FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

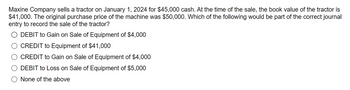

Transcribed Image Text:Maxine Company sells a tractor on January 1, 2024 for $45,000 cash. At the time of the sale, the book value of the tractor is

$41,000. The original purchase price of the machine was $50,000. Which of the following would be part of the correct journal

entry to record the sale of the tractor?

DEBIT to Gain on Sale of Equipment of $4,000

CREDIT to Equipment of $41,000

CREDIT to Gain on Sale of Equipment of $4,000

DEBIT to Loss on Sale of Equipment of $5,000

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardFrancis Company purchased a machine for $24, 000; the seller is holding the note. Francis Company paid $5, 400 for improvements to extend the life of the machine. Francis Company has deducted depreciation on the machine for 3 years totaling $12,000. Francis Company owes $10,000 to the seller. What is Francis Company's adjusted basis in the machine? Group of answer choicesarrow_forwardAn asset's book value is $64,800 on January 1, Year 6. The asset is being depreciated $900 per month using the straight-line method. Assuming the asset is sold on July 1, Year 7 for $46,600, the company should record: Multiple Choice Neither a gain or loss is recognized on this type of transaction. A loss on sale of $2,000. A gain on sale of $1,000. A loss on sale of $1,000. A gain on sale of $2,000.arrow_forward

- ← On January 2, 2023, Once Again Clothing Consignments purchased showroom fixtures for $19,000 cash, expecting the fixtures to remain in service for five years. Once Again has depreciated the fixtures on a double-declining-balance basis, with zero residual value. On October 31, 2024, Once Again sold the fixtures for $8,000 cash. Record both depreciation expense for 2024 and sale of the fixtures on October 31, 2024. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Note that 2023 depreciation was recorded and posted in 2023.) Begin by recording the depreciation expense for January 1, 2024 through October 31, 2024. Accounts and Explanation Date Oct. 31 Debit Creditarrow_forward1. Denver, Inc., exchanged land and cash of $8,000 for equipment. The land was purchased at $55,000 a few years ago and a fair value of $60,000. Prepare the journal entry to record the exchange. Assume the exchange has no commercial substance. 2. Metro Inc. trades its used machine for a new model at Denver Inc. The used machine has a book value of $8,000 (original cost of $12,000) and a fair value of $4,000. The new model lists for $15,000. Denver gives Metro a trade-in allowance of $7,000 for the used machine, $3,000 more than its fair value. Prepare a journal entry for Metro, assuming commercial substance.arrow_forward26 Cliff Company traded in an old truck for a new one. The old truck had a cost of $77,000 and accumulated depreciation of $61,600. The new truck had an invoice price of $127,000. Huffington was given a $12,320 trade-in allowance on the old truck, which meant they paid $114,680 in addition to the old truck to acquire the new truck. If this transaction has commercial substance, what is the recorded value of the new truck? cBook keterences Multiple Choice $114,680 $130,080 $15,400 $127,000arrow_forward

- Hot Stone Creamery sold ice cream equipment for $17,600. Hot Stone originally purchased the equipment for $94,000, and depreciation through the date of sale totaled $73,000. Record the gain or loss on the sale of the equipment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardBremer Company made the following exchanges of assets during 2019: Jan. 1 Acquired a more advanced machine worth $10,000 by paying $2,000 cash and giving up a machine that had originally cost $40,000 and has a book value of $12,000. Feb. 1 Acquired a building worth $55,000 by paying $5,000 cash and giving up a piece of land that had originally cost $35,000. Mar. 1 Acquired a more advanced machine worth $20,000 by paying $5,000 cash and giving up a machine that had originally cost $13,000 and has a book value of $11,000. Apr. 1 Acquired a car by giving up a truck that had originally cost $20,000, has a book value of $15,000, and has a "blue book" value of $16,800. In addition, the company received $1,000 cash. Required: Prepare Bremer's journal entry for each exchange. Assume all exchanges were determined to have commercial substance.arrow_forward16arrow_forward

- Nonearrow_forwardPlease do not Give image formatarrow_forward- Blossom Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2025. The terms of acquisition for each truck are described below. 1. 2. 3. 4. 1. Your answer is partially correct. 2. Prepare the appropriate journal entries for the above transactions for Blossom Corporation. (Round present value factors to 5 decimal places, e.g. 0.52587 and final answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) 3. Truck #1 has a list price of $54,750 and is acquired for a cash payment of $50,735. Truck #2 has a list price of $58,400 and is acquired for a down payment of $7,300 cash and a zero-interest-bearing note with a face amount of $51,100. The note is due April 1, 2026. Blossom would…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education