Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

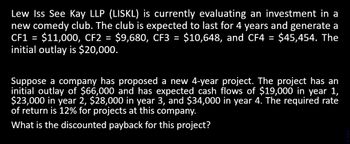

Transcribed Image Text:Lew Iss See Kay LLP (LISKL) is currently evaluating an investment in a

new comedy club. The club is expected to last for 4 years and generate a

CF1 = $11,000, CF2 = $9,680, CF3 = $10,648, and CF4 = $45,454. The

initial outlay is $20,000.

Suppose a company has proposed a new 4-year project. The project has an

initial outlay of $66,000 and has expected cash flows of $19,000 in year 1,

$23,000 in year 2, $28,000 in year 3, and $34,000 in year 4. The required rate

of return is 12% for projects at this company.

What is the discounted payback for this project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forwardFalkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated revenue producing life of 4 years. Falkland has a cost of capital of 8%. The patent is expected to generate the following amounts of annual income and cash flows: A. What is the NPV of the investment? B. What happens if the required rate of return increases?arrow_forwardRedbird Company is considering a project with an initial investment of $265,000 in new equipment that will yield annual net cash flows of $45,800 each year over its seven-year life. The companys minimum required rate of return is 8%. What is the internal rate of return? Should Redbird accept the project based on IRR?arrow_forward

- pleaser provide correct answer without fail !!!!arrow_forwardThe Ball Shoe Company is considering an investment project that requires an initial investment of $532,000 and returns cash inflows of $79,275 per year for 10 years. The firm has a maximum acceptable payback period of 8 years. a. Determine the payback period for this project. b. Should the company accept the project?arrow_forwardFastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $198,000 per year. Once in production, the bike is expected to make $316,800 per year for 10 years. Assume the cost of capital is 10%. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment? (Round to the nearestdollar.) By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.) 3. What is the NPV of the investment if the cost of capital is 15%? Note: Assume that all cash flows occur at the end of the appropriate year and that the inflows do not start until year 7.arrow_forward

- ← FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $214,500 per year. Once in production, the bike is expected to make $296,481 per year for 10 years. The cash inflows begin at the end of year 7. For parts a-c, assume the cost of capital is 9.5%. a. Calculate the NPV of this investment opportunity. Should the company make the investment? b. Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. c. How long must development last to change the decision? For parts d-f, assume the cost of capital is 14.2%. d. Calculate the NPV of this investment opportunity. Should the company make the investment? e. How much must this cost of capital estimate deviate to change the decision? f. How long must development last to change the decision? a. Calculate the NPV of this investment opportunity. If the cost of capital is 9.5%, the NPV is $.…arrow_forwardHelp NPV Calculate the net present value (NPV) for a 10-year project with an initial investment of $20,000 and a cash inflow of $6,000 per year. Assume that the firm has an opportunity cost of 18%. Comment on the acceptability of the project. The project's net present value is $ (Round to the nearest cent.) Тext ia Librai Calculat Resource Enter your answer in the answer box and then click Check Answer. Check Answer c Study 1 part remaining Clear All 10:27 PM unication Tools > 4/19/202 Type here to search insert fo 144arrow_forwardCustomMetalworks is considering the expansion of their cable fabrication business for towers, rigging, winches, and many other uses. They have available $250,000 for investment and have identified the following indivisible alternatives, each of which will provide an exit with full return of the investment at the end of a 5-year planning horizon. Each year, custom Metalworks will receive an annual return as noted below. MARR is 12%. For the original problem: a. Which alternatives should be selected by Custom Metalworks? b. What is the present worth for the optimum investment portfolio ? c. What is the IRR for the optimum investment portfolio?arrow_forward

- Viera Corporation is considering investing in a new facility. The estimated cost of the facility is $1,911,898. It will be used for 12 years, then sold for $718,600. The facility will generate annual cash inflows of $399,500 and will need new annual cash outflows of $152,600. The company has a required rate of return of 7%. Click here to view PV table.Calculate the internal rate of return on this project. (Round answer to 0 decimal place, e.g. 13%.) Internal rate of return is _________? % Whether the project should be accepted. The project SHOULD OR SHOULD NOT??? - be accepted.arrow_forwardA firm is considering a new project that requires an investment of $750,000. The firm plans to raise $250,000 through crowd funding and finance the remaining $500,000 through a private equity investment with a required rate of return of 15%. The project is expected to generate cash flows of $150,000 per year for the next 8 years. Required: What is the internal rate of return (IRR) of the project? Should the firm take this project?arrow_forwardWhispering Winds Corporation is considering investing in a new facility. The estimated cost of the facility is $3,551,000. It will be used for 12 years, then sold for $836,000. The facility will generate annual cash inflows of $499,000 and will need new annual cash outflows of $125,000. The company has a required rate of return of 5%. Calculate the internal rate of return on this project, and discuss whether the project should be accepted. (Round answer to 0 decimal places, e.g. 13%) Internal rate of return The project should be %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College