FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

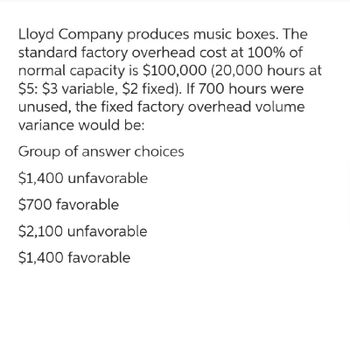

Transcribed Image Text:Lloyd Company produces music boxes. The

standard factory overhead cost at 100% of

normal capacity is $100,000 (20,000 hours at

$5: $3 variable, $2 fixed). If 700 hours were

unused, the fixed factory overhead volume

variance would be:

Group of answer choices

$1,400 unfavorable

$700 favorable

$2,100 unfavorable

$1,400 favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Costner produces two product lines. Prices/costs per unit follow. "W" "H" Selling price $60 $45 Direct material $16 $12 Direct labor ($20/hour) $15 $10 Variable overhead $13 $8 Demand for "W" is 216 units and "H" is 342 units If Costner has only 177 labor hours available, how many units of "W" should be manufactured? Round your final answer to the nearest whole unit.arrow_forwardI don't have option. can you give me the solution of this problem.arrow_forwardStandard Product Costs Deerfield Company manufactures product M in its factory. Production of M requires 2 pounds of material P, costing $4 per pound and 0.5 hour of direct labor costing, $10 per hour. The variable overhead rate is $8. per direct labor hour, and the fixed overhead rate is $12 per direct labor hour. What is the standard product cost for product M? Direct material Direct labor Variable overhead Fixed overhead Standard product cost per unit $ $arrow_forward

- Facts and circumstances: A company produces three different products on several identical machines. The annual capacity is restricted to 12,000 machine hours. The controller has prepared the following overview. Please help her to find out the product mix with the maximum contribution possible using the form below: Required: Which quantities of X, Y and Z should be produced and what would be the maximum contribution? Components Sales price Variable costs Allocated fixed costs Total cost Machine hours per unit Estimated sales demand (units) X 90 40 30 70 3 2,50 0 Y Z Control 80 70 20 40 30 30 50 70 2.5 1,00 0 2 2,50 0arrow_forwardTimberlake Company planned for a production and sales volume of 13,100 units. However, the company actually makes and sells 14,100 units. Per-Unit Standards Flexible Budget Number of units Sales revenue Variable manufacturing costs: Materials Labor Overhead Variable general, selling, and administrative costs Contribution margin Fixed costs Manufacturing overhead General, selling, and administrative costs Net income What was the total variable cost volume varlance? Multiple Choice $51,300 favorable $51,300 unfavorable $24,700 favorable $24,700 unfavorable $76.00 $ 16.00 $ 14.00 $ 5.30 $ 16.00 Static Budget 13,100 $ 995,600 209,600 183,400 69,430 209,600 $ 323,570 111,800 56,000 $ 155,770 14,100 $ 1,071,600 225,600 197,400 74,730 225,600 $ 348,270 111,800 56,000 $ 180,470arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,800 units of actual production are as follows: Line Item DescriptionValueFixed overhead (based on 10,000 hours)3 hours per unit at $0.71 per hourVariable overhead3 hours per unit at $1.98 per hour Actual Costs Total variable cost, $18,200 Total fixed cost, $8,200 The fixed factory overhead volume variance is Group of answer choices $1,136 unfavorable $909 unfavorable $909 favorable $0arrow_forward

- Haresharrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows: Standard Costs 3 hours per unit at $0.71 per hour 3 hours per unit at $1.92 per hour Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $18,200 Total fixed cost, $8,100 The variable factory overhead controllable variance is Oa. $3,800 unfavorable Ob. $3,800 favorable Oc. $3,040 favorable Od. Soarrow_forwardWITH THE FOLLOWING BACKGROUND PREPARE COSTING: - UNIT SELLING PRICES $10 - UNIT RAW MATERIAL $400. - SALARY OF 2 OPERATORS: THE FIRST WITH A FIXED SALARY IN PRODUCTION FOR A MONTHLY VALUE OF $500.000. AND THE SECOND WITH A TOTAL VARIABLE SALARY OF $45 PER UNIT PRODUCED. - THE PRODUCTION SUPERVISOR HAS A VARIABLE MONTHLY SALARY OF $10,000 PER UNIT OF ARTICLE PRODUCED. - A FIXED SALARY IN ADMINISTRATION OF $500,000 PER MONTH. - VARIABLE SALES SALARIES ARE 3% OF SALES. - THERE ARE PRODUCTION MACHINERY DEPRECIATION COSTS OF $20 PER UNIT PRODUCED. - THE COST OF LEASING THE PRODUCTION CENTER IS $100- PER KILO PRODUCED. - PRODUCTION UNITS ARE 20,000 UNITS. - 15,000 UNITS ARE SOLD, IT IS REQUESTED: 1. ABSORPTIVE OR TRADITIONAL METHOD COSTING. 2. DIRECT OR VARIABLE METHOD COSTING.arrow_forward

- Please do not give solution in image format thankuarrow_forwardThe Russell Company provides the following standard cost data per unit of product: Direct material (2 gallons @ $3 per gallon) Direct labor (1 hours @ $13 per hour) During the period, the company produced and sold 26,000 units, incurring the following costs: Direct material Direct labor 55,000 gallons @ $ 2.9 per gallon 26,500 hours @ $12.75 per hour $ 6 $13 The direct material price variance was:arrow_forwardOcean Company makes calendars. Information on cost per unit is as follows: Direct materials $1.50 Direct labor 1.20 Variable overhead 0.90 Variable marketing expense 0.40 Fixed marketing expenses totaled $12,000 and fixed administrative expenses totaled $32,000. The price per calendar is $15. What is the break-even point in units?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education