Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

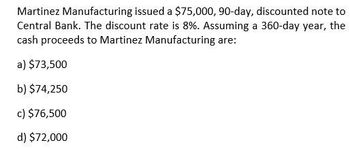

Transcribed Image Text:Martinez Manufacturing issued a $75,000, 90-day, discounted note to

Central Bank. The discount rate is 8%. Assuming a 360-day year, the

cash proceeds to Martinez Manufacturing are:

a) $73,500

b) $74,250

c) $76,500

d) $72,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardOn June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forwardJain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual interest rate of 3.5%, due in 6 months. What journal entry is created when Jain honors the note?arrow_forward

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardHalep Inc. borrowed $30,000 from Davis Bank and signed a 4-year note payable stating the interest rate was 4% compounded annually. Halep Inc. will make payments of $8,264.70 at the end of each year. Prepare an amortization table showing the principal and interest in each payment.arrow_forwardChemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forward

- Lime Co. incurs a $4,000 note with equal principal installment payments due for the next eight years. What is the amount of the current portion of the noncurrent note payable due in the second year? A. $800 B. $1,000 C. $500 D. nothing, since this is a noncurrent note payablearrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forwardAssuming a 360-day year, proceeds of $45,552 were received from discounting a $46,830, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was а. 12.16% b. 12.67% C. 8.92% Od. 10.92%arrow_forward

- BBY Company loaned $66,116 to Orwell, Inc, accepting Orwell's 2-year, $80,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare BBY's journal entries for the initial transaction, recognition of interest each year, and the collection of $80,000 at maturity. Debit - Notes Receivable $80,000 Credit - Credit - Cash Debit - Credit - Debit - Credit - Interest Revenue 6.026 DEC 16 618 10arrow_forwardAssuming a 360-day year, proceeds of $52,258 were received from discounting a $52,919, 90-day note at a bank. The discount rate used by the bank in computing the proceeds was Oa. 3% Ob. 6% Oc. 5% Od. 7%arrow_forwardAnderson Co. issued a $50,932, 60-day, discounted note to National Bank. The discount rate is 11%. At maturity, assuming a 360-day year, the borrower will pay:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT