Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:ces

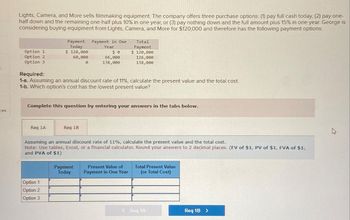

Lights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1) pay full cash today, (2) pay one-

half down and the remaining one-half plus 10% in one year, or (3) pay nothing down and the full amount plus 15% in one year. George is

considering buying equipment from Lights, Camera, and More for $120,000 and therefore has the following payment options:

Option 1

Option 2

Option 3

Payment Payment in One

Today

Year

Req 1A

$ 120,000

60,000

0

Required:

1-a. Assuming an annual discount rate of 11%, calculate the present value and the total cost.

1-b. Which option's cost has the lowest present value?

Option 1

Option 2

Option 3

Complete this question by entering your answers in the tabs below.

$0

66,000

138,000

Req 1B

Total

Payment

$ 120,000

126,000

138,000

Assuming an annual discount rate of 11%, calculate the present value and the total cost.

Note: Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places. (FV of $1, PV of $1, FVA of $1,

and PVA of $1)

Payment

Today

Present Value of

Payment in One Year

Total Present Value

(or Total Cost)

< Reg 1A

Req 1B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Solve step by step the following problem (solve in digital format) Carlos buys a cell phone that is paid with a 25% advance and a 3-month document with a nominal value of $ 3,800. He supposes that the interest rate is equal to the TIIE plus 10 percentage points and that on the day of the purchase the TIIE was 4.3% simple per year. Calculate: a. The price of the cell phone b. The interests that are generatedarrow_forwardYou have decided to purchase a new car. The car costs $27,500. The dealer is offering to finance the car for 6 years at a rate 8.75%. How much would your monthly payment be? Question 3 options: $492 $495 $504 $518 $511arrow_forwardVijay shiyalarrow_forward

- Monthly loan payments Personal Finance Problem Tim Smith is shopping for a used luxury car. He has found one priced at $31,000. The dealer has told Tim that if he can come up with a down payment of $6,200, the dealer will finance the balance of the price at a 6% annual rate over 5 years (60 months). a. Assuming that Tim accepts the dealer's offer, what will his monthly (end-of-month) payment amount be? b. Use a financial calculator or spreadsheet to help you figure out what Tim's monthly payment would be if the dealer were willing to finance the balance of the car price at an annual rate of 3.8%? a. Tim's monthly (end-of-month) payment amount is $ (Round to the nearest cent.)arrow_forward6. Homes-R-Us is offering free credit on a new $200,000 home. You pay $40,000 down and then $16,000 a year for the next 10 years. We-Build'em-Better does not offer free credit but will give you $40,000 off the list price. a. If the discount rate is 5% per year, which company is offering the better deal? b. If the discount rate is 8% per year, which company is offering the better deal? Compare your answers to (a) and (b). Why do you think you are getting those results? c.arrow_forwardYou want to buy a $13,000 car. The company is offering a 3.46% monthly interest rate for 60 months (5 years). What will your monthly payments be? Question Help: D Video 1 D Video 2 D Video 3 Submit Questionarrow_forward

- Use the following to answer questions 31 – 33 You want a new car. At the dealership, you find a car that you like. The dealership gives you two payment options: 1. Pay $23,000 in cash for the car today...OR Pay $370.41 at the end of each month for six years at 5% (0.41667% monthly for 72n). 2. How much CASH (in total) up paying if you choose to make monthly 31. $ will you end payments for the car? 32. How much interest (in total) $ will you pay if you choose to make payments instead of paying cash for the car today? 33. $ How much interest has accrued by the time the first car payment is due (round to two decimal places)?arrow_forwardPls solve this question correctly in 5 min i will give u like for surearrow_forwardLights, Camera, and More sells filmmaking equipment. The company offers three purchase options: (1) pay full cash today, (2) pay one- half down and the remaining one-half plus 10% in one year, or (3) pay nothing down and the full amount plus 15% in one year. George is considering buying equipment from Lights, Camera, and More for $130,000 and therefore has the following payment options: Payment Payment in One Option 1 Option 2 Option 3 Required: Today $130,000 Year $ 0 Total Payment $130,000 65,000 0 71,500 149,500 136,500 149,500 1-a. Assuming an annual discount rate of 12%, calculate the present value and the total cost. 1-b. Which option's cost has the lowest present value? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Assuming an annual discount rate of 12%, calculate the present value and the total cost. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use tables, Excel, or a financial calculator. Round your answers to 2 decimal places.) Payment…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education