FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

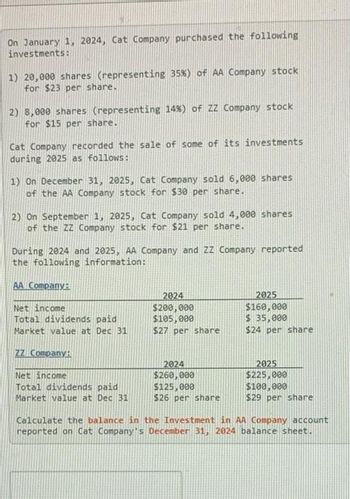

Transcribed Image Text:On January 1, 2024, Cat Company purchased the following

investments:

1) 20,000 shares (representing 35%) of AA Company stock

for $23 per share.

2) 8,000 shares (representing 14%) of ZZ Company stock

for $15 per share..

Cat Company recorded the sale of some of its investments

during 2025 as follows:

1) On December 31, 2025, Cat Company sold 6,000 shares

of the AA Company stock for $30 per share.

2) On September 1, 2025, Cat Company sold 4,000 shares

of the ZZ Company stock for $21 per share.

During 2024 and 2025, AA Company and ZZ Company reported

the following information:

AA Company:

Net income.

Total dividends paid

Market value at Dec 31

ZZ Company:

Net income

Total dividends paid

Market value at Dec 31

2024

$200,000

$105,000

$27 per share

2024

$260,000

$125,000

$26 per share

2025

$160,000

$ 35,000

$24 per share

2025

$225,000

$100,000

$29 per share

Calculate the balance in the Investment in AA Company account

reported on Cat Company's December 31, 2024 balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2021 Blossom Company purchased 8700 shares of Nash Inc. for $17 per share. During the year Blossom Company sold 1850 shares of Nash, Inc. for $22 per share. At December 31, 2021 the market price of Nash, Inc.’s stock was $15 per share. What is the total amount of gain/(loss) that Blossom Company will report in its income statement for the year ended December 31, 2021 related to its investment in Nash, Inc. stock? $-8150 $-17400 $-4450 $9250arrow_forwardOn January 1, 2020, Swifty Corporation purchased 37% of the common stock outstanding of Cullumber Corporation for $610000. During 2020, Cullumber Corporation reported net income of $180000 and paid cash dividends of $120000. The balance of the Stock Investments-Cullumber account on the books of Swifty Corporation at December 31, 2020 is $610000. O $565600. O $632200. O $676600. eTextbook and Media Save for Later Attempts: 0 of 2 used Submit Answer 2$ & 7 8 9 4. y f h b n m altarrow_forwardCPA corporation purchased a 10% interest in ABC co. on January 1, 2021 as an available for sale investment for a price of P120,000. On January 1, 2022, CPA purchase 7,000 additional shares of ABC from existing stockholders for P945,000. This purchase increased CPA's interest to 70%. ABC had the following statement of financial position just prior to the second purchase. Current Assets 495,000 Building, Net Equipment, Net 420,000 300,000 Liabilities 195,000 Common Stock, P30 par Retained Earnings 300,000 720,000 On the date of second purchase, CPA determines that the equipment was understated by 150,000 and had a remaining life of 5yrs. All other book values approximate their fair values. Any remaining excess is attributed to goodwill. On January 1, 2022 consolidated financial position, what is the amount of goodwill to be reported?arrow_forward

- On January 2, 2021 Pod Company purchased 25% of the outstanding ordinary shares of Jobs, Inc. and subsequently used the equity method to account for the investment. During 2021 Jobs, Inc. reported net income of P420,000 and distributed dividends of P180,000. The ending balance in the Equity Investments account at December 31, 2021 was P320,000 after applying the equity method during 2021. What was the purchase price Pod Company paid for its investment in Jobs, Inc? a.) P170,000 b.) P260,000 c.) P380,000 d.) P470,000arrow_forwardOwearrow_forwardOn January 1, 2020, Windsor Company purchased 6,100 shares of Kusher Company stock for $439,200. Windsor's investment represents 30 percent of the total outstanding shares of Kusher. During 2020, Kusher paid total dividends of $152,000 and reported net income of $456,000. What revenue does Windsor report related to this investment and what is the amount to be reported as an investment in Kusher stock at December 31? Revenue $ Investment in Kusher stock at December 31 $arrow_forward

- On January 1, 2022, Mojito Corporation purchased 20% (20,000 shares) of the outstanding stock of Dulcinea Corporation for $153,000. During 2022, Dulcinea Corporation paid total dividends of $45,000 and earned $80,000 in net income. At the end of 2022, Dulcinea Corporation’s stock had a fair market value of $155,000. Required: Prepare the journal entries that Mojito would make during 2022 assuming that they do NOT have significant influence over Dulcinea as a result of their stock ownership (i.e. fair value method). Prepare the journal entries that Mojito would make during 2022 assuming that they do have significant influence over Dulcinea as a result of their stock ownership (i.e. equity method).arrow_forwardMetlock Corporation made the following cash purchases of securities during 2020, which is the first year in which Metlock invested in securities. 1. On January 15, purchased 11,600 shares of Sanchez Company’s common stock at $ 33.50 per share plus commission $ 2,304. 2. On April 1, purchased 5,800 shares of Vicario Co.’s common stock at $ 52 per share plus commission $ 3,902. 3. On September 10, purchased 8,120 shares of WTA Co.’s preferred stock at $ 26.50 per share plus commission $ 5,692. On May 20, 2020, Metlock sold 4,524 shares of Sanchez Company’s common stock at a market price of $ 35 per share less brokerage commissions, taxes, and fees of $ 4,466. The year-end fair values per share were Sanchez $ 30, Vicario $ 55, and WTA $ 28. In addition, the chief accountant of Metlock told you that the corporation plans to hold these securities for the long-term but may sell them in order to earn profits from appreciation in prices. The equity method of accounting is…arrow_forwardOn April 1, 2024, BigBen Company acquired 30% of the shares of LittleTick, Incorporated BigBen paid $100,000 for t investment, which is $40,000 more than 30% of the book value of LittleTick's identifiable net assets. BigBen attributer $15,000 of the $40,000 difference to inventory that will be sold in the remainder of 2024, and the rest to goodwill. LittleTick recognized a total of $20,000 of net income for 2024, and paid total dividends for the year of $10,000; these dividends were issued quarterly. BigBen's investment in LittleTick will affect BigBen's 2024 net income by: O a loss of $10,500. earnings of $4,500. earnings of $1,125. earnings of $3,450.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education