FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

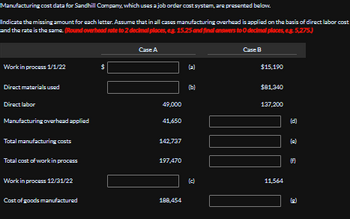

Transcribed Image Text:Manufacturing cost data for Sandhill Company, which uses a job order cast system, are presented below.

Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost

and the rate is the same. (Round overhead rate to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, eg. 5,275.)

Work in process 1/1/22

Direct materials used

Direct labor

Manufacturing overhead applied

Total manufacturing costs

Total cost of work in process

Work in process 12/31/22

Cost of goods manufactured

Case A

49,000

41,650

142,737

197,470

188,454

(2)

3

D

Case B

$15,190

$81,340

137,200

11,564

(d)

3

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Manufacturing cost data for Cullumber Company, which uses a job - order cost system, are presented below. Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labour cost and the rate is the same.arrow_forwardThe following is taken from Clausen Company’s internal records of its factory with two operating departments. The cost driver for indirect labor is direct labor hours, and the cost driver for the remaining items is number of hours of machine use. Compute the total amount of overhead cost allocated to Dept. 1 using activity-based costing. Direct Labor Hours Machine Hours Operating Dept. 1 1,020 9,600 Operating Dept. 2 2,380 6,400 Totals 3,400 16,000 Factory overhead costs Rent and utilities $ 22,900 Indirect labor 18,500 Depreciation – Equipment 15,600 Total factory overhead $ 57,000arrow_forwardJackson Foundry uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required. (Click the icon to view the costs.) Requirements 1. 2. 3. Compute Jackson's predetermined overhead allocation rate. Prepare the journal entry to allocate manufacturing overhead. Post the manufacturing overhead transactions to the Manufacturing Overhead T-account. Is manufacturing overhead underallocated or overallocated? By how much? 4. Prepare the journal entry to adjust for the underallocated or overallocated manufacturing overhead. Does your entry increase or decrease Cost of Goods Sold? Print Allocated overhead to WIP Done - X Data table At the beginning of 2024, the company expected to incur the following: Manufacturing overhead costs Direct labor costs $880,000 1,540,000 Machine hours 80,000 hours At the end of 2024, the company had actually incurred: Direct labor costs Depreciation on manufacturing plant and equipment Property taxes on plant…arrow_forward

- Care Company uses job costing and has assembled the following cost data for the production and assembly of item X: (Click the icon to view the cost data.) Based on the above cost data, the manufacturing overhead for item X is A. $1,590 underallocated. B. $350 overallocated. C. $350 underallocated. D. $1,590 overallocated. Cost Data Direct manufacturing labor wages Direct material used Indirect manufacturing labor Utilities Fire insurance Manufacturing overhead applied Indirect materials Depreciation on equipment $ 36,000 100,000 3,800 450 490 10,000 6,500 350 Xarrow_forwardDistribution of Direct and Indirect Overhead Costs to Producing Departments. Ming Chemical Co. operates with three producing departments—Blending, Testing, and Terminal. The overhead items and amounts for the period, along with the bases for their allocation, are listed below. How much is the total overhead to be charged to Terminal Department? Round your answer to whole number. 2. What is the overhead rate per direct labor hour under Blending Department?. Round your answer in two decimal places.arrow_forwardA job cost sheet of Wildhorse Company is given below. Job Cost Sheet JORNO White Lion C Date Requested 42 FOR Told Company Date Completed Date Direct Materials Direct Manufacturing Labor Overhead 7/10 200 600 730 400 480 1700 1520 31 500 600 Cost of completed job Direct materials Direct labor Manufacturing overhead Total cost Unit cost (a) Your answer is correct Answer the following questiona. (1) What are the source documents for direct maten als direct labor, and manufacturing overhead costs assigned to this job? Source Documents Direct material Direct labar Manufacturing (2) Overhead is applied on the basis of direct tabar cost. What is the predetermined manufacturing overhead rate! termined manufacturing overhead cate 120 31 What are the total cost and the unit cost of the completed job Round unitat o 2 decimal places, eg 125 Total cost of the completed job 120 Unit cost of the completed job S 14006 Textbook and Media List of Accounts Prepare the salty to record the soniction…arrow_forward

- Telstar uses job order costing. The T-accounts below summarize its production activity for the year. Raw Materials Inventory Debit Factory Wages Payable Debit Credit Credit 46,900 Work in Process Inventory Debit Credit 26,150 9,900 26,150 87,650 104,584 Required 1 172,220 1. Compute the amount for each of the following. a. Direct materials used b. Indirect materials used c. Direct labor used d. Indirect labor used e. Cost of goods manufactured f. Cost of goods sold (before closing over- or underapplied overhead) 2. Compute the amount that overhead is overapplied or underapplied. Required 2 127,900 Complete this question by entering your answers in the tabs below. Finished Goods Inventory Credit Debit 172,220 155,190 Required 1 Required 2 87,650 42, 150 Compute the amount for each of the following. a. Direct materials used b. Indirect materials used c. Direct labor used d. Indirect labor used e. Cost of goods manufactured f. Cost of goods sold (before closing over- or underapplied…arrow_forwardPratice Problem 2: A company's individual job sheets show these costs: A chart showing costs for Jobs 131, 132, and 133. Direct materials is RO 4585, RO 8723, and RO 1575 respectively. Direct labor is RO2385, RO 2498, and RO 2874, respectively. Overhead is applied at 1.25 times the direct labor cost. You are required to : Prepare an entry to record the assignment of direct materials to work in process. Prepare an entry to record the assignment of direct labor to work in process. Prepare an entry to record the assignment of manufacturing overhead to work in process.arrow_forwardRound off all amounts to three decimal places. direct materials cost. Factory overhead is allocated on the basis of direct labor cost Reguired: The amount of direct labor and the amount of factory overhead in Finished Goods for Serarrow_forward

- Under Lamar Company's job costing system, manufacturing overhead is applied to Work-in-Process Inventory using a predetermined overhead rate. During June, Lamar's transactions included the following: Direct materials issued to production $ 91,700 Indirect materials issued to production 9,700 Manufacturing overhead cost incurred 126,700 Manufacturing overhead cost applied 114,700 Direct labor cost incurred 108,700 Lamar Company had no beginning or ending inventories. What was the cost of goods manufactured for June? (CMA adapted)arrow_forwardPlease see picture below.arrow_forwardPlease show your work.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education