FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

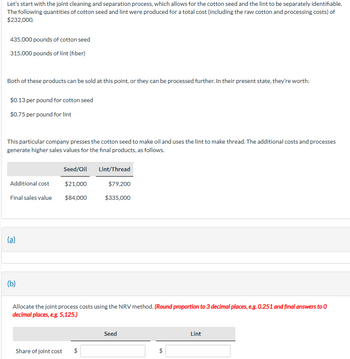

Transcribed Image Text:Let's start with the joint cleaning and separation process, which allows for the cotton seed and the lint to be separately identifiable.

The following quantities of cotton seed and lint were produced for a total cost (including the raw cotton and processing costs) of

$232,000.

435,000 pounds of cotton seed

315,000 pounds of lint (fiber)

Both of these products can be sold at this point, or they can be processed further. In their present state, they're worth:

$0.13 per pound for cotton seed

$0.75 per pound for lint

This particular company presses the cotton seed to make oil and uses the lint to make thread. The additional costs and processes

generate higher sales values for the final products, as follows.

Seed/Oil

Lint/Thread

Additional cost

$21,000

$79,200

Final sales value $84,000

$335,000

(a)

(b)

Allocate the joint process costs using the NRV method. (Round proportion to 3 decimal places, e.g. 0.251 and final answers to O

decimal places, e.g. 5,125.)

Share of joint cost

$

Seed

$

Lint

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The Brite Beverage Company bottles soft drinks into aluminum cans. The manufacturing process consists of three activities:i. Mixing: water, sugar, and beverage concentrate are mixed. ii. Filling: mixed beverage is filled into 12-oz. cans. iii. Packaging: properly filled cans are boxed into cardboard “fridge packs.” The activity costs associated with these activities for the period are as follows:Activity CostsMixing $218,000Filling 186,000Packaging 99,000Total 503,000The activity costs do not include materials costs, which are ignored for this analysis. Each can is expected to contain 12 ounces of beverage. Thus, after being filled, each can is automatically weighed. If a can is too light, it is rejected, or “kicked,” from the filling line prior to being packaged. The primary cause of kicks is heat expansion. With heat expansion, the beverage overflows during filling, resulting in underweight cans. This process begins by mixing and filling 6,300,000 cans during the period, of which…arrow_forwardThe following question presents hypothetical data concerning transfer of cotton between departments as part of the Cotton On Group's production processes. The textile department produces cotton for use by various other production departments within the Cotton On Group. The costs incurred by the textile department to produce cotton are provided below: Cost per square metre Direct materials $2.10 Direct labour $0.50 Variable overhead $0.25 Fixed overhead $0.15 The textile department can also sell cotton to external customers for $5.00 per square metre. Sales staff from the textile department are paid a sales commission of SO.10 per square metre for sales to external customers. No sales commissions are paid for transfers to internal customers. Required 1. Measure and discuss the internal transfer price for cotton if the general transfer price rule is used in the following situations: 1. The textile department has infinite capacity. 2. The textile department has no spare capacity . 3. The…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Corporation manufactures three products from a joint process. The three products are in industrial grade form at the split off point. They can either be sold at that point or processed further into premium grade. Costs related to each batch of this process is as follows: Product 1 Product 2 Product 3 Sales Price at split-off point $16 $12 $5 Allocated joint costs $6,000 $6,000 $6,000 Sales Price after further processing $20 $18 $14 Cost of further processing $6,360 $1,420 $2,650 Product Quantity 1,000 lb. 1,000 lb. 1,000 Ib. Q. What would be the additional amount of profit that Corp. would gain from further processing the product(s) that is/are more profitable to process further rather than be sold at the split-off point?arrow_forwardMcKenzie’s Soap Sensations, Inc., produces hand soaps with three different scents: morning glory, snowflake sparkle, and sea breeze. The soap is produced through a joint production process that costs $30,000 per batch. Each batch produces 14,800 bottles of morning glory hand soap, 12,000 bottles of snowflake sparkle hand soap, and 10,000 bottles of sea breeze hand soap at the split-off point. Each product is processed further after the split-off point, but the market value of a bottle of any of the flavors at this point is estimated to be $1.25 per bottle. The additional processing costs of morning glory, snowflake sparkle, and sea breeze hand soap are $0.50, $0.55, and $0.60 per bottle, respectively. Morning glory, snowflake sparkle, and sea breeze hand soap are then sold for $2.00, $2.20, and $2.40 per bottle, respectively.Instructions1. Using the net realizable value method, allocate the joint costs of production to each product. 2. Explain why McKenzie’s Soap Sensations, Inc.,…arrow_forwardMobil Manufacturing purchases a liqid raw material. The material was refined into 3 complete products; neon, argon, and xenon. In the manufacturing process, the 3 products undergo a joint process that has a total cost of $160,000, which includes the cost of the liquid raw material. We learn that 25,000 gallonw of argon can be sold for $45,000 immediately after the completion of the joint production process, without any further processing. 30,000 gallons of xenon are processed in a second department for an extra cost of $66,000 and was sold for $120,000. 60,000 gallons of neon was processed in a third department at an extra cost of $119,000 and was sold for $175,000. Both xenon and neon can be sold at the split-off point for $40,000 and $60,000. Question: Show the allocation of the joint costs among the 3 products using physical unit method, sales value at split-off method, and constant gross margin method.arrow_forward

- The Atlanta Company processes unprocessed goat milk up to the split-off point where two products, condensed goat milk and skim goat milk result. Total cost of purchasing and processing 120,000 gallons of goat milk in Joint Process was $144,000 which resulted into 35,640 gallons of goat milk and 72,360 gallons of skim goat milk (the remaining materials was shrinkage). Additional shrinkage occurred during additional processing as follows:Condensed 35,640 gallons of goat milk is processed further at $3.60 per gallon to yield 33,600 gallons of a medicinal milk product, called Xyla (the remainder is shrinkage). Xyla can be sold for $21.60 per gallon. The 72,360 gallons of Skim goat milk can be processed further at $2.40 per gallon to yield 64,800 gallons of skim goat ice cream. Each gallon of skim goat ice cream can be sold for $14.40 per gallon. The following information was collected for the month of March: Products Quantity yield at split off Additional processing cost per…arrow_forwardChoi Company manufactures two skin care lotions, Smooth Skin and Silken Skin, from a joint process. The joint costs incurred are $410,000 for a standard production run that generates 290,000 pints of Smooth Skin and 130,000 pints of Silken Skin. Separable processing costs beyond the split-off point are $1.60 per pint for Smooth Skin and $1.30 per pint for Silken Skin. Required: How much of the joint costs are allocated to Smooth Skin and Silken Skin under each of the following methods: 1. Physical quantity method 2. Sales value at split-off method. Assume the following sales prices at the split-off point: Smooth Skin sells for $2.50 per pint, while Silken Skin sells for $4.00 per pint. 3. Net realizable value method. Assume the following sales prices after further processing: Smooth Skin sells for $2.50 per pint, while Silken Skin sells for $4.00 per pint. (For all requirements, do not round intermediate calculations. Round final answers to nearest whole dollar amounts.) 1. Physical…arrow_forwardCrane's woodworking business produces two products from its joint process: one main product (sanded and finished trim pieces) and one by-product (sawdust/shavings). The joint process has a cost of $31,000, which results in trim pieces worth $47,000 and sawdust/shavings that can be sold for $2,800. If Crane uses the production method to account for by-products, determine how much of the joint process cost will be allocated to each product. In other words, how much inventory cost will be recorded for each product? Main product By-product Allocated joint costs $arrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardMcKenzie’s Soap Sensations, Inc., produces hand soaps with three different scents: morning glory, snowflake sparkle, and sea breeze. The soap is produced through a joint production process that costs $30,000 per batch. Each batch produces 14,800 bottles of morning glory hand soap, 12,000 bottles of snowflake sparkle hand soap, and 10,000 bottles of sea breeze hand soap at the split-off point. Each product is processed further after the split-off point, but the market value of a bottle of any of the flavors at this point is estimated to be $1.25 per bottle. The additional processing costs of morning glory, snowflake sparkle, and sea breeze hand soap are $0.50, $0.55, and $0.60 per bottle, respectively. Morning glory, snowflake sparkle, and sea breeze hand soap are then sold for $2.00, $2.20, and $2.40 per bottle, respectively. 1. Using the net realizable value method, allocate the joint costs of production to each product. 2. Using the Market Value at Split Off Point Method, allocate…arrow_forwardPlease help to solve this question. It is partially correct but I need help with the ones with "x"'s by them. Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education