600; CR Retained Earnings -Issue Of Shares, $4,400. d. DR Property, $320,000; CR Common Share Capital, $315,600; CR Gain On Issue Of Shares, $4,400. e. None of the above entries.arrow_forward

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: Record on journal page 10: Jan. 3 Issued 15,000 shares of $20 par common stock at $30, receiving cash. Feb. 15 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. May 1 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. 16 Declared a dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. Journalize this transaction as a single entry. 26 Paid the cash dividends declared on May 16. Jun. 1 Purchased 7,500 shares of Solstice Corp. at $40 per share, plus a $150 brokerage commission. The investment is classified as an available-for-sale investment. 8 Purchased 8,000 shares of treasury common stock at $33 per share.…arrow_forwardBlue Corporation had 306,000 shares of common stock outstanding on January 1, 2025. On May 1, Blue issued 33,000 shares. (a) Compute the weighted-average number of shares outstanding if the 33,000 shares were issued for cash. Weighted-average number of shares outstanding I (b) Compute the weighted-average number of shares outstanding if the 33,000 shares were issued in a stock dividend. Weighted-average number of shares outstandingarrow_forwardCheck my work The annual report for Mega Mills disclosed that 1 billion shares of common stock have been authorized. At the beginning of 2017, 785 million shares had been issued and the number of shares in treasury stock was 96 million. During 2017, the only common share transactions were that 19 million common shares were reissued from treasury and 25 million common shares were purchased and held as treasury stock. Required: Determine the number of common shares (a) issued, (b) in treasury, and (c) outstanding at the end of 2017. (Enter your answers in millions.) Number of Common Shares (in millions) |(a) Issued Stock |(b) Treasury Stock |(c) Shares Outstandingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education