Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

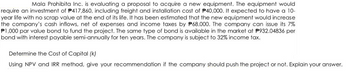

Transcribed Image Text:Mala Prohibita Inc. is evaluating a proposal to acquire a new equipment. The equipment would

require an investment of P417,860, including freight and installation cost of P40,000. It expected to have a 10-

year life with no scrap value at the end of its life. It has been estimated that the new equipment would increase

the company's cash inflows, net of expenses and income taxes by P68,000. The company can issue its 7%

P1,000 par value bond to fund the project. The same type of bond is available in the market at P932.04836 per

bond with interest payable semi-annually for ten years. The company is subject to 32% income tax.

Determine the Cost of Capital (k)

Using NPV and IRR method, give your recommendation if the company should push the project or not. Explain your answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $116,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $57,000. The machine would require a $4,000 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $48,000 per year. The marginal tax rate is 25%, and the WACC is 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. How should the $4,500 spent last year be handled? Only the tax effect of the research expenses should be included in the analysis. Last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be included in the initial investment outlay. Last year's expenditure is considered…arrow_forwardEsfandairi Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.18 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $1.645 million in annual sales, with costs of $610,000. The project requires an initial investment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. The tax rate is 21 percent. a. What is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567.) b. If the required return is 12 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Year 0 cash flow a. Year 1 cash flow…arrow_forwardHeidi Company is considering the acquisition of a machine that costs $401,000. The machine is expected to have a useful life of 6 years, a negligible residual value, an annual net cash inflow of $128,000, and annual operating income of $88,392. The estimated cash payback period for the machine is (round to one decimal point)? a.5.5 years b.4.5 years c.4.0 years d.3.1 yearsarrow_forward

- Rundle Airline Company is considering expanding its territory. The company has the opportunity to purchase one af two different used airplanes. The first airplane is expected to cost $14,280,000; it will enable the company to increase its annual cash inflow by $6,800,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $33,840,000; it will enable the company to increase annual cash flow by $9,400,000 per year. This plane has an eight-year useful life and a zero salvage value. Required a. Determine the payback period for each investment alternative and identify the alternative Rundle should accept if the decision is based on the payback approach. (Round your answers to 1 decimal place.) Payback Period a-1. Alternative 1 (First plane) years Alternative 2 (Second plane) years a-2. Rundle should accept alternative 1arrow_forwardTree's Ice Cubes is considering a new three-year expansion project. The initial fixed asset investment will be $1.80 million and the fixed assets will be depreciated straight-line to zero over its three-year tax life, after which time the assets will be worthless. The annual sales of the project is estimated to be $1,005,000, with costs of $485,000. What is the OCF for this project, if the tax rate is 21 percent? (Do not round intermediate calculations.) Multiple Choice $536,800 $812,246 $544,200 $616,150 $746150arrow_forwardNewcastle Coal Company is considering a project that requires an investment in new equipment of $4,200,000, with an additional $210,000 in shipping and installation costs. Newcastle estimates that its accounts receivable and inventories need to increase by $840,000 to support the new project, some of which is financed by a $336,000 increase in spontaneous liabilities (accounts payable and accruals). The total cost of Newcastle's new equipment is and consists of the price of the new equipment plus the In contrast, Newcastle's initial investment outlay is Suppose Newcastle's new equipment is expected to sell for $1,200,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working capital investment. The company chose to use straight-line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total terminal cash flow? O $1,224,000 ○…arrow_forward

- Five Star is considering leasing a building and buying the necessary equipment to operate a public warehouse. Alternatively, the company could use the funds to invest in $149,600 of 5% U.S. Treasury bonds that mature in 16 years. The bonds could be purchased at face value. The following data have been assembled: Cost of equipment Life of equipment Estimated residual value of equipment Yearly costs to operate the warehouse, excluding depreciation of equipment Yearly expected revenues-years 1-8 Yearly expected revenues-years 9-16 Required: Differential revenue from alternatives: Revenue from operating warehouse Revenue from investment in bonds Differential revenue from operating warehouse 1. Prepare a differential analysis report of the proposed operation of the warehouse for the 16 years as compared with present conditions. Five Star Proposal to Operate Warehouse. Differential cost of alternatives: Costs to operate warehouse ✓ $149,600 16 years $27,500 Cost of equipment less residual…arrow_forwardSummer Tyme, Inc., is considering a new 3-year expansion project that requires an initial fixed asset investment of $662,691. The fixed asset will be depreciated straight-line to 61,885 over its 3-year tax life, after which time it will have a market value of $112,268. The project requires an initial investment in net working capital of $78,031. The project is estimated to generate $223,911 in annual sales, with costs of $101,913. The tax rate is 0.29 and the required return on the project is 0.12. What is the total cash flow in year 0? (Make sure you enter the number with the appropriate +/- sign)arrow_forwardGRIP Industries is considering a new assembly line costing RM1,600,000. The instaliation will ncur a cost of RM350,000 and after-tax training cost of RM105,000. The assembly line will be fuly depreciated using the simplified straight-ine method over its 3- year depreciable life. Net working capital is expected to increase by RM420,000 at start and the full amount ill be recovered at the end of up year 3. First year sales are estimated to be RM1,800,00, and illincrease by RM200,000 each year throughout the 3-year period. Variable cost is 55% from sales, while fixed cost takes up RM225,000 per year. At terminal, the assembly line can be sold at RM700,000. GRIP is in the 35 percent tax bracket and has a required rate of returm of 12% A) Calculate the total initial outlay of the project. B) Determine the annual cash flow for the project from year 1 to year 3. C) Calculate the terminal cash flow at year 3. D) Calculate the net present value (NPV) and intermal required rate of return (IRR)…arrow_forward

- You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $104,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $43,000. The machine would require a $5,500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $56,000 per year. The marginal tax rate is 25%, and the WACC is 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? I. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. The cost of research is an incremental cash flow and should be included in the analysis. III. Only the tax effect of the research expenses…arrow_forwardou must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $157,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $86,000. The machine would require an $8,000 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $47,000 per year. The marginal tax rate is 25%, and the WACC is 9%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. What is the initial investment outlay for the machine for capital budgeting purposes after the 100% bonus depreciation is considered, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar.arrow_forwardHeidi Company is considering the acquisition of a machine that costs $828,800. The machine is expected to have a useful life of six years, a negligible residual value, an annual net cash flow of $112,000, and annual operating income of $80,000. What is the estimated cash payback period for the machine (round to one decimal point)? a.10.4 years b.4.3 years c.7.4 years d.1.4 years Determine the average rate of return for a project that is estimated to yield total income of $411,040 over four years, cost $668,000, and has a $66,000 residual value. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education