FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

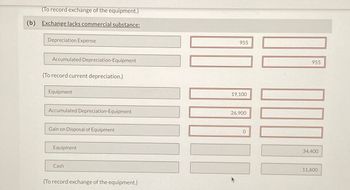

Transcribed Image Text:(To record exchange of the equipment.)

(b) Exchange lacks commercial substance:

Depreciation Expense

Accumulated Depreciation-Equipment

(To record current depreciation.)

Equipment

955

19,100

Accumulated Depreciation-Equipment

26,900

Gain on Disposal of Equipment

Equipment

Cash

(To record exchange of the equipment.)

0

955

34,400

11,600

Transcribed Image Text:Swifty Company purchased an electric press on June 30, 2025, by trading in its old gas model and paying the balance in cash. The

following data relate to the purchase: \table[[List price of new press, $25, 100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange lacks commercial substance.arrow_forwardQ7.4 Revaluation of Long-Lived Assetsarrow_forwardDepreciation: A. Measures the decline in market value of an asset.B. Measures physical deterioration of an asset.C. Is the process of allocating to expense the cost of an item of property, plant and equipment.D. Is an outflow of cash from the use of an item of property, plant and equipment.E. Is applied to land.arrow_forward

- Which of the following statements concerning Intangible assets are TRUE?(In your answer, provide the appropriate letter(s) A – E for each statement believed to be true)A. Goodwill can never be recognisedB. Only purchased intangibles can be recognisedC. Intangibles are amortised over their useful life where the life is finiteD. Research expenditure is expensedE. A brand name may be recognised when one business acquires anotherarrow_forwardRiverbed Corporation exchanged equipment used in its manufacturing operations for equipment used in the operations of Marin Ltd. The following information pertains to the exchange: Riverbed Corp. Marin Ltd. $84,200 $84,200 Equipment (cost) Accumulated depreciation 46,700 40,600 Fair value of old equipment 42,200 43,500 Cash given up 1,300 Both companies agreed that the exchange did not have commercial substance. Prepare the necessary journal entries to record the asset exchange on the books of both companies. (Credit account titles are automatically indented when the amount is entered. Do r indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Riverbed Corporation: Account Titles and Explanation Debit Creditarrow_forwardAn international financial reporting standard concerning depreciation states that: 1. The straight-line method should be used to depreciate all tangible non-current assets. 2. The reducing-balance method should be used to depreciate all intangible non-current assets. Are the above statements true or false? A. B. C. D. Statement 1 False False True True Statement 2 True False False Truearrow_forward

- don't give answer in image formatarrow_forwardDomesticarrow_forwardA fixed asset with a cost of $24,737 and accumulated depreciation of $22,263 is traded for a similar asset priced at $60,057 (fair market value) in a transaction with a commercial substance. Assuming a trade-in allowance of $4,264, at what cost will the new equipment be recorded in the books? a.$4,264 b.$1,790 c.$60,057 d.$20,473arrow_forward

- Which of the following is a false statement about depreciation? It has no impact on cash It represents the physical deterioration of an asset It exists because of the matching principle Accelerated methods of calculating depreciation are acceptable under GAAParrow_forwardIn Able Company’s efforts to estimate a value for Baker Company's goodwill, Able is estimating Baker Company's expected future earnings. Able is using Baker's past earnings to project the future earnings. Which of the following items should be eliminated from Baker's past earnings in order to project future earnings? Extraordinary items Amortization expense for identifiable intangibles a. Yes Nob. Yes Yesc. No Yesd. No Noarrow_forwardPlease Solve With Explanation and do not Give solution in images formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education