Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

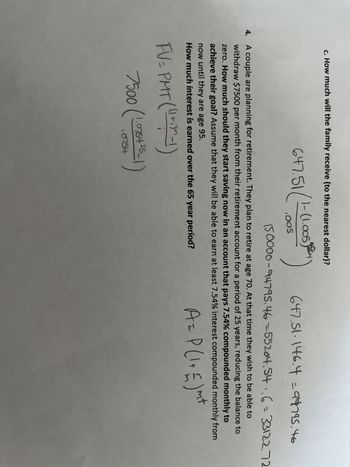

Transcribed Image Text:c. How much will the family receive (to the nearest dollar)?

647.51/1-6

1-(1.005264

.OOS

647.51.146.4 = 94795.46

150000-94795.46-55204.54₁,6 = 33122.72

4. A couple are planning for retirement. They plan to retire at age 70. At that time they wish to be able to

withdraw $7500 per month from their retirement account for a period of 25 years, reducing the balance to

zero. How much should they start saving now in an account that pays 7.54% compounded monthly to

achieve their goal? Assume that they will be able to earn at least 7.54% interest compounded monthly from

now until they are age 95.

nt

How much interest is earned over the 65 year period?

A = P(1 + £ ) m²

FV= PMT ((1+1)^-1)

7500 (1.076+25-1)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- What is the future value of $2,575 per year for 17 years at an interest rate of 6.69 percent?Multiple Choicea. $73,613.44B. $69.984.94 C. $74,578.42D. $73,883.59E. $77.241.93arrow_forwardSuppose you deposit $1,181.00 into an account 5.00 years from today. Exactly 18.00 years from today the account is worth $1,800.00. What was the account's interest rate?arrow_forwardHow much will a registered retirement savings deposit of $23 700.00 be worth in 8 years at 6.54% compounded semiannually? How much of the amount is interest?arrow_forward

- F2arrow_forwardPresent value = $100; Interest rate = 5%; Number of years 11 (assume annual compounding). What is the future value? Group of answer choices 171.03 155.00 55.00 223.13 Answer with Explanation and with reason of answer is correct or incorrectarrow_forwardAssuming you made all the weekly payments for 12 years and left the money in the account without making any additional payments or withdrawals, how much did you pay into your retirement account over the 47 years? Assuming you made all the weekly payments for 12 years and left the money in the account without making any additional payments or withdrawals, how much interest did you earn over the 47 years?arrow_forward

- What is the rate of interest by what $100 becomes $200 in 4 years?arrow_forwardHow can a perpetuity, which has an infinite maturity, have a duration as short as 10 or 20 years?arrow_forwardWhy does the APR term doEs not explain precisely the amount of interest that will accumulate in a year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education