FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ES

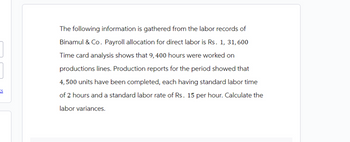

The following information is gathered from the labor records of

Binamul & Co. Payroll allocation for direct labor is Rs. 1, 31, 600

Time card analysis shows that 9,400 hours were worked on

productions lines. Production reports for the period showed that

4,500 units have been completed, each having standard labor time

of 2 hours and a standard labor rate of Rs. 15 per hour. Calculate the

labor variances.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Ramona Company has the following labor-related data: Standard labor hours for output: 15,000 hours Standard labor rate: $10 per hour Actual labor rate: $8 per hour Actual labor hours: 17,500 hours Given this data, which one of the following would be included in the single journal entry needed to record Wages Payable and the labor variances? a. credit Labor Efficiency Variance for $25,000 b. debit Labor Rate Variance for $35,000 c. credit Wages Payable for $175,000 d. debit Work-In-Process Inventory for $140,000 e. credit Labor Rate Variance for $10,000 f. credit Labor Rate Variance for $35,000 g. credit Labor Efficiency Variance for $10,000arrow_forwardSubject:arrow_forwardThe following labour standards have been established for a particular product:standard labour hours per unit of output 2.0 hoursstandard labour rate = $15.00 per hourThe following data pertain to operations concerning the product for the last month:Actual hours worked 3700 hoursactual total labour cost $58000actual output 2300 units what was the labour rate variance for the month?a)1295 favourableb) 2500 unfavorablec) 2950 favourabled) 2950 unfavourablearrow_forward

- The following labor standards have been established for a particular product: Standard labor-hours per unit of output 8.6 hours Standard labor rate $ 15.50 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked 8,500 hours Actual total labor cost $ 129,200 Actual output 840 units What is the labor rate variance for the month?arrow_forwardThe following labor standards have been established for a particular product: Standard labor hours per unit of output 8.7 hours Standard labor rate $18.10 per hour The following data pertain to operations concerning the product for November: Actual hours worked 3,800 hours Actual total labor cost $67,640 Actual output 500 units What is the direct labor rate variance for November?arrow_forwardThe following labor standards have been established for a particular product: Standard labor-hours per unit of output Standard labor rate The following data pertain to operations concerning the product for the last month: Actual hours worked Actual total labor cost. Actual output What is the labor efficiency variance for the month? Multiple Choice O $26,008 F $26,008 U $22,360 F 7,400 hours $23,048 F $ 96,200 9.6 hours $13.40 per ho 950 unitsarrow_forward

- The following labor standards have been established for a particular product: The following data pertain to operations concerning the product for the last month: What is the labor efficiency variance for the month? Select one: a. $9,240 F b. $6,090 U c. $5,955 U d. $9,240 Uarrow_forwardThe following labor standards have been established for a particular product: Standard labor-hours per unit of output 8.7 hours Standard labor rate $12.50 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked 6,500 hours Actual total labor cost $78,650 Actual output 900 units What is the labor efficiency variance for the month? Multinl e CholcAarrow_forwardThe standard direct labor cost per unit for a company was $21 (= $14 per hour × 1.5 hours per unit). During the period, actual direct labor costs amounted to $136,500, 9,600 labor-hours were worked, and 5,600 units were produced. Required: Compute the direct labor price and efficiency variances for the period.arrow_forward

- The following labor standards have been established for a particular product: Standard labor hours per unit of output Standard labor rate The following data pertain to operations concerning the product for the last month: Actual hours worked Actual total labor cost Actual output 5,700 hours $ 98,610 4.9 hours $17.20 per hour 1,100 units Required: a. What is the labor rate variance for the month? b. What is the labor efficiency variance for the month? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.arrow_forwardUse the following data to find the direct labor rate variance if the company produced 3,800 units during the period. Direct labor standard (4 hrs. @ $6.95/hr.) $27.80 per unit Actual hours worked 14,000 Actual rate per hour $7.40arrow_forwardIn October, Pine Company reports 19,200 actual direct labor hours, and it incurs $126,000 of manufacturing overhead costs. Standard hours allowed for the work done is 21,000 hours. The predetermined overhead rate is $5.75 per direct labor hour. Compute the total overhead variance. Total Overhead Variance $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education