FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

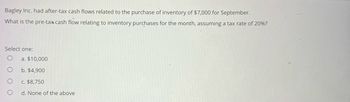

Transcribed Image Text:Bagley Inc. had after-tax cash flows related to the purchase of inventory of $7,000 for September.

What is the pre-tax cash flow relating to inventory purchases for the month, assuming a tax rate of 20%?

Select one:

O a. $10,000

O

b. $4,900

c. $8,750

d. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Listed below are selected transactions of Splish Department Store for the current year ending December 31. On December 5, the store received $470 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 1. 2. 3. 4. During December, cash sales totaled $802.200, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. On December 10, the store purchased for cash three delivery trucks for $121.600. The trucks were purchased in a state that applies a 5% sales tax The store sold 30 gift cards for $100 per card. At year-end, 25 of the gift cards are redeemed. Splish expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry.…arrow_forwardPHE, Inc.estimates warranty expense at 2% of sales. Sales during the year were $4 million and warranty related cash expenditures were $34,000. What was the balance in the Warranty Liability account at the end of the year? Select one: a. $80,000 b. $36,000 c. $34,000 d. $46,000 e. $56,000arrow_forwardQuestio Venus Corp. sold goods, with a selling price of $16,221, for cash. The state sales tax rate is 8%. What amount is credited to the Sales Revenue account? (Round calculations to the nearest dollar.) O $15,843 O $1378 O $17,221 O $16,221 Question 1 of 41>>arrow_forward

- The cost of merchandise sold by Kohl's Corporation for a recent year was $12,265 million. The balance sheet showed the following current account balances (in millions): Merchandise inventories Accounts payable Balance, End of Year Balance, Beginning of Year $ 4,038 1,251 $ 3,814 1,511 Determine the amount of cash payments for merchandise.arrow_forwardDuring the fiscal year 20x4, the initial inventory of the goods of company A is 15.000 €, purchases of goods for the fiscal year 25.000,00 € and the final stock of goods 10.000,00 €. The revenue from the sales of goods is 75.000,00 €, the operating expenses 30.000,00 € and the tax rate is 40%. An employee of the accounting department registered as the final stock of goods the amount of 12.000 €. What is the effect on the cost of sales during the use of 20X4?arrow_forwardPHE, Inc.estimates warranty expense at 2% of sales. Sales during the year were $4 million and warranty related cash expenditures were $34,000. What was the balance in the Warranty Liability account at the end of the year? Select one: O a. $56,000 O b. $34,000 c. $80,000 O d. $36,000 O e. $46,000arrow_forward

- At the Bartholomew Company last year all sales were for cash and all expenses were paid in cash. The tax rate was 30%. If the after-tax net cash inflow from these operations last year was $10,500, and if the total before tax cash expenses were $35,000, then the total before-tax cash sales must have been: (M) A. $65,000. B. $60,000. C. $45,000. D. $50,000.arrow_forwardNYFG, Inc.I has sales including sales taxes for the month of $742,000. If the sales tax rate is 6%, how much does NYFG owe for sales tax? Select one: O a. $48,000 O b. $42,000 c. $38,260 d. $45,420 e. $44,520arrow_forwardRincoe Company does not ring up sales taxes separately on the cash register. Total receipts for October amounted to $390,527. If the sales tax rate is 5%, what amount must be remitted to the state for October's sales taxes? Round your answer to 2 decimal places.arrow_forward

- uring the month of April, Orison Supply Store sold $39,000 of inventory, with $25,000 sold on credit and the remaining for cash. The business collected $15,000 from the previous month's credit sales that excluded a bad debt of $750. The inventory sold was purchased at a cost of $2,3400. What was the total revenue recognised in the month of September? (Ignore GST for this question)A. None of the other answers B. 54,000 C. 14,250 D. 38,250 E. 39,000arrow_forwardDuring December, Far West Services makes a $3,200 credit sale. The state sales tax rate is 6% and the local sales tax rate is 2.5%. Record sales and sales tax payable.arrow_forwardWindsor's Boutique has total receipts for the month of $27510 including sales taxes. If the sales tax rate is 5%, what are Windsor's sales for the month? $26200 $26135 $27510 It cannot be determined.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education