FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

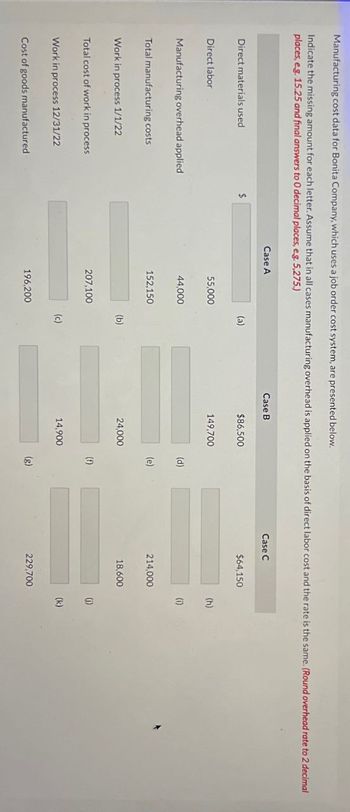

Transcribed Image Text:Manufacturing cost data for Bonita Company, which uses a job order cost system, are presented below.

Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost and the rate is the same. (Round overhead rate to 2 decimal

places, e.g. 15.25 and final answers to O decimal places, eg. 5,275.)

Case A

Case B

Direct materials used

$

(a)

$86,500

Direct labor

55,000

149,700

Manufacturing overhead applied

44,000

Total manufacturing costs

152,150

Work in process 1/1/22

Total cost of work in process

207,100

Work in process 12/31/22

Cost of goods manufactured

196,200

(b)

24,000

(c)

14,900

(d)

Case C

$64,150

(e)

214,000

(f)

18,600

(g)

229,700

(h)

(i)

(j)

(k)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- All information includedarrow_forwardA company has traditionally allocated its overhead based on machine hours but had collected this information to change to activity-based costing: Estimated Activity Activity Center Product 1 Product 2 Estimated Cost Machine Setups 15 45 $11,400 Assembly Parts 4,500 4,500 217,800 Packaging Pieces 250 200 27,450 Machine Hours per Unit 4 Production Volume 750 1,500 A. How much overhead would be allocated to each unit under the traditional allocation method? Round your answers to two decimal places. Product 1 Product 2 Allocation per unit $ B. How much overhead would be allocated to each unit under activity-based costing? Round your answers to two decimal places. Product 1 Product 2 Allocation per unit $ $4arrow_forwardView Policies Current Attempt in Progress Manufacturing cost data for Marin Company are presented as follows. Determine the missing amount for each letter (a) through (i). Direct materials used Direct labor Manufacturing overhead Total manufacturing costs Work in process 1/1/22 Total cost of work in process Work in process 12/31/22 Cost of goods manufactured Save for Later Case A 72,000 58,800 250,100 282,800 237,020 (a) (b) (c) Case B $88,300 109,600 103,700 85,200 13,600 (d) (e) (f) Case C Attempts: 0 of 7 used $166,400 129,600 323,000 430,400 89,600 (g) (h) (i) Submit Answerarrow_forward

- Manufacturing cost data for Cullumber Company, which uses a job - order cost system, are presented below. Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labour cost and the rate is the same.arrow_forwardssume estimated overhead cost is $4,500,000, estimated direct labor costs is $3,000,000. Overhead is based on direct labor cost. If Job 265 incurs direct material costs of $963, direct labor of $1,750, and is sold for $7,200. **Use the following format for the journal entries: Dr. Raw Materials Inventory 500 Cr. Accounts Payable 500**** 1. What is the overhead rate? % 2. What is the journal entry to apply overhead to Job 5265? 3. What is total cost of Job? $ 4. What is gross profit? $ 5. At the end of the period it was determined that actual overhead incurred was $4,468,000. What is the adjusting entry to record the over/under applied OH?arrow_forwardThe following accounts are from last year's books at Sharp Manufacturing: Balance Balance (g) Debit Debit Debit Raw Materials 0 (b) 170,500 13,900 Finished Goods 0 (g) 520,400 47,400 Cost of Goods Sold 473,000 Credit Credit Credit 156,600 Balance (b) (c) (c) 473,000 (b) (c) (d) Debit Debit Work In Process 0 (1) 133,300 170,600 216,500 0 Manufacturing Overhead 23,300 (e) 27,300 158,600 Credit Credit 520,400 216,500 7,300 Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?arrow_forward

- Telstar uses job order costing. The T-accounts below summarize its production activity for the year. Raw Materials Inventory Debit Factory Wages Payable Debit Credit Credit 46,900 Work in Process Inventory Debit Credit 26,150 9,900 26,150 87,650 104,584 Required 1 172,220 1. Compute the amount for each of the following. a. Direct materials used b. Indirect materials used c. Direct labor used d. Indirect labor used e. Cost of goods manufactured f. Cost of goods sold (before closing over- or underapplied overhead) 2. Compute the amount that overhead is overapplied or underapplied. Required 2 127,900 Complete this question by entering your answers in the tabs below. Finished Goods Inventory Credit Debit 172,220 155,190 Required 1 Required 2 87,650 42, 150 Compute the amount for each of the following. a. Direct materials used b. Indirect materials used c. Direct labor used d. Indirect labor used e. Cost of goods manufactured f. Cost of goods sold (before closing over- or underapplied…arrow_forwards === Mulligan Manufacturing Company uses a job order cost system with overhead applied to products at a rate of 150 percent of direct labor cost. Required: Treating each case independently, selected from the manufacturing data given below, find the missing amounts. You should do them in the order listed. (Hint: For the manufacturing costs in Case 3, first solve for conversion costs and then determine how much of that is direct labor and how much is manufacturing overhead.) Note: Do not round your intermediate calculations. Round your final answers to the nearest whole dollar. Enter all amounts as positive values. Direct materials used Direct labor Manufacturing overhead applied Total current manufacturing costs Beginning work in process inventory Ending work in process inventory Cost of goods manufactured Beginning finished goods inventory Ending finished goods inventory Cost of goods sold 89 SEP 17 84 < Prev Case 1 16,000 12,000 8,100 5,900 3,800 7,900 6 of 8 tv Case 2 ‒‒‒ ‒‒‒ ▬▬▬…arrow_forwarddo not give solution in image format and fast answer pleasearrow_forward

- Required information Use the following information to answer questions. (Algo) [The following information applies to the questions displayed below.] The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Inventories Raw materials Work in process Finished goods Beginning of period $ 43,000 9,200 63,000 Cost incurred for the period Raw materials purchases Factory payroll Factory overhead (actual) Indirect materials used Indirect labor used Other overhead costs End of Period $ 57,000 18,600 34,300 $ 183,000 150,000 18,000 34,500 98,500 Exercise 15-12 (Algo) Computing materials, labor, overhead, and cost of goods manufactured LO P1, P2, P3, P4 1. In the Raw Materials Inventory T-account, insert amounts for beginning and ending balances along with purchases and indirect materials used. Solve for direct materials used in the…arrow_forwardSunland Company has the following data: Direct labor Direct materials used Total manufacturing overhead Ending work in process inventory Beginning work in process inventory (a) Compute total manufacturing costs. Total manufacturing costs $71,440 78,960 61,100 28,200 42,300arrow_forwardanswer in text form please (without image), answer both the partsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education