FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

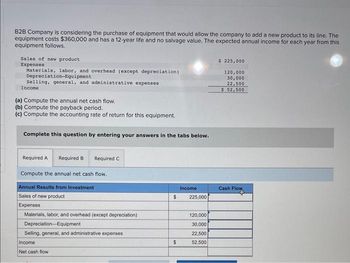

Transcribed Image Text:B2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The

equipment costs $360,000 and has a 12-year life and no salvage value. The expected annual income for each year from this

equipment follows.

Sales of new product

Expenses

Materials, labor, and overhead (except depreciation)

Depreciation-Equipment

Selling, general, and administrative expenses

Income

(a) Compute the annual net cash flow.

(b) Compute the payback period.

(c) Compute the accounting rate of return for this equipment.

Complete this question by entering your answers in the tabs below.

Required A

Compute the annual net cash flow.

Required B

Required C

Annual Results from Investment

Sales of new product

Expenses

Materials, labor, and overhead (except depreciation)

Depreciation Equipment

Selling, general, and administrative expenses.

Income

Net cash flow

Income

$ 225,000

$

120,000

30,000

22,500

52,500

$ 225,000

120,000

30,000

22,500

$ 52,500

Cash Flow

Flow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- To open a new store, Zachary Tire Company plans to invest $378,000 in equipment expected to have a seven-year useful life and no salvage value. Zachary expects the new store to generate annual cash revenues of $322,000 and to incur annual cash operating expenses of $192,000. Zachary's average income tax rate is 40 percent. The company uses straight-line depreciation. Required Determine the expected annual net cash inflow from operations for each of the first four years after Zachary opens the new store. Note: Negative amounts should be indicated by a minus sign. Year 1 Year 2 Year 3 Year 4 Net cash Inflow or Outflowarrow_forward. Flexsteel Industries manufactures furniture for the retail, contract, and recreational vehicle furniture markets. The company is considering the purchase of a new piece of equipment, which would have an initial cost of $1,000,000 and a 5-year life. There is no salvage value for the equipment. The increase in cash flow each year of the equipment's life would be as follows: Year 1 Year 2 Year 3 Year 4 Year 5 $395,000 $ 370,000 $ 305,000 $ 250,000 $ 205,000 What is the payback period?arrow_forwardTipton Corporation has gathered the following data on a proposed investment project (Ignore income taxes.): Investment required in equipment Annual cash inflows Salvage value of equipment Life of the investment Required rate of return O 5 years O 15 years O2 years O 7.143 years $ 30,000 $ 6,000 $0 Chapter 8 15 10 The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period for the investment is: years %arrow_forward

- Most Company has an opportunity to invest in one of two new projects. Project Y requires a $325,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $325,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project Y Project Z Sales $ 370,000 $ 296,000 Expenses Direct materials 51,800 37,000 Direct labor 74,000 44,400 Overhead including depreciation 133,200 133,200 Selling and administrative expenses 26,000 26,000 Total expenses 285,000 240,600 Pretax income 85,000 55,400 Income taxes (38%) 32,300 21,052 Net income $ 52,700 $…arrow_forwardHello, just need help with the annual net cash flow portion. I haven't computed it in this methodarrow_forwardAccounting Rate of Return Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. Cobre Company is considering the purchase of new equipment that will speed up the process for extracting copper. The equipment will cost $4,100,000 and have a life of 5 years with no expected salvage value. The expected cash flows associated with the project are as follows: Year Cash Revenues Cash Expenses 1 $6,000,000 $4,800,000 2 6,000,000 4,800,000 3 6,000,000 4,800,000 4 6,000,000 4,800,000 5 6,000,000 4,800,000 Emily Hansen is considering investing in one of the following two projects. Either project will require an investment of $75,000. The expected cash revenues minus cash expenses for the two projects follow. Assume each project is depreciable. Year Project A Project B 1 $22,500 $22,500 2 30,000 30,000 3 45,000 45,000 4 75,000 22,500 5 75,000 22,500 Suppose that a…arrow_forward

- Walton Manufacturing Company has an opportunity to purchase some technologically advanced equipment that will reduce the company's cash outflow for operating expenses by $1,287,000 per year. The cost of the equipment is $5,187,854.53. Walton expects it to have a 9-year useful life and a zero salvage value. The company has established an investment opportunity hurdle rate of 19 percent and uses the straight-line method for depreciation. (PV of $1 and PVA of $1) Note: Use appropriate factor(s) from the tables provided. W Required a. Calculate the internal rate of return of the investment opportunity. Note: Do not round intermediate calculations. b. Indicate whether the investment opportunity should be accepted. a. Internal rate of return b. Should the investment opportunity be accepted? Prev 1 of 15 「買買買 --- MacBook Air Next >arrow_forwardSubject: acountingarrow_forwardNational Integrated Systems (NIS), a global provider of heating and air conditioning is planning a project whose data is provided below. The project’s equipment has a 3 year tax life after which its salvage value will be zero. The machinery will be depreciated on a straight line basis over three years. Revenues and other operating costs are expected to be constant over the project’s life. What is the project’s cash flow in Year 1? Equipment Cost = $130,000Depreciation rate = 33.33%Annual Sales Revenue= $120,000Operating Costs (ex Depreciation) = $50,000 Tax Rate = 35%arrow_forward

- Payback; ARRPortsmouth Port Services creates and maintains shipping channels at various ports around the world. The company is considering the purchase of a $72,000,000 ocean-going dredge that has a five-year life and no salvage value. The company depreciates assets on a straight-line basis. This equipment’s expected annual cash flow on a before-tax basis is $19,000,000. Ports-mouth requires that an investment be recouped in less than five years and have a pre-tax accounting rate of return of at least 18 percent.a. Compute the payback period for this equipment.Note: Round your answer to one decimal place (i.e. round 4.3555 to 4.4).Payback period Answer yearsb. Compute the accounting rate of return for this equipment.Note: Round percentage to one decimal point (i.e. round 4.555% to 4.6%).Accounting rate of return Answer%c. Is the equipment an acceptable investment for Portsmouth? Answerarrow_forwardVandezande Inc. is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value. The cash flows that would be produced by the machine are (Ignore income taxes): Net Cash Flows Year 1 $ 128,000 Year 2 $ 105,000 Year 3 $ 126,000 Year 4 $ 123,000 Year 5 $ 122,000 Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to:arrow_forwardA business is planning to purchase new equipment at a cost of £60,000. The equipment is expected to last 4 years and to have no scrap value (residual value). Depreciation is calculated on a straight-line basis. The investment is expected to generate the following profits/(losses): Year 1 2 3 4 Profit/(loss) (10,000) 20,000 40,000 20,000 Required: Convert these profits/(losses) to cash flows.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education