Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Sub. Cost Account

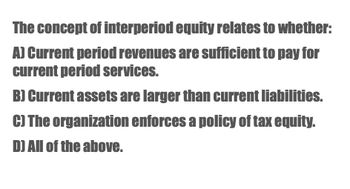

Transcribed Image Text:The concept of interperiod equity relates to whether:

A) Current period revenues are sufficient to pay for

current period services.

B) Current assets are larger than current liabilities.

C) The organization enforces a policy of tax equity.

D) All of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following refers to the elements of Comprehensive Income? a) Net Income, Interest Payments and Income Tax Payments b) Retained Earnings and Other Comprehensive Income c) Net Income and Other Comprehensive Income d) Sales and Other Comprehensive Incomearrow_forwardWhat is the purpose of the financial statements, and how do they provide information to stakeholders? How does the revenue recognition principle affect the timing of income reporting?arrow_forwardDiscuss the revenue recognition principle and its significance in financial accounting. What factors must be considered when determining when and how much revenue to recognize?arrow_forward

- In general, how does the income statement help satisfy the objectives of financial reporting?arrow_forwardExplain how the following items affect equity: revenue, expenses, investments by owners, and distributions to owners.arrow_forwardWhich of the following principles matches expenses with associated revenues in the period in which the revenues were generated? A. revenue recognition principle B. expense recognition (matching) principle C. cost principle D. full disclosure principlearrow_forward

- Which of the following is not a criterion to recognize revenue under GAAP? A. The earnings process must be completed. B. A product or service must be provided. C. Cash must be collected. D. GAAP requires that the accrual basis accounting principle be used in the revenue recognition process.arrow_forwardWhich option is the correct definition of tax base? Select one: a. Tax base is the amount the asset or liability is recorded at in the accounting records. b. Tax base is a comparing the balance sheet derived using accounting rules with balance sheet that would be derived from taxation rules c. Tax base is the recognition of assets and liabilities in the balance sheet based on the differences between accounting and tax values of assets and liabilities. d. Tax base is defined as the amount that is attributed to an asset or liability for tax purposes.arrow_forwardListed below are several terms and phrases associated with income statement presentation and the statement ofcash flows. Pair each item from List A (by letter) with the item from List B that is most appropriately associatedwith it.List A List B_____ 1. Intraperiod tax allocation_____ 2. Comprehensive income_____ 3. Unrealized holding gain oninvestments_____ 4. Operating income_____ 5. A discontinued operation_____ 6. Earnings per share_____ 7. Prior period adjustment_____ 8. Financing activities_____ 9. Operating activities (SCF)_____ 10. Investing activities_____ 11. Direct method_____ 12. Indirect methoda. An other comprehensive income itemb. Starts with net income and works backwards to convert tocashc. Reports the cash effects of each operating activity directly onthe statementd. Correction of a material error of a prior periode. Related to the external financing of the companyf. Associates tax with income statement itemg. Total nonowner change in equityh. Related to the…arrow_forward

- 8. Income is: a. An amount for payment of services, interest, or profit from investment b. The gain derived from capital or labor c. Any material gain, not otherwise excluded by law, realized out of a closed and completed transaction, where there is an exchange of economic value for economic value, with a specified taxable period, under the method of accounting employed. d. A flow of service rendered by capital by the payment of money from it or any other benefit rendered by a fund of capital in relation to such fund through a period of time.arrow_forwardWhich of the following is an External sources of finance? a.Depreciation funds b.Retained earnings c.Loans from Banks and Financial institutions d.Surplusarrow_forwardDefine the following. a. Retained earnings? b. Goodwill? c. Investing activities?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College