Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Do fast answer of this accounting questions

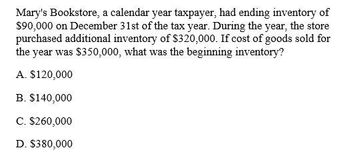

Transcribed Image Text:Mary's Bookstore, a calendar year taxpayer, had ending inventory of

$90,000 on December 31st of the tax year. During the year, the store

purchased additional inventory of $320,000. If cost of goods sold for

the year was $350,000, what was the beginning inventory?

A. $120,000

B. $140,000

C. $260,000

D. $380,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Joe's Grocery Store, a calendar year taxpayer, had ending inventory of $160,000 on December 31st of the tax year. During the year, the store purchased additional inventory of $415, 000. If cost of goods sold for the year was $470,000, what was the beginning inventory? A. $55,000. B. $215,000. C. $255,000. D. $310,000.arrow_forwardA VAT taxpayer had the following data on its operations for he month of January 2018: Sales, total invoice price P 592,480 Purchases of goods, VAT not included: From VAT registered persons 100,000 From nonVAT registered persons 8,000 From persons subject to percentage taxes 10,000 Salaries of employees 60,000 Other operating expenses 12,000 This is the first month of being liable to value added tax. Data in inventories at the beginning of the period bought from VAT registered persons follow: Inventory at cost P 44,800 Inventory at realizable value 49,000 Value added tax paid on beginning inventory 4,800 How much is the input tax? How much is the value added tax payable?arrow_forwardA VAT taxpayer had the following data on its operations for he month of January 2018:Sales, total invoice price P 592,480Purchases of goods, VAT not included:From VAT registered persons 100,000From nonVAT registered persons 8,000From persons subject to percentage taxes 10,000Salaries of employees 60,000Other operating expenses 12,000This is the first month of being liable to value added tax. Data in inventories at the beginning of the period bought from VAT registeredpersons follow:Inventory at cost P 44,800Inventory at realizable value 49,000Value added tax paid on beginning inventory 4,80016. How much is the input tax?17. How much is the value added tax payable?arrow_forward

- Bagley Inc. had after-tax cash flows related to the purchase of inventory of $7,000 for September. What is the pre-tax cash flow relating to inventory purchases for the month, assuming a tax rate of 20%? Select one: O a. $10,000 O b. $4,900 c. $8,750 d. None of the abovearrow_forwardAt 1 December 20X5, Laurel owes the sales tax authorities $23,778. During the month of December, she recorded the following transactions: Sales of $800,000 exclusive of 17.5% sales tax. Purchases of $590,790 inclusive of sales tax. What is the balance on Laurel's sales tax account at the end of December? $arrow_forwardall I need is Darrow_forward

- A VAT taxpayer had the following sales and purchases during the month:Sales, inclusive of VAT Php 336,000Purchases, exclusive of VAT 250,000Compute the gross income under each of the following independent cases:7. The sale is made to regular customers.8. The sale is made by a registrable person.arrow_forwardA VAT taxpayer had the following sales and purchases during the month:Sales, inclusive of VAT Php 336,000Purchases, exclusive of VAT 250,000Compute the gross income under each of the following independent cases:5. The sale is VAT-exempt.6. The sale is made to the government.arrow_forwardIn the quarter ended 31 March 20X2, Chas had taxable sales, net of sales tax, of $90,000 and taxable purchases, net of sales tax, of $72,000. If the rate of sales tax is 10%, how much sales tax is due? A $1,800 receivable В $2,000 receivable C $1,800 payable D $2,000 payablearrow_forward

- Roger Company completed the following transactions during Year 1. Roger’s fiscal year ends on December 31. Jan. 8 Purchased merchandise for resale on account. The invoice amount was $14,780; assume a perpetual inventory system. 17 Paid January 8 invoice. Apr. 1 Borrowed $54,000 from National Bank for general use; signed a 12-month, 10% annual interest-bearing note for the money. June 3 Purchased merchandise for resale on account. The invoice amount was $17,420. July 5 Paid June 3 invoice. Aug. 1 Rented office space in one of Roger’s buildings to another company and collected six months’ rent in advance amounting to $6,000. Dec. 20 Received a $180 deposit from a customer as a guarantee to return a trailer borrowed for 30 days. 31 Determined wages of $9,200 were earned but not yet paid on December 31 (disregard payroll taxes). Show how all of the liabilities arising from these transactions are reported on the balance sheet at December 31.…arrow_forwardIn the third quarter of 2017, a taxpayer engaged in the sale of services whose annual grossreceipts do not exceed P1,919,500 has the following data:Accounts receivable, beginning of the quarter 50,000Sales during the quarter, on account 100,000Accounts receivable, end of quarter 75,000Purchase of supplies, total invoice amount 11,200The percentage tax due for the quarter is_______________Assuming the taxpayer is VAT-registered, the VAT payable is __________________arrow_forwardListed below are selected transactions of Splish Department Store for the current year ending December 31. On December 5, the store received $470 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 1. 2. 3. 4. During December, cash sales totaled $802.200, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. On December 10, the store purchased for cash three delivery trucks for $121.600. The trucks were purchased in a state that applies a 5% sales tax The store sold 30 gift cards for $100 per card. At year-end, 25 of the gift cards are redeemed. Splish expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT