FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

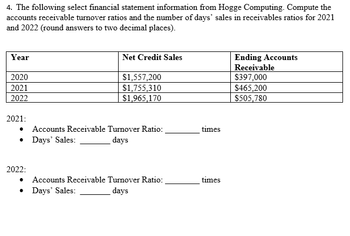

Transcribed Image Text:4. The following select financial statement information from Hogge Computing. Compute the

accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2021

and 2022 (round answers to two decimal places).

Year

2020

2021

2022

2021:

Net Credit Sales

2022:

$1,557,200

$1,755,310

$1,965,170

Accounts Receivable Turnover Ratio:

• Days' Sales:

days

Accounts Receivable Turnover Ratio:

Days' Sales:

days

times

times

Ending Accounts

Receivable

$397,000

$465,200

$505,780

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sales Cost of goods sold Accounts receivable 2021: 2020: 2018: 2018: 2021: 20:20: Compute trend percents for the above accounts, using 2017 as the bese year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Numerator: 2021: 2020: 2018: 2018: 2821 $ 553,453 284, 861 26,808 Numerator: Numerator: T 2017: Is the trend parcent for Net Sales favorable or unfavorable? I Trend Perent for Net Bales: I } J 2828 J I 184,986 21,060 2018: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Cost of Goods Bold: Denominator: 2019 $ 295,790 154,003 20,232 T " I Denominator: Trend Perent for Accounts Receivable: Denominator: 2018 $ 283,903 185,586 11,893 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? 11 11 "H |||||| 11 11 11 2817 $ 148,000 75,939 10,170 11 Trend percent Trend parcant Trend percent aan | 20arrow_forwardHi! Please answer thank you! The second picture is the second part of the questionarrow_forward4. A Company has Net Sales of 2,000,000 for 2020, Accounts Recitable for 500,000 in 2020, and Accounts Receivable of 350,000 in 2019. Calculate the Accounts Receivable Turnover Ratio.arrow_forward

- The following select financial statement information from Candid Photography. CANDID PHOTOGRAPHY Year Net Credit Sales Ending Accounts Receivable 2017 $2,988,000 $1,290,450 2018 2019 3,750,860 4,000,350 1,345,600 1,546,550 Compute the accounts receivable turnover ratios and the number of days' sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What is the Average Accounts Receivable? What is the Net Credit Sales that would be used? What is the Accounts Relievable Turnover? what is the Days in Receivable Ratio?arrow_forwardPlease fill all requirementsarrow_forwardTask 2: Evaluate the company's efficiency in collecting its accounts receivable during the fiscal year ended 31 December 2021. Use the company's information from its annual reports: Receivables as of 31 December 2020 $4,468,392 $4,972,722 $45,349,943 Receivables as of 31 December 2021 Sales revenue for year ended 31 December 2021 1. Calculate the company's number of days of sales outstanding (DSO) for the fiscal year ended 31 December 2021. (Use the average receivables to calculate the ratio). Not Accounting receivable Average Day's sales in receivable = 154; 2. Interpret the calculated ratio. 3. Assume that the industry average DSO ratio is 60 days. Based on this information and the subject company's DSO ratio, critically evaluate the company's credit policy and its implications.arrow_forward

- Suppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forwardJohn Lee Wholesale provides the following information: Accounts Receivable - 01/07/2020 $150 Accounts Receivable - 30/06/2021 900 Cash received from accounts receivable 8,050 What would be the credit sales for the year? Select one: 8,950 750 8,800 1,050arrow_forwardSuppose the following information was taken from the 2022 financial statements of FedEx Corporation, a major global transportation/delivery company. (in millions) 2022 2021 Accounts receivable (gross) $ 3,770 $ 4,640 Accounts receivable (net) 3,400 4,400 Allowance for doubtful accounts 370 240 Sales revenue 35,600 38,100 Total current assets 7,184 7,250 Answer each of the following questions. (a) Calculate the accounts receivable turnover and the average collection period for 2022 for FedEx. (Round answers to 1 decimal place, e.g. 12.5. Use 365 days for calculation.) Accounts receivable turnover enter the accounts receivable turnover in times rounded to 1 decimal place times The average collection period for 2022 enter the average collection period for 2022 in days rounded to 1 decimal place daysarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education