Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

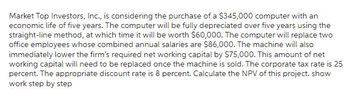

Transcribed Image Text:Market Top Investors, Inc., is considering the purchase of a $345,000 computer with an

economic life of five years. The computer will be fully depreciated over five years using the

straight-line method, at which time it will be worth $60,000. The computer will replace two

office employees whose combined annual salaries are $86,000. The machine will also

immediately lower the firm's required net working capital by $75,000. This amount of net

working capital will need to be replaced once the machine is sold. The corporate tax rate is 25

percent. The appropriate discount rate is 8 percent. Calculate the NPV of this project. show

work step by step

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $40,000, and it falls into the MACRS 3-year class. Purchase of the computer would require an increase in net operating working capital of $5,000, which would be recovered when the computer is sold. The computer would increase the firm's before-tax revenues by $20,000 per year but would also increase operating costs by $5,000 per year. The computer is expected to be used for 3 years and then be sold for $20,000. The firm's marginal tax rate is 22 percent, and the project's cost of capital is 14 percent.What is the total value of the terminal year non-operating cash flows at the end of Year 3? Round it to a whole dollar, and do not include the $ sign. Year MACRS Percent 1 0.33 2 0.45 3 0.15 4 0.07arrow_forwardBilk.com, an online retailing company, proposes to spend $50 million on servers and other computer equipment for managing its Web site and processing orders. The company will depreciate the equipment over five years to zero. However, the company actually expects that it will be able to sell the equipment for $25 million at the end of five years. This equipment is expected to generate $30 million in sales in the first year and $21 million in cash operating costs in the first year. Both revenue and cash operating costs are expected to grow at an annual rate of 3% throughout the useful life of the equipment. There is no initial working capital requirement. However, the company will need to have a working capital balance at the end of each year equal to 20% of that year’s sales. The working capital can be fully recovered at the end of the project’s life. Bilk.com’s tax rate is 40%, and the cost of capital for this project is 8%. Calculate the cash flows in year 1. a. $2,825,000…arrow_forwardThe ABC Corporation is considering purchasing a machine to manufacture mobile phones. The purchase of this machine will cause an increase in earnings before depreciation and taxes of $280,000 per year. The machine has a purchase price of $500,000 and it would cost an additional $20,000 to install this machine properly. In addition, the proper operation of this machine needs an increase of working capital of $30,000. The machine has an expected life of 5 years, and it will have a salvage value of $70,000. The company uses straight-line depreciation method; it faces a 25% marginal tax rate and requires a rate of return of 8% for this project. Should ABC Corporation accept the project? Elaborate your rationale and show your calculation steps.arrow_forward

- The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $ 4 0,000, and it falls into the MACRS 3- year class. Purchase of the computer would require an increase in net operating working capital of $2,000. The computer would increase the firm's before-tax revenues by $ 24 ,000 per year but would also increase operating costs by $ 19 ,000 per year. The computer is expected to be used for 3 years and then be sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent. What is the operating cash flow in Year 2? Round it to a whole dollar, and do not include the $ sign. Year MACRS Percent 1 0.33 2. 0.45 3 0.15 0.07 Your Answer:arrow_forwardThe president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $70,000, and it falls into the MACRS 3-year class. Purchase of the computer would require an increase in net operating working capital of $6,000. The computer would increase the firm's before-tax revenues by $30,000 per year but would also increase operating costs by $19,000 per year. The computer is expected to be used for 3 years and then be sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent.What is the net cash flow at t = 0? Cash outflow should be in negative number, e.g., -33,000, and do not include the $ sign.arrow_forwardThe president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $40,000, and it falls into the MACRS 3-year class. Purchase of the computer would require an increase in net operating working capital of $2,000. The computer would increase the firm's before-tax revenues by $26,000 per year but would also increase operating costs by $18,000 per year. The computer is expected to be used for 3 years and then be sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent.What is the operating cash flow in Year 2? Round it to a whole dollar, and do not include the $ sign. Year MACRS Percent 1 0.33 2 0.45 3 0.15 4 0.07arrow_forward

- The Adderley Corporation is considering investing in a new machine that has an estimated life of three years. The cost of the machine (in 5 millions) is $500 and the machine will be depreciated straight line over its three-year life to a residual value of $0. The machine will result in sales of 300 million widgets in year 1 with future sales estimated to grow by 10% per year. The price per widget that Adderley will charge its customers is $19 and is to remain constant over the three years. The widgets have a cost per unit to manufacture of $7 each. Installing the machine and the resulting increase in manufacturing capacity will require an increase in various net working capital accounts. It is estimated that the company will need to hold 3% of its annual revenues in cash, 4% of its annual revenues in accounts receivable, 13% of its annual revenues in inventory, but will also benefit from trade financing (ie, accounts payable) equal to 6% of its annual revenues. The firm is in the 28%…arrow_forwardRealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forwardA firm is considering an investment in a new machine with a price of $17.6 million to replace its existing machine. The current machine has a book value of $7.3 million and a market value of $6 million. The new machine is expected to have a 4-year life, and the old machine has four years left in which it can be used. If the firm replaces the old machine with the new machine, it expects to save $7.25 million in operating costs each year over the next four years. Both machines will have no salvage value in four years. If the firm purchases the new machine, it will also need an investment of $440,000 in net working capital. The required return on the investment is 11 percent and the tax rate is 24 percent. The company uses straight-line depreciation. What is the NPV of the decision to purchase a new machine? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) What is the IRR of the decision to purchase a…arrow_forward

- Galvanized Products is considering the purchase of a new computer system for its enterprise data management system. The vendor has quoted a purchase price of $100,000. Galvanized Products is planning to borrow one-fourth of the purchase price from a bank at 15% compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer system is expected to last 5 years and has a salvage value of $5,000 at that time. Over the 5-year period, GalvanizedProducts expects to pay a technician $25,000 per year to maintain the system but will save $55,000 per year through increased efficiencies. Galvanized Products uses a MARR of 18%/yr to evaluate investments. Solve a. What is the external rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on external rate of return? c. Should the new computer system be purchased?arrow_forwardA firm is considering an investment in a new machine with a price of $15.9 million to replace its existing machine. The current machine has a book value of $5.7 million and a market value of $4.4 million. The new machine is expected to have a 4-year life, and the old machine has four years left in which it can be used. If the firm replaces the old machine with the new machine, it expects to save $6.45 million in operating costs each year over the next four years. Both machines will have no salvage value in four years. If the firm purchases the new machine, it will also need an investment of $280,000 in net working capital. The required return on the investment is 11 percent and the tax rate is 23 percent. The company uses straight-line depreciation. a)- What is the NPV of the decision to purchase the new machine? b) What is the IRR of the decision to purchase the new machine? c) WHat is the NPV of the decison to keep using the old machine? d) What is the IRR of the decison to keep…arrow_forwardDixie Dynamite Company is evaluating two methods of blowing up old buildings for commercial purposes over the next five years. Method one (implosion) is relatively low in risk for this business and will carry a 13 percent discount rate. Method two (explosion) is less expensive to perform but more dangerous and will call for a higher discount rate of 17 percent. Either method will require an initial capital outlay of $92,000. The inflows from projected business over the next five years are shown next. Years Method 1 Method 2 1 2 3 4 5 $31,100 $20,800 37,200 24,400 44,600 42,200 38,800 37,300 19,200 70,900 Use Appendix B for an approximate answer but calculate your final answers using the formula and financial calculator methods. a. Calculate net present value for Method 1 and Method 2. (Do not round intermediate calculations and round your answers to 2 decimal places.) Method 1 Method 2 Net Present Value b. Which method should be selected using net present value analysis? Method 1…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education