Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

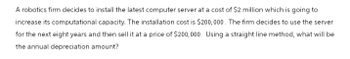

Transcribed Image Text:A robotics firm decides to install the latest computer server at a cost of $2 million which is going to

increase its computational capacity. The installation cost is $200,000. The firm decides to use the server

for the next eight years and then sell it at a price of $200,000. Using a straight line method, what will be

the annual depreciation amount?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Market Top Investors, Incorporated, is considering the purchase of a $345,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method, at which time it will be worth $78,000. The computer will replace two office employees whose combined annual salaries are $89,000. The machine will also immediately lower the firm’s required net working capital by $78,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 23 percent. The appropriate discount rate is 11 percent. Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardA Funiture Factory is considering buying a new automated planing machine for a cost of $80,250. This price includes a complete guarantee of the maintenance costs for the first two years, and it covers a good proportion of the maintenance costs for years 3 and 4. The company’s portion of the maintenance cost is estimated to be $1,000 in year 3 and $3,000 in year 4. Depreciation on the capital cost would be 7% per year. Determine the Economic Life and EAC* of the new machine assuming the MARR is 6.5% and that there will be an installation cost of $2,800. PLEASE PLEASE SHOW FULL DETAILED STEPSarrow_forwardA new production system for a factory is to be purchased and installed for $135331. This system will save approximately 300,000 kWh of electric power each year for a 6-year period. Assume the cost of electricity is $0.10 per kWh, and factory MARR is 15% per year, and the salvage value of the system will be $8662 at year 6. Using the PW method to analyzes if this investment is economically justified A- calculate the PW of the above investment and insert the result below.arrow_forward

- Cullumber Lumber, Inc; is considering purchasing a new wood saw that costs $65000. The saw will generate revenues of $100,000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $4500 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Cullumber’s tax rate is 26 percent, and it’s opportunity cost of capital is 13.10 percent. What is the project’s NPV?arrow_forwardA small strip mining cola company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the shell will cost $150,000 and is expected to have a $65,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for $20,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenue of $12,000 per year. If the company’s MARR is 15% per year, should the clamshell be purchased or leased on the basis of future worth analysis. (Enter the FW value of the selected alternative with proper positive or negative sign)arrow_forwardAlliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of 10 additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings (in labor, materials, and maintenance) of $6,000 per year. The new machine costs $25,000 delivered and installed. It has an estimated useful life of 10 years and a salvage value of $1,000 at the end of this period. The firm’s cost of capital is 14 percent, and its marginal income tax rate is 40 percent. The firm uses the straight-line depreciation method.a. What is the net cash flow in year 0 (i.e., initial outlay)?b. What are the net cash flows after taxes in each of the next 10 years?c. What is the NPV of the investment?d. Should Alliance replace its existing drill press?arrow_forward

- Milling, Inc. is considering a new milling machine. The machine costs $125,000. They can received a $15,000 trade in allowance for the old milling machine. The new machine can be used to generate $35,500 in annual revenue. Cash operation expenses are estimated to be $14,500 per year. The machine has a useful life of 15 years and annual depreciation expense would be $9,500. The machine would require a $5,100 maintenance in year 7. The machine has an approximate salvage value of $12,300 at the end of its useful life. The company has a 10% minimum rate of return. The net present value of this investment is? $63,112.75 $35,978.80 $55,820.11 $50,049.40arrow_forwardBuiltrite is considering the purchase of a new five-year machine worth $90,000. It will cost another $10,000 to install the machine and Builtrite will need to keep an extra $9,000 in inventory on hand due to the machine's efficiency. The current machine being used is 5 years old and originally cost $60,000 and is being depreciated down to zero over a 10-year period. If the current machine were sold today, it could be sold for $45,000. In five years, the new machine is estimated to have a salvage value of $36,000. Two employees will need to be trained for the new machine at a cost of $4000. The new machine is expected to produce $80,000 in annual savings. Builtrite is in the 34% tax bracket. What is the terminal cash flow for the new machine? O $23.760 O $31,800 O $32,760arrow_forward2. Super Apparel wants to replace an old machine with a new one. The new machine would increase annual revenue by $200,000 and annual operating expenses by $80,000. The new machine would cost $400,000. The estimated useful life of the machine is 10 years with zero salvage value. i. Compute Accounting Rate of Return (ARR) of the machine using above information. ii. Should Super Apparel purchase the machine if management wants an Accounting Rate of Return of 19% on all capital investments? Hint: Use Average Income or Profit after deducting tax, depreciation, and operating expenses.arrow_forward

- A new machine costing $150,000 is expected to save the McKaig Brick Company $11,000 per year for 5 years before depreciation and taxes. The machine will be depreciated on a straight-line basis for a 5-year period to an estimated salvage value of $0. The firm’s marginal tax rate is 40 percent. What are the annual net cash flows associated with the purchase of this machine? Round your answer to the nearest dollar. $ Compute the net investment (NINV) for this project. Round your answer to the nearest dollar. $arrow_forwardDeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer, more efficient model. The old machine has a book value of $450,000 and a remaining useful life of 5 years. The current machine would be worn out and worthless in 5 years, but DeYoung can sell it now to a Halloween mask manufacturer for $135,000. The old machine is being depreciated by $90,000 per year for each year of its remaining life. If DeYoung doesn't replace the old machine, it will have no salvage value at the end of its useful life. The new machine has a purchase price of $775,000, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $105,000. The applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. Being highly efficient, it is expected to economize on electric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total,…arrow_forwardThe management of XY Company is considering to purchase an equipment to be attached with the main manufacturing machine. The equipment will cost $6,000 and will increase annual cash inflow by $2,200. The useful life of the equipment is 6 years. After 6 years it will have no salvage value. The management wants a 20% return on all investments. Compute net present value (NPV) of this investment project.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education