FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

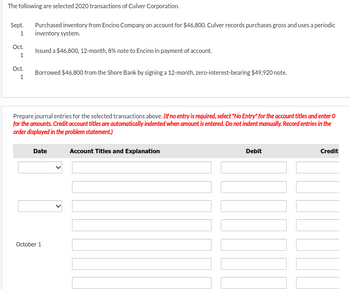

Transcribed Image Text:The following are selected 2020 transactions of Culver Corporation.

Sept.

Purchased inventory from Encino Company on account for $46,800. Culver records purchases gross and uses a periodic

inventory system.

1

Issued a $46,800, 12-month, 8% note to Encino in payment of account.

Oct.

1

Oct.

1

Borrowed $46,800 from the Shore Bank by signing a 12-month, zero-interest-bearing $49,920 note.

Prepare journal entries for the selected transactions above. (If no entry is required, select "No Entry" for the account titles and enter O

for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the

order displayed in the problem statement.)

Account Titles and Explanation

Date

October 1

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the necessary joumal entries for the following fiscal year 2022 transactions made by Airflowing Corp. Additional Information: 1 Ai rflowing Corp. year-end is 12/31. 2 Assume straight-line amortization of discounts. 3 Ai rflowing Corp. records all purchases and payables at gross. Description Date February 2, 2022 Aiflowing Corp. purchased goods from Vents Inc for $ 250,00 ( 3/ 10, n 30 terms were February 26, 2022 Airfbwing Corp. paid Vents inc. for the 2/2/22 purchase. June 1, 2022 Arfbwing Corp. purchased a truck for $ 85,000 from Ford Mator Company Fleet Sales Division. The sales agreement call for Airfbwing Corp. to pay 10,000 on purchase date and to sign a 1-year, 10% note forthe remaning balance of the purchase price. July 1, 2022 Arfbwing Corp. borrowed from St. Paul Nat ibnalBank $ 3500,0 by signing a $ 3,700,000 zero-interest be aring note due one year from July 1 Airflowing Corp.s CFO has concerns re bted to cash the frst quarter of 2023.arrow_forwardACRS Hudson Corporation's balance sheet at December 31, 2021, is presented below. Hudson Corporation Balance Sheet December 31, 2021 Cash Accounts receivable Allowance for doubtful accounts Inventory 3 8 11 15 17 21 24 $13,100 19,780 (800) During January 2022, the following transactions occurred. Hudson uses the perpetual inventory method. Jan. 1 Hudson accepted a 4-month, 8% note from Betheny Company in payment of Betheny's $1,200 account. Hudson wrote off as uncollectible the accounts of Walter Corporation ($450) and Drake Company ($280). Hudson purchased $17,200 of inventory on account. 9,400 $41,480 Accounts payable Common stock Retained earnings $ 8,750 20,000 12,730 27 31 Hudson paid other operating expenses, $3,218. $41,480 Hudson sold for $25,000 on account inventory that cost $17,500. Hudson sold inventory that cost $700 to Jack Rice for $1,000. Rice charged this amount on his Visa First Bank card. The service fee charged Hudson by First Bank is 3%. Hudson collected $22,900…arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Clark Company paid Sherman Company for merchandise with a $4,000, 60-day, 9% note dated April 1. If Clark Company pays the note at maturity, what entry should Sherman make at that time? Select one: a. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense A) +4,360 -4,000 +360 +360 b. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense B) -4,360 -4,000 -360 +360 c. BALANCE SHEET INCOME STATEMENT ASSETS = LIABILITIES + STOCKHOLDER'SEQUITY REVENUE - EXPENSE Cash NotesReceivable NotesPayable Retained Earnings InterestIncome InterestExpense C) +4,060 -4,000 +60 +60 d. BALANCE SHEET INCOME STATEMENT ASSETS =…arrow_forwardRecord the following transactions for the month of October 2022 in the financial statements effects template below and record the journal entries. NOTE: 2 parts ot the question. Part 1: A) Paid for the purchase $3,000 of inventory. B and C) Sold inventory purchased in (A) for $8,000 on account. (Note: requires 2 entries) D) Received and paid electricity bill for $800 related to June E) Received $16,000 in cash for inventory to be delivered in November. Transaction A) B) C) D) E) Balance Sheet Cash Asset Noncash Assets = Liabilities + Contributed Earned Capital Capital Part 2: Record the journal entries for each transcation + Income Statement Rev. Exp. = Nearrow_forwardSlinky Company purchased inventory on June 10, 2024, at a price of $22,000, subject to credit terms of 2/10, 1/30. Slinky uses the net method for recording purchases and uses a perpetual inventory system. Required: 1. Prepare the journal entry to record the purchase. 2. & 3. Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2024 and July 8, 2024. Complete this question by entering your answers in the tabs below. Req 1 Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2024 and July 8, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Req 2 and 3 View transaction list Journal entry worksheetarrow_forward

- Slinky Company purchased inventory on June 10, 2024, at a price of $20,000, subject to credit terms of 2/10, 1/30. Slinky uses the net method for recording purchases and uses a perpetual inventory system. Required: 1. Prepare the journal entry to record the purchase. 2. & 3. Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2024 and July 8, 2024. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3. Prepare the journal entry to record the purchase. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1 Record the purchase of merchandise subject to credit terms 2/10, n/30. Note: Enter debits before credits. Date June 10, 2024 Record entry General Journal Clear entry Debit Credit View general journalarrow_forward5. Help me selecting the right answer. Thank youarrow_forwardc. On 9/12 Year 7 $2,000 of ACCOUNTS PAYABLE is paid after the discount period. Phrase 1st: 2nd: Phrase 1st: Account 2nd: Accounts Account Category AL SER E contra AL SER E contra + Accounts Debit Affect d. On 9/28 Year 7 INVENTORY originally purchased for $4,000 on 9/1 Year 7 and was paid for on 9/10 Year 7 is returned by the purchaser and a debit memorandum (a debit to A/P) is received from the seller. [Hint: the amount of cash involved in this transaction must take the 2% discount into account.] Debit + Category AL SE RE contra AL SE RE contra + - + Affect Dr. or Cr. Dr Cr Dr Cr Credit Dr. or Cr. Credit Dr Cr Dr Crarrow_forward

- Required information [The following information applies to the questions displayed below] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 28 Purchased $37,508 of merchandise on credit fron Locust, terms n/30. May 19 Replaced the April 28 account payable to Locust with a 90-day, 9%, $35,000 note payable along with paying $2,500 in cash. July 8 Borrowed $66,080 cash from NBR Bank by signing a 120-day, 12%, $66,088 note payable. Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to NBR Bank at the maturity date. November 28 Borrowed $24,08e cash from Fargo Bank by signing a 60-day, 8%, $24,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 Paid the amount due on the note to Fargo Bank at the maturity date.arrow_forwardDengerarrow_forwardLiability transactions The following items were selected from among the transactions completed by Sherwood Co. during the current year: Date Transaction Feb. 15. Purchased merchandise on account from Kirkwood Co., $144,000, terms n/30. Mar. 17. Issued a 60-day, 7% note for $144,000 to Kirkwood Co., on account. May 16. Paid Kirkwood Co. the amount owed on the note of March 17. June 15. Borrowed $140,400 from Triple Creek Bank, issuing a 60-day, 8% note. July 21. Purchased tools by issuing a $120,000, 90-day note to Poulin Co., which discounted the note at the rate of 9%. Aug. 14. Paid Triple Creek Bank the interest due on the note of June 15 and renewed the loan by issuing a new 60-day, 10% note for $140,400. (Journalize both the debit and credit to the notes payable account.) Oct. 13. Paid Triple Creek Bank the amount due on the note of August 14. Oct. 19. Paid Poulin Co. the amount due on the note of July 21. Dec. 1. Purchased equipment from Greenwood Co. for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education