FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

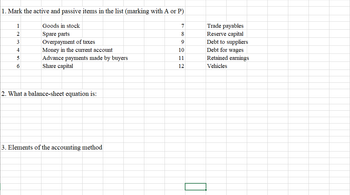

Transcribed Image Text:1. Mark the active and passive items in the list (marking with A or P)

2

3

4

5

6

Goods in stock

Spare parts

Overpayment of taxes

Money in the current account

Advance payments made by buyers

Share capital

2. What a balance-sheet equation is:

3. Elements of the accounting method

7

8

9

10

11

12

Trade payables

Reserve capital

Debt to suppliers

Debt for wages

Retained earnings

Vehicles

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Data table (Click on the icon in order to copy its contents into a spreadsheet.) Inventory Common stock Cash Operating expenses Short-term notes payable Interest expense Depreciation expense Sales Accounts receivable Accounts payable Long-term debt Cost of goods sold Buildings and equipment Accumulated depreciation Taxes General and administrative expense Retained earnings 6,470 45,070 16,570 1,380 600 870 540 12,740 9,560 4,750 54,860 5,710 122,330 33,960 1,400 870 ? I Xarrow_forwardAccounts Payable Accounts Receivable Accumulated Depreciation (Equip) Allowance for Doubtful Accounts Bonds Payable Cash Cash Dividends Common Stock Cost of Goods Sold Depreciation expense Equipment Interest Expense Inventory Adjusted Trial Balance 12/31/2020 Gain on Sale of Equipment Notes Payable (due 9/30/22) PIC in Excess of Par - Common PIC from Treasury Stock Preferred Stock Prepaid Rent Retained Earnings Salary Expense Sales Returns & Allowances Sales Revenue Supplies Treasury Stock Unearned Sales Revenue Utilities Expense TOTALS Debit $4,000 $12,400 $2,800 $16,400 $1,400 $50,000 $400 $4,800 $600 $4,600 $2,000 $400 $600 $2,000 Credit $9,000 $10,000 $200 $10,000 $600 $600 $600 $20,000 $1,400 $6,000 $6,400 $36,800 $800 $102,400 $102,400 Total Assets Total Current Assets Total Liabilities Total Current Liabilities Total Stockholders' Equity Total Paid-in Capital Gross Profit Income from Operations Net Income Intangible Assetsarrow_forwardThe following is list of accounts each represented by letter(s). A Accounts Payable U Loss from discontinued operations B Accounts Receivable V Losses due to fire E Accumulated Depreciation-Equip W Merchandise Inventory F Bonds Payable X Notes Payable G Cash Y Premium on Bonds Payable H Cost of Goods Sold Z Rent Expense I Capital Lease Payable AA Rent Revenue J Discount on Bonds Payable BB Retained Earnings K Equipment EE Salaries and Wages Payable L Federal Income Tax Withheld Payable FF Sales Returns M Federal Unemployment Taxes Payable GG Sales Revenues N FICA Taxes Payable HH Sales Taxes Payable O Income Summary II Shipping Expense P Income Taxes Payable JJ State Income Tax Withheld Payable Q Interest Expense KK State Unemployment Taxes Payable R Interest Payable LL Supplies S Land MM Tax Expense T Land Improvement NN Unearned Rent Revenue Example of Answer: G4000D,B2000D,GG5000C,HH1000CWhere G denotes…arrow_forward

- Answer Using the Pictures 4) Evaluate the information from (i) two liquidity ratios (ii) four debt management ratios (iii) four profitability ratiosarrow_forwardIdentifying and Classifying Financial Statement Items For each of the following items, indicate whether they would be reported in the balance sheet (B) or income statement (1). (a) Machinery (b) Supplies expense (c) Inventories (d) Sales (e) Common stock (f) Factory buildings (g) Receivables (h) Taxes payable (i) Taxes expense (i) Cost of goods sold (k) Long-term debt (1) Treasury stock ◆ ◆ ◆ ♦ ♦ ◆ ◆ ♦ ♦arrow_forwardA Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated Depreciation—Equip EE Notes Payable F Allowance for Doubtful Accounts FF Payroll Tax Expense G Bad Debt Expense GG Premium on Bonds Payable H Bonds Payable HH Prepaid Insurance I Building II Prepaid Rent J Capital Lease Payable JJ Rent Expense K Cash KK Rent Revenue L Cost of Goods Sold LL Retained Earnings M Depreciation Expense MM Salaries and Wages Expense N Discount on Bonds Payable NN Salaries and Wages Payable O Dividends OO Sales Commission Expense P Equipment PP Sales Commission Payable Q Fed Income Tax Payable QQ Sales Returns R Fed Unemployment Tax Payable RR Sales Revenues S FICA Taxes Payable SS Sales Taxes Payable T Income Summary TT Service Revenue U Insurance Expense UU State Income Tax Payable V Interest Expense VV State Unemployment Tax Payable W Interest Payable WW Supplies X Interest Receivable XX Supplies Expense Y…arrow_forward

- A Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated Depreciation—Equip EE Notes Payable F Allowance for Doubtful Accounts FF Payroll Tax Expense G Bad Debt Expense GG Premium on Bonds Payable H Bonds Payable HH Prepaid Insurance I Building II Prepaid Rent J Capital Lease Payable JJ Rent Expense K Cash KK Rent Revenue L Cost of Goods Sold LL Retained Earnings M Depreciation Expense MM Salaries and Wages Expense N Discount on Bonds Payable NN Salaries and Wages Payable O Dividends OO Sales Commission Expense P Equipment PP Sales Commission Payable Q Fed Income Tax Payable QQ Sales Returns R Fed Unemployment Tax Payable RR Sales Revenues S FICA Taxes Payable SS Sales Taxes Payable T Income Summary TT Service Revenue U Insurance Expense UU State Income Tax…arrow_forwardAccount Titles Debit CreditCash $ 7Accounts Receivable 3Supplies 3Equipment 9Accumulated Depreciation $ 2Software 6Accumulated Amortization 2Accounts Payable 4Notes Payable (short-term) 0Salaries and Wages Payable 0Interest Payable 0Income Taxes Payable 0Deferred Revenue 0Common Stock 15Retained Earnings 5Service Revenue 0Depreciation Expense 0Amortization Expense 0Salaries and Wages Expense 0Supplies Expense 0Interest Expense 0Income Tax Expense 0Totals $ 28 $ 28Transactions during 2018 (summarized in thousands of dollars) follow:Borrowed $25 cash on July 1, 2018, signing a six-month note payable.Purchased equipment for $28 cash on July 2, 2018.Issued additional shares of common stock for $5 on July 3.Purchased software on July 4, $3 cash.Purchased supplies on July 5 on account for future use, $7.Recorded revenues on December 6 of $58, including $8 on credit and $50 received in…arrow_forwardA Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E Accumulated Depreciation—Equip EE Notes Payable F Allowance for Doubtful Accounts FF Payroll Tax Expense G Bad Debt Expense GG Premium on Bonds Payable H Bonds Payable HH Prepaid Insurance I Building II Prepaid Rent J Capital Lease Payable JJ Rent Expense K Cash KK Rent Revenue L Cost of Goods Sold LL Retained Earnings M Depreciation Expense MM Salaries and Wages Expense N Discount on Bonds Payable NN Salaries and Wages Payable O Dividends OO Sales Commission Expense P Equipment PP Sales Commission Payable Q Fed Income Tax Payable QQ Sales Returns R Fed Unemployment Tax Payable RR Sales Revenues S FICA Taxes Payable SS Sales Taxes Payable T Income Summary TT Service Revenue U Income Tax Payable UU State Income Tax Payable V Interest Expense VV State Unemployment Tax Payable W Interest Payable WW Supplies X Interest Receivable XX Supplies Expense Y…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education