FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

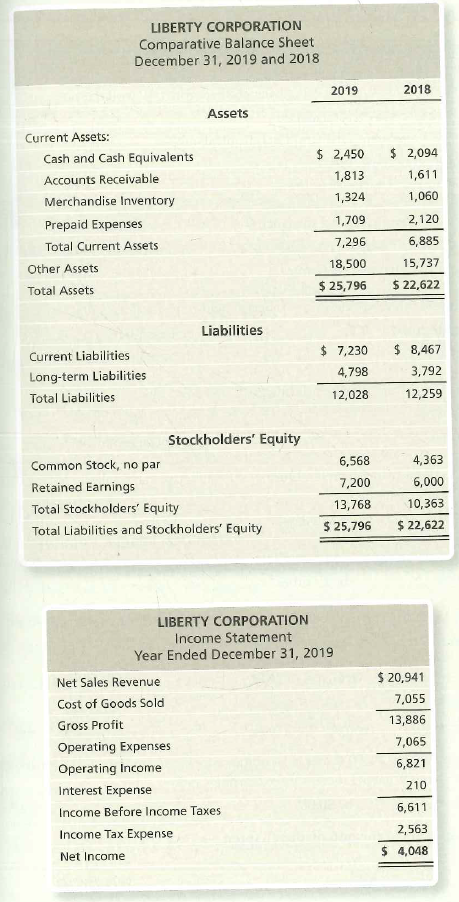

Liberty Corporation reported the following financial statements:

Assume all sales are on credit. During 2019, Liberty’s days’ sales in receivables ratio Was (amounts rounded)

a. 34 days.

b. 30 days.

c. 32 days.

d. 28 days

Transcribed Image Text:LIBERTY CORPORATION

Comparative Balance Sheet

December 31, 2019 and 2018

2019

2018

Assets

Current Assets:

Cash and Cash Equivalents

$ 2,450

$ 2,094

Accounts Receivable

1,813

1,611

Merchandise Inventory

1,324

1,060

1,709

2,120

Prepaid Expenses

7,296

6,885

Total Current Assets

18,500

15,737

Other Assets

$ 25,796

$ 22,622

Total Assets

Liabilities

$ 7,230

$ 8,467

Current Liabilities

4,798

3,792

Long-term Liabilities

Total Liabilities

12,028

12,259

Stockholders' Equity

Common Stock, no par

6,568

4,363

Retained Earnings

7,200

6,000

Total Stockholders' Equity

13,768

10,363

Total Liabilities and Stockholders' Equity

$ 25,796

$ 22,622

LIBERTY CORPORATION

Income Statement

Year Ended December 31, 2019

$ 20,941

Net Sales Revenue

Cost of Goods Sold

7,055

13,886

Gross Profit

7,065

Operating Expenses

6,821

Operating Income

210

Interest Expense

Income Before Income Taxes

6,611

2,563

Income Tax Expense

$ 4,048

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2021, the general ledger of Big Blest Fireworks includes the following account balances: Accounts Cash Debit Credit $ 23,300 48, e00 Accounts Receivable Allowance for Uncollectible Accounts $ 4, See Inventory Land 37,800 72,108 Accounts Payable Notes Payable (6%, due in 3 years) Comnon Stack 28,9ee 37,000 63, 0e0 Retained Earnings 39,0e0 Totals $172,400 $172,48e The $37,000 beginning balance of inventory consists of 370 units, eoch costing $100. During Janusry 2021, Big Blast Fireworks had the following inventory transections: January 3 Purchase 1,6e0 units for $168,80e on account ($18s cach). January 8 Purchase 1,78e units for $187,000 on account ($11e cach). January 12 Purchase 1,8e0 units for $287, B0e on account ($115 cach). January 15 Return 135 of the units purchased on 3anuary 12 because of defcects. January 19 sell 5,280 units on account for $788,eee. The cost of the units sold is deternined using a FIFO perpetual inventory systen. January 22 Receive $753, eee…arrow_forwardThe financial statements of the Novak Corp. report net sales of $300000 and accounts receivable of $55200 and $27600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days? (Use 365 days for calculation.)arrow_forwardAs of January 1, 2021, Company had a credit balance of 535,000 in its allowance for uncollectible accounts. Based on experience, 2% of the company's gross accounts receivable have been uncollectibleDuring 2021, the company wrote off 665,000 of accounts receivable . The company's gross accounts receivable as December 31, 2021, is 18,750,000 In its December 31, 2021, balance sheet, what amount should the company report as allowance for uncollectible accounts?arrow_forward

- ook int ences During 2020, Jesse Jericho Enterprises Corporation recorded credit sales of $786,000. At the beginning of the year, Accounts Receivable, Net of Allowance was $93,500. At the end of the year, after the Bad Debt Expense adjustment was recorded but before any bad debts had been written off, Accounts Receivable, Net of Allowance was $70,000. Required: 1. Assume that on December 31, 2020, accounts receivable totalling $10,000 for the year were determined to be uncollectible and written off. What was the receivables turnover ratio for 2020? (Round your answer to 1 decimal place.) Receivables turnover ratio 2. Assume instead that on December 31, 2020, $11,000 of accounts receivable was determined to be uncollectible and written off. What was the receivables turnover ratio for 2020? (Round your answer to 1 decimal place.) Receivables turnover ratioarrow_forwardAt December 1, 2021, Vaughn Company's accounts receivable balance was $1860. During December, Vaughn had credit revenues on account of $7080 and collected accounts receivable of $6070. At December 31, 2021, the accounts receivable balance is $850 credit. Ⓒ $850 debit Ⓒ $2870 debit. O $2870 credit.arrow_forwardse the following selected financial statement information from Black Water Industries. BLACK WATER INDUSTRIES Year Net Credit Sales Ending Accounts Receivable 2017 $687,430 $332,250 2018 705,290 362,450 2019 769,500 403,650 A. Compute the number of days’ sales in receivables ratios for 2018 and 2019. Round your answers to two decimal places. 2018 fill in the blank 1 days 2019 fill in the blank 2 days B. Using the sales in accounts receivable, choose the statement that most closely describes the company's management of its receivables. a. The company collects its accounts slowly, and the days are increasing. b. This may be leave the company unable to pay current debt owed to a lender. c. The company may need to be more aggressive with its receivable collection procedures. d. All of the above statements may be correct.arrow_forward

- 4. The following select financial statement information from Hogge Computing. Compute the accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2021 and 2022 (round answers to two decimal places). Year 2020 2021 2022 2021: Net Credit Sales 2022: $1,557,200 $1,755,310 $1,965,170 Accounts Receivable Turnover Ratio: • Days' Sales: days Accounts Receivable Turnover Ratio: Days' Sales: days times times Ending Accounts Receivable $397,000 $465,200 $505,780arrow_forwardThe financial statements of Bolero Manufacturing Inc. report net credit sales of $900,000 and accounts receivable of S80,000 and $40,000 at the beginning of the year and end of the year, respectively. What is the average collection period for accounts receivable in days (rounded)? O 49 days O 16 days 24 days 32 daysarrow_forwardDuring August 2024, Yond Company recorded the following: • Sales of $51,100 ($44,000 on account; $7,100 for cash). Ignore Cost of Goods Sold. • Collections on account, $33,800. • Write-offs of uncollectible receivables, $1,900. • Recovery of receivable previously written off, $200. Date Aug. Accounts and Explanation Debit Credit Requirements Journalize Yond's transactions during August 2024, assuming Yond uses the direct write-off method. 1. 2. Journalize Yond's transactions during August 2024, assuming Yond uses the allowance method.arrow_forward

- Please Do not Give image formatarrow_forwardThe following information was taken from the accounts receivable records of Sarasota Corporation as at December 31, 2020: OutstandingBalance Percentage Estimatedto be Uncollectible 0 – 30 days outstanding $160,000 0.5% 31 – 60 days outstanding 66,000 2.5% 61 – 90 days outstanding 40,200 4.0% 91 – 120 days outstanding 20,600 6.5% Over 120 days outstanding 5,600 10.0% (a) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a credit balance of $1,200 prior to the adjustment (b) Prepare the year-end adjusting entry for bad debt expense, assuming allowance for doubtful accounts had a debit balance of $3,880 prior to the adjustment.arrow_forwardSuppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education