FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

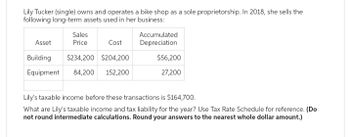

Transcribed Image Text:Lily Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2018, she sells the

following long-term assets used in her business:

Sales

Asset

Price

Cost

Building

$234,200 $204,200

Equipment 84,200 152,200

Accumulated

Depreciation

$56,200

27,200

Lily's taxable income before these transactions is $164,700.

What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. (Do

not round intermediate calculations. Round your answers to the nearest whole dollar amount.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mario, a single taxpayer with two dependent children, has the following items of income and expense during 2020: Gross receipts from business $144,000 Business expenses 180,000 Net capital gain 22,000 Interest income 3,000 Itemized deductions (state taxes, residence interest, and contributions) 24,000 a. Determine Mario's taxable income or loss for 2020. Adjusted gross income Less: itemized deductions Less: Deduction for qualified business income Loss b. Indicate which items are adjustments to taxable income or loss when computing an NOL. Business receipts Business Expenses Net capital gain Interest income Itemized deductions c. Determine Mario's NOL for 2020. Mario's NOL is ?arrow_forwardDan's business has accounting income after tax expense of $10,000. Tax expense recorded for accounting totaled $1,000. Dan has also expected Meals and entertainment of $500 and property taxes of $2,000. Calculate Dan's taxable income. 11,250 11,500 13,250 10,250arrow_forwardDerek purchases a small business from Art on August 30, 2022. He paid the following amounts for the business: Fixed assets Goodwill Covenant not to compete Total $256,600 51,320 64,150 $372,070 a. How much of the $372,070 purchase price is for Section 197 intangible assets? b. What amount can Derek deduct on his 2022 tax return as Section 197 intangible amortization? If required, round the final answer to the nearest dollar. Use months, not days, in your computations.arrow_forward

- Subject : Accountingarrow_forwardVikram Bhaiarrow_forwardLily Tucker (single) owns and operates a bike shop as a sole proprietorship. This year, she sells the following long-term assets used in her business: Asset Sales Price Cost Accumulated Depreciation Building $230,000 $200,000 $52,000 Equipment 80,000 148,000 23,000 Lily's taxable income before these transactions is $160,500. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Taxable Income= Tax Liability=arrow_forward

- Gadubhaiarrow_forwardTo whom is the income allocated, why, and how much: When Worf’s parent’s died, the made him the beneficiary of a trust which holds real estate as well as income producing assets. Worf distributes one of the rental properties to Alexander outright. Alexander collects the rent from the tenants and manages the properties. In 2011, his revenue less his costs was 50K, and in 2010 his revenue less his costs was 32K.arrow_forwardLeRoy has the following capital gains and losses for the current year: Short-term capital gain $10,000 Collectible loss (3,000) Long term capital gain 5,000 If LeRoy is single and has a taxable income from other sources of $52,000, what is the tax on his capital gains? Oa. $2,500 Ob. $3,000 Oc. $2,640 Od. $1.800arrow_forward

- lly Tucker (single) owns and operates a bike shop as a sole proprietorship. In 2022, she sells the following long-term assets used in her business: Asset Building Equipment Sales Price $ 235,000 85,000 Cost $ 205,000 153,000 Accumulated Depreciation $ 57,000 28,000 lly's taxable income before these transactions is $195,500. What are Lily's taxable income and tax liability for the year? Use Tax Rate Schedule for reference. Note: Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amount. Description Taxable income Tax liability Amount $ 242,500arrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income Real estate taxes Utilities Mortgage interest Depreciation Repairs and maintenance Required: What is Sandra's net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value. Rental income Real estate taxes Utilities Mortgage interest Repairs and maintenance Depreciation Net rental income 15,900 2,700 2,475 4,700 7,600 1,260 Schedule E Schedule Aarrow_forwardIn the current year, Sandra rented her vacation home for 75 days, used it for personal use for 22 days, and left it vacant for the remainder of the year. Her income and expenses before allocation are as follows: Rental income 11,400 Real estate taxes 1,200 Utilities 1,350 Mortgage interest 3,200 Depreciation 6,000 Repairs and maintenance 810 equired: What is Sandra’s net income or loss from the rental of her vacation home? Use the Tax Court method. Note: Round your intermediate computations to 5 decimal places and final answers to nearest whole dollar value.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education