FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

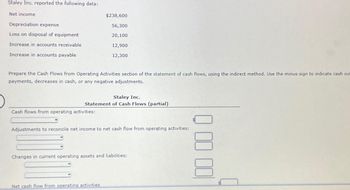

Staley inc .repoted the following data:\ table[[Net income,$238,600

Transcribed Image Text:Staley Inc. reported the following data:

Net income

Depreciation expense

Loss on disposal of equipment

Increase in accounts receivable

Increase in accounts payable

Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out

payments, decreases in cash, or any negative adjustments.

$238,600

56,300

20,100

12,900

12,300

Staley Inc.

Statement of Cash Flows (partial)

Cash flows from operating activities:

Adjustments to reconcile net income to net cash flow from operating activities:

Changes in current operating assets and liabilities:

Net cash flow from operating activities

Q00 00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jitu Don't upload any image pleasearrow_forwardOne item is omitted from each of the following computations of the return on investment: Return on Investment = Profit Margin × Investment Turnover 18% = 10% × (a) (b) = 28% × 0.75 24% = (c) × 1.5 10% = 20% × (d) (e) = 15% × 2.2 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. Item Answer (a) fill in the blank 1 (b) fill in the blank 2% (c) fill in the blank 3% (d) fill in the blank 4 (e) fill in the blank 5%arrow_forwardYour company has net sales revenue of $43 million during the year. At the beginning of the year, fixed assets are $15 million. At the end of the year, fixed assets are $17 million. What the fixed asset turnover ratio? Multiple Choice 2.87 1.34 2.53 269arrow_forward

- ABC company has NOA of $23,046. Its comparable companies show the following financial data: Company Operating value NOA $23,046 $29,828 $32.956 LBJ $36412 $29,828 $18,923 MLK $34,277 $26,449 NDR $20,932 What is ABC company's operating value? Assume an equally weighted average is used in the multiple method. $14,702arrow_forwardPXG Co. has total assets of $10,300,000 and a total asset turnover of 2.53 times. Assume the return on assets is 11 percent. What is its profit margin? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardJones Corp. reported current assets of $184,000 and current liabilities of $127,500 on its most recent balance sheet. The current assets consisted of $63,800 Cash; $45,700 Accounts Receivable; and $74,500 of Inventory. The acid-test (quick) ratio is: Multiple Choice 1.4: 1. 0.86: 1. 0.60: 1. ...arrow_forward

- Bouvous Corporation had the following information for 2015:Revenue $400,000Operating expenses 350,000Total assets 530,000What is the return on investment?arrow_forwardThis topic is about CVP Analysis. Check the photo for the problemarrow_forwardBottlebrush Company has operating income of $150,720, invested assets of $314,000, and sales of $1,004,800. Use the DuPont formula to compute the return on investment, and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round answers to one decimal place.arrow_forward

- 14. Briggs Company has operating income of $33,516, invested assets of $133,000, and sales of $478,800. Use the DuPont formula to compute the return on investment. If required, round your answers to two decimal places. a. Profit margin ____ % b. Investment turnover ____ c. Return on investment ____ %arrow_forwardNeed help with Operating income. What is the formula using the data in the pictures.arrow_forwardOne item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 17 % = 10 % x (a) (b) = 28 % x 0.75 18 % = (c) x 1.5 10 % = 20 % x (d) (e) = 15 % x 1.2 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank (b) fill in the blank % (c) fill in the blank % (d) fill in the blank (e) fill in the blank %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education