FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

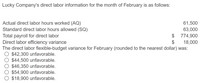

Transcribed Image Text:Lucky Company's direct labor information for the month of February is as follows:

Actual direct labor hours worked (AQ)

Standard direct labor hours allowed (SQ)

Total payroll for direct labor

Direct labor efficiency variance

The direct labor flexible-budget variance for February (rounded to the nearest dollar) was:

O $42,300 unfavorable.

$44,500 unfavorable.

$46,350 unfavorable.

$54,900 unfavorable.

$18,900 unfavorable.

61,500

63,000

$ 774,900

$

18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ES The following information is gathered from the labor records of Binamul & Co. Payroll allocation for direct labor is Rs. 1, 31, 600 Time card analysis shows that 9,400 hours were worked on productions lines. Production reports for the period showed that 4,500 units have been completed, each having standard labor time of 2 hours and a standard labor rate of Rs. 15 per hour. Calculate the labor variances.arrow_forwardA company shows a $24,000 unfavorable direct labor rate variance and a $18,000unfavorable direct labor efficiency variance. The company's standard cost of direct labor is $370,000. What is the actual cost of direct labor? Actual cost of direct laborarrow_forwardInformation for Garner Company's direct-labor costs for the month of September 2005 was as follows: Actual direct-labor hours Standard direct-labor hours Total direct-labor payroll Direct-labor efficiency variance-favorable Answer: 34,500 hours 35,000 hours $241,500 $3,200 What is Garner's direct-labor price (or rate) variance? Be sure to label the variance favorable or unfavorable.arrow_forward

- Williams Corporation reports the following direct labor information for November: Standard rate $4 Actual rate paid Standard hours allowed for actual production Labor efficiency variance 33.00 per hour 33.80 per hour 44, 600 hours $201, 300 F Required: Based on these data, what was the number of actual hours worked and what was the labor price variance? (Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.) Actual hours worked Labor price variance hoursarrow_forwardNonearrow_forwardLucky Company's direct labor information for the month of February is as follows: Actual direct labor hours worked (AQ) 61,500 Standard direct labor hours allowed (SQ) 63,000 Total payroll for direct labor $ 774,900 Direct labor efficiency variance $ 18,000 The standard direct labor rate per hour (SP) for February was: Multiple Choice $12.00. $12.30. $12.60. $13.20. $13.50.arrow_forward

- Please help me fastarrow_forwardCoronado Corporation accumulates the following data relative to jobs started and finished during the month of June 2022. Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Overhead controllable variance $ Overhead volume variance Actual $ $4.40 11,000 $177,600 14,800 $242,800 Standard $4.30 10,100 $174,420 15,300 Overhead is applied on the basis of standard machine hours. 3.20 hours of machine time are required for each direct labor hour. The jobs were sold for $475,000. Selling and administrative expenses were $40,100. Assume that the amount of raw materials purchased equaled the amount used. Compute the overhead controllable variance and the overhead volume variance. $244,800 49,960 $89,928 $3.20 $1.80…arrow_forwardA company uses a standard costing system and applies overhead to production based on direct labor-hours. It provided the following information for its most recent year. $300,000 $276,000 60,000 56,000 56,500 Budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator hours) Actual direct labor-hours Standard direct labor-hours al1lowed for actual output What is the fixed overhead volume variance? Multiple Cholce $20,000 F $17,500 U $20,000 U MacBook Air 吕口 豐arrow_forward

- In October, Pine Company reports 19,400 actual direct labor hours, and it incurs $122,380 of manufacturing overhead costs Standard hours allowed for the work done is 21,100 hours. The predetermined overhead rate is $5.75 per direct labor hour. Compute the total overhead variance Total Overhead Variancearrow_forwardDuring March 2022, Vaughn Tool & Die Company worked on four jobs. A review of direct labor costs reveals the following summary data. Actual Standard Job Number Hours Costs Hours Costs Total Variance A257 220 $5,500 226 $5,650 $150 F A258 470 13,160 450 11,250 1,910 U A259 320 8,320 318 7,950 370 U A260 100 2,400 92 2,300 100 U Total variance $2,230 U Analysis reveals that Job A257 was a repeat job. Job A258 was a rush order that required overtime work at premium rates of pay. Job A259 required a more experienced replacement worker on one shift. Work on Job A260 was done for one day by a new trainee when a regular worker was absent.Prepare a report for the factory supervisor on direct labor cost variances for March.arrow_forwardThe standard rate of pay is 12 per direct labor hour. If the actual direct labor payroll was $51744 for 4400 direct labor hours worked, the e direct labor price (rate) variance is a. $1200 unfavorable b. $1200 favorable c. $1056 favorable d. $1056 untavorablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education