FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

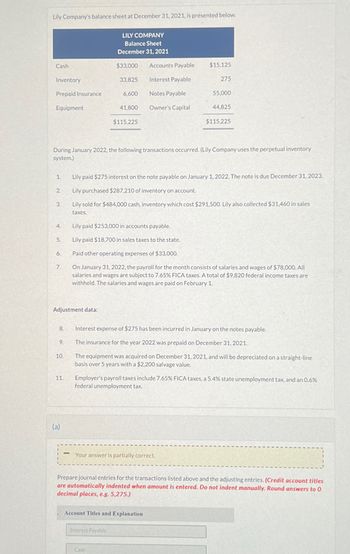

Transcribed Image Text:Lily Company's balance sheet at December 31, 2021, is presented below.

LILY COMPANY

Balance Sheet

December 31, 2021

Cash

$33,000

Accounts Payable

$15,125

Inventory

33,825

Interest Payable

275

Prepaid Insurance

6,600

Notes Payable

55,000

Equipment

41,800

Owner's Capital

44,825

$115,225

$115,225

During January 2022, the following transactions occurred. (Lily Company uses the perpetual inventory

system.)

1.

2.

Lily paid $275 interest on the note payable on January 1, 2022. The note is due December 31, 2023.

Lily purchased $287,210 of inventory on account.

3.

Lily sold for $484,000 cash, inventory which cost $291,500. Lily also collected $31,460 in sales

taxes.

4.

Lily paid $253,000 in accounts payable.

5.

Lily paid $18,700 in sales taxes to the state.

6.

Paid other operating expenses of $33,000.

7.

On January 31, 2022, the payroll for the month consists of salaries and wages of $78,000. All

salaries and wages are subject to 7.65% FICA taxes. A total of $9,820 federal income taxes are

withheld. The salaries and wages are paid on February 1.

Adjustment data:

8. Interest expense of $275 has been incurred in January on the notes payable.

9.

The insurance for the year 2022 was prepaid on December 31, 2021.

10.

11.

The equipment was acquired on December 31, 2021, and will be depreciated on a straight-line

basis over 5 years with a $2,200 salvage value.

Employer's payroll taxes include 7.65% FICA taxes, a 5.4% state unemployment tax, and an 0.6%

federal unemployment tax.

(a)

Your answer is partially correct.

Prepare journal entries for the transactions listed above and the adjusting entries. (Credit account titles

are automatically indented when amount is entered. Do not indent manually. Round answers to 0

decimal places, e.g. 5,275.)

Account Titles and Explanation

Interest Payable

Cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps with 1 images

Knowledge Booster

Similar questions

- Presented below is information related to Blossom Company, owned by D. Flamont, for the month of January 2021. Ending inventory per perpetual records $20,400 Insurance expense $12,700 Ending inventory actually on hand 18,700 Rent expense 20,300 Cost of goods sold 210,000 Salaries expense 54,700 Freight out 6,000 Sales discounts 9,700 Sales returns and allowances 12,800 Sales 368,000 Prepare the necessary adjusting entry for inventory. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 31 enter an account title to adjust ending inventory to actual at year end on January 31 enter a debit amount enter a credit amount enter an account title to adjust ending inventory to actual at year end on January 31 enter a debit amount enter a credit amount (To adjust ending inventory to actual at year…arrow_forwardCurrent Attempt in Progress At December 31,2022, the following information (in thousands) was available for Swifty Inc: ending inventory $22.200; beginning inventory $21.800; cost of goods sold $180.400, and sales revenue $435,000. Calculate the inventory turnover and days in inventory for Swity. (Round answers to 1 decimal places, e.g. 15.2. Use 365 days for calculation.) times Inventory turnover Days in inventory daysarrow_forwardEarly in 2022, Pharoah Company switched to a just-in-time inventory system. Its sales revenue, cost of goods sold, and inventory amounts for 2021 and 2022 are shown below. Sales Cost of goods sold Beginning inventory Ending inventory Inventory turnover 2021 $3,115,000 1,260,800 Days in inventory 175,000 219,000 2022 $3,711,000 1,428,700 Determine the inventory turnover and days in inventory for 2021 and 2022. (Round answers to 1 decimal place, e.g. 12.5.) 2021 219,000 95,000 I days 2022 daysarrow_forward

- Taylor Company uses a periodic inventory system. The following is partial information from its income statements for 2019 and 2020: 2019 2020 Beginning inventory $ (b) $ (d) Sales 250,000 (f) Purchases 120,000 140,000 Purchase returns 2,000 3,000 Ending inventory 45,000 70,000 Gross profit (a) 88,000 Cost of goods sold 111,000 (e) Expenses 70,000 62,000 Net income (c) 26,000 Required Fill in the blanks lettered a through f. (Hint: It probably is easiest to work through the blanks according to the sequential letters.) (a) Gross profit (b) Beginning inventory (c) Net income (d) Beginning inventory of 2020 (e) Cost of goods sold (f) Salesarrow_forwardSlinky Company purchased inventory on June 10, 2024, at a price of $22,000, subject to credit terms of 2/10, 1/30. Slinky uses the net method for recording purchases and uses a perpetual inventory system. Required: 1. Prepare the journal entry to record the purchase. 2. & 3. Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2024 and July 8, 2024. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Prepare the journal entry to record the purchase. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 Record the purchase of merchandise subject to credit terms 2/10, n/30. Note: Enter debits before credits. Date June 10, 2024 Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardSlinky Company purchased inventory on June 10, 2024, at a price of $20,000, subject to credit terms of 2/10, 1/30. Slinky uses the net method for recording purchases and uses a perpetual inventory system. Required: 1. Prepare the journal entry to record the purchase. 2. & 3. Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2024 and July 8, 2024. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2024 and July 8, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward

- .arrow_forwardThe financial statements of Crane, Inc's. 2025 annual report disclose the following information: (in millions) May 24, 2025 $250 ttempt in Progress Inventories Sales Cost of goods sold Net income (a) (b) 2025 Fiscal Year $3,900 1,300 320 May 25, 2024 $240 Inventory turnover 2024 $3,900 1,300 Compute Crane's (a) inventory turnover and (b) the average days to sell inventory for 2025 and 2024. (Round inventory turnover to 2 decimal places, e.g. 7.63 and average days to sell inventory to 1 decimal place, e.g. 65.1.) 300 Average days to sell inventory May 26, 2023 $200 2025 times days 2024 times daysarrow_forwardA company that uses the perpetual inventory system purchased inventory for $1,130,000 on account with terms of 5/7, n/20. Which of the following correctly records the payment made 15 days after the date of invoice? A. Accounts Payable 1,130,000 Merchandise Inventory 1,130,000 B. Accounts Payable 1,130,000 Merchandise Inventory 56,500 Cash 1,073,500 C. Accounts Payable 1,130,000 Cash 1,130,000 D. Cash 1,130,000 Accounts Payable 1,130,000arrow_forward

- Coronado Corporation began operations on December 1, 2019. The only inventory transaction in 2019 was the purchase of inventory on December 10, 2019, at a cost of $ 23 per unit. None of this inventory was sold in 2019. Relevant information is as follows. Ending inventory units December 31, 2019 165 December 31, 2020, by purchase date December 2, 2020 165 July 20, 2020 50 215 During the year 2020, the following purchases and sales were made. Purchases Sales March 15 365 units at $ 28 April 10 265 July 20 365 units at 29 August 20 365 September 4 265 units at 32 November 18 215 December 2 165 units at 35 December 12 265 The company uses the periodic inventory method. (a1) Your answer is correct.arrow_forwardSuppose this information is available for PepsiCo, Inc. for 2020, 2021, and 2022. (in millions) Beginning inventory Ending inventory Cost of goods sold Sales revenue 2020 2021 $1,900 $2,300 $2,500 2,300 2,500 2,600 21,840 21,420 Inventory turnover 19,320 40,000 44,300 2022 Calculate the inventory turnover for 2020, 2021, and 2022. (Round inventory turnover to 1 decimal place, e.g. 5.1.) 2020 44,260 times 2021 times 2022 timesarrow_forwardpresented below is information related to Ayayai industries for the month of january 2020. Ending Inventory per ; 1. perpetual records €24.710 Ending inventory actually; 1. on hand 23.910 2. cost of goods sold 213.050 3. freight out 7.270 4. insurance expenses €11.820 5. rent expenses 22.450 6. salaries and wages expense 55.490 7. sales discounts 13.080 8. sales returns and allowances 15.060 9. sales revenue 401.870 prepare the necessary adjusting entry for inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education